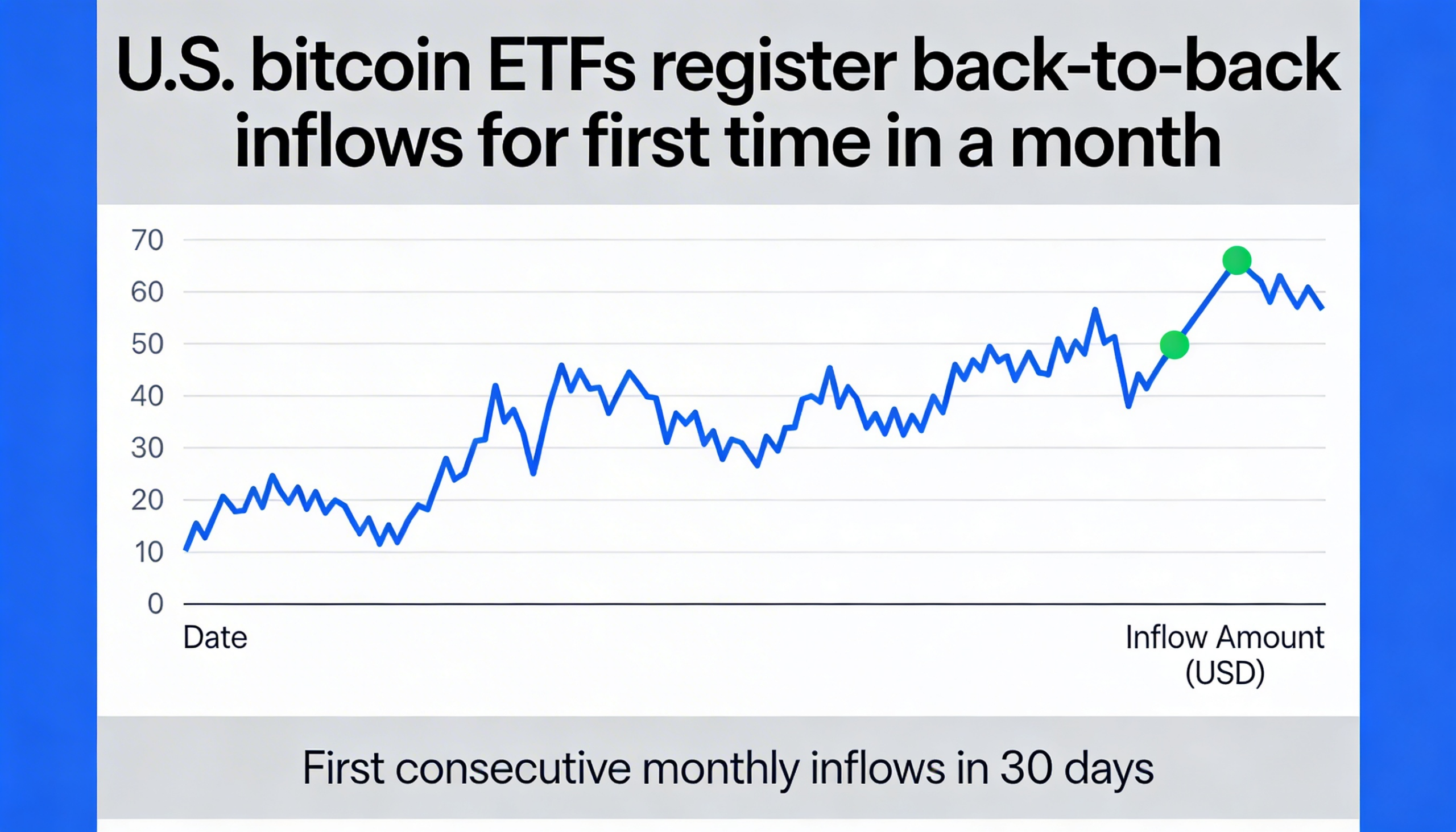

U.S. spot bitcoin ETFs have broken a weeks-long streak of outflows, even as bitcoin’s price remains significantly below its recent highs.

For the first time since mid-January, the funds posted consecutive days of net inflows. Data from SoSoValue shows $471.1 million entered the ETFs on Friday, followed by an additional $144.9 million on Monday. The renewed buying came as bitcoin rebounded from last week’s slide to $60,000 and climbed back toward $70,000.

The inflow streak marks a shift after a prolonged period of redemptions that followed bitcoin’s mid-January peak near $98,000. That rally, which began around $87,000 and lasted roughly two weeks, gave way to a sharp correction that ultimately drove prices down to $60,000. During that decline, investors withdrew substantial sums from spot ETF products.

Despite the pullback in price, overall ETF holdings have shown relative resilience.

According to Checkonchain data, the combined assets under management of the 11 U.S. spot bitcoin ETFs have declined by roughly 7% since early October, falling from 1.37 million BTC to about 1.29 million BTC. Over the same timeframe, bitcoin has retreated more than 40% from its record high above $126,000.

The contrast suggests that while short-term fund flows respond to price volatility, the broader base of ETF investors has largely maintained exposure, underscoring continued longer-term conviction in the asset class

Share this content: