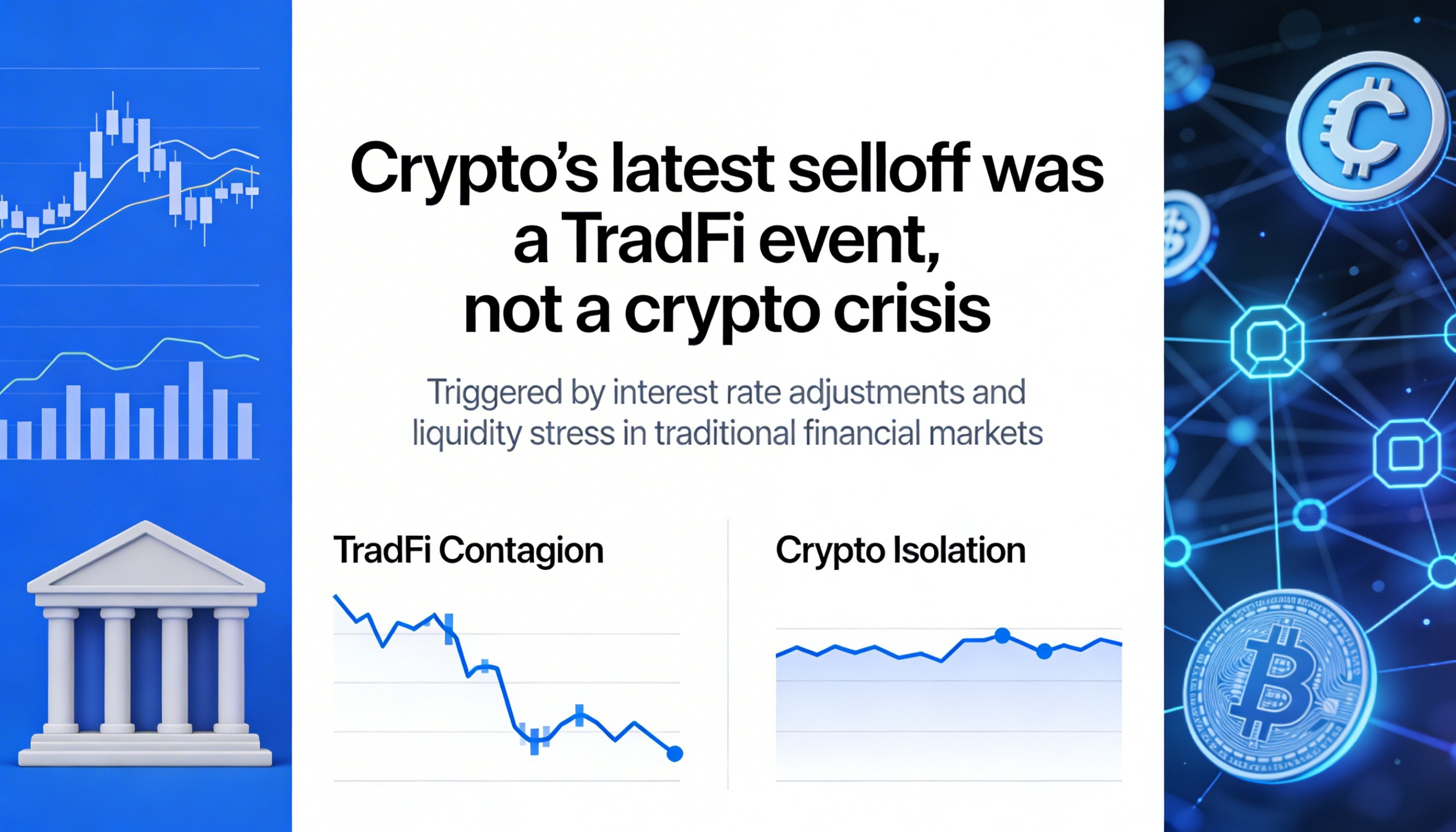

Last week’s crypto rout was triggered by a broader macro deleveraging cycle — not by fresh turmoil within the digital asset industry — according to speakers at Consensus Hong Kong 2026.

HONG KONG — The sharp pullback across bitcoin and other digital assets reflected stress originating in traditional financial markets, as leveraged macro trades began to unwind, panelists said during a discussion at Consensus Hong Kong.

Rather than echoing the exchange failures and credit blowups of 2022, the latest downturn was driven by shifts in global funding conditions.

“Risk had already been reduced after Oct. 10,” said Fabio Frontini, founder of Abraxas Capital Management. “What happened last week was essentially a spillover from traditional finance. Crypto doesn’t trade in isolation anymore.”

A key pressure point was the reversal of yen carry trades, a strategy in which investors borrow Japanese yen at low interest rates and deploy the capital into higher-yielding or risk assets. Those allocations often include bitcoin, ether, precious metals and equities.

The trade becomes vulnerable when Japanese rates rise or the yen strengthens. As funding costs climb, investors must buy back yen to repay loans, forcing the liquidation of positions and amplifying volatility across markets.

Thomas Restout, group CEO of liquidity provider B2C2, said rising rates and market turbulence increased both borrowing costs and margin requirements. “As volatility picked up, collateral requirements jumped,” he noted, citing metals markets where margin requirements rose from roughly 11% to 16%. The higher capital demands prompted some leveraged players to pare back positions.

The deleveraging extended across asset classes, placing crypto under pressure alongside other risk assets rather than singling it out as the source of instability.

Bitcoin exchange-traded funds also saw heavy trading activity during the sell-off, though panelists pushed back against the idea of broad institutional flight. At their peak, spot bitcoin ETFs managed about $150 billion in assets. They now hold close to $100 billion, with roughly $12 billion in net outflows since October — notable, but limited relative to total holdings.

“That suggests repositioning more than capitulation,” Restout said.

Looking ahead, market participants emphasized that the ties between traditional finance and blockchain infrastructure are only strengthening. Emma Lovett, credit lead for Market DLT at J.P. Morgan, described 2025 as a regulatory turning point, particularly in the U.S., where a more constructive policy backdrop has encouraged experimentation beyond private networks.

“What we began seeing in 2025 was the use of public blockchains and stablecoins to settle traditional securities,” Lovett said, signaling a deeper integration of crypto rails into mainstream financial systems as 2026 unfolds.

Share this content: