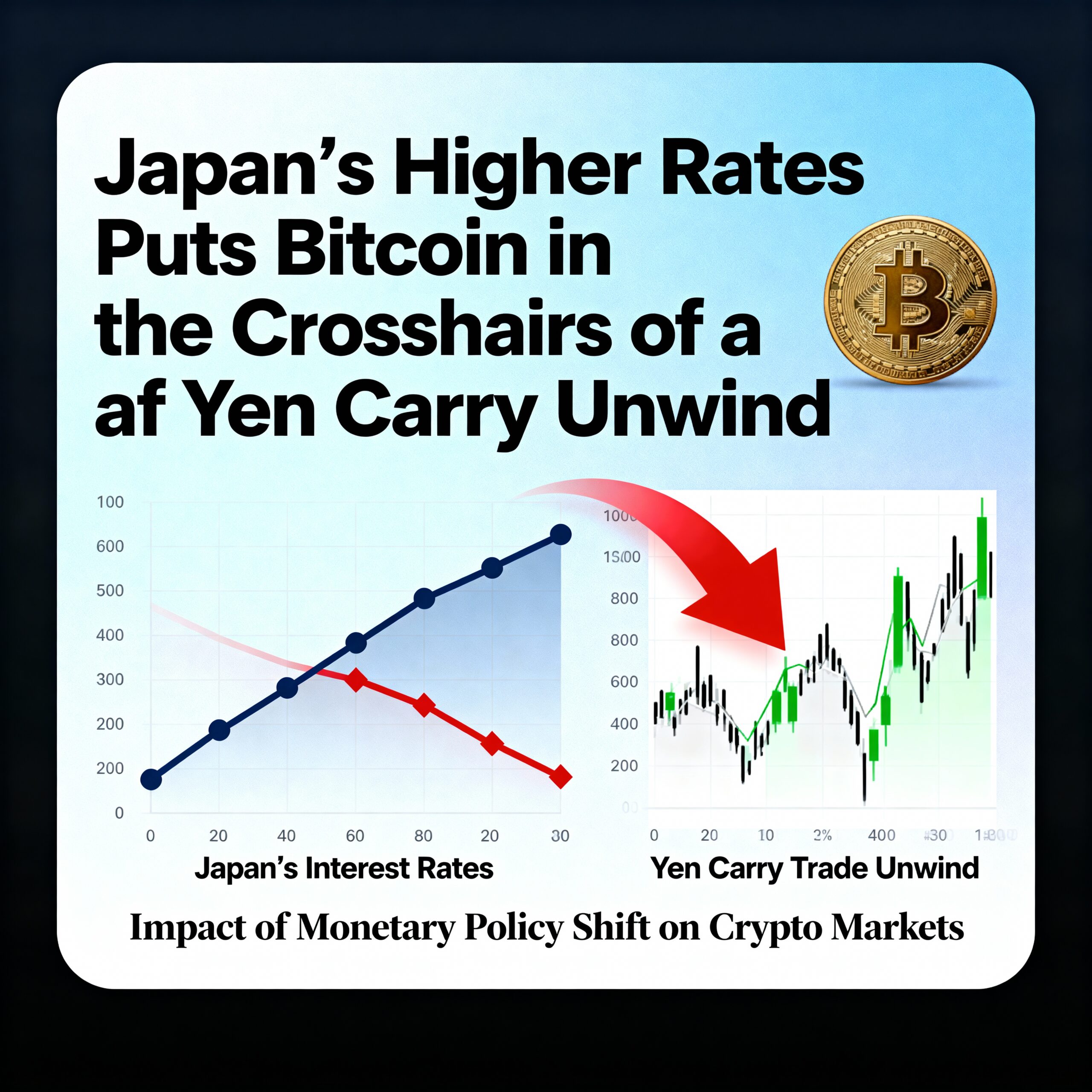

BOJ Rate Hike Could Shake Markets, Put Bitcoin in the Crosshairs

The Bank of Japan is preparing to lift interest rates at its December policy meeting, potentially pushing the benchmark to its highest level since 1995 and sending ripples across global markets, including cryptocurrencies.

Sources told Bloomberg that policymakers are leaning toward a 25-basis-point hike to 0.75% at the Dec. 19 meeting, provided there are no major shocks to global markets or Japan’s economy. Following the report, the yen strengthened, rising from just above 155 to around 154.56 per dollar.

The move threatens the yen-funded carry trade, a long-standing strategy where hedge funds borrow yen at ultra-low rates to fund leveraged positions in higher-yielding assets. Higher Japanese rates make this trade less attractive and could trigger repositioning in leveraged markets, including bitcoin.

A stronger yen often coincides with risk-off sentiment, which could tighten liquidity that recently supported BTC’s rebound from November lows. Bitcoin dipped toward $86,000 earlier this week before recovering to over $93,000 alongside U.S. equities, highlighting its sensitivity to global rate expectations.

Governor Kazuo Ueda said the board will make an “appropriate decision” on rates, while market pricing implies almost a 90% chance of a December hike. Officials may signal readiness for further tightening but remain cautious about committing to a defined path.

For bitcoin traders, the key risk lies in the disruption of a decades-long source of global liquidity. Rising yen funding costs could prompt leveraged funds to cut BTC exposure, though a measured BOJ tightening may have only limited near-term impact, particularly as U.S. rate-cut expectations grow.

Share this content: