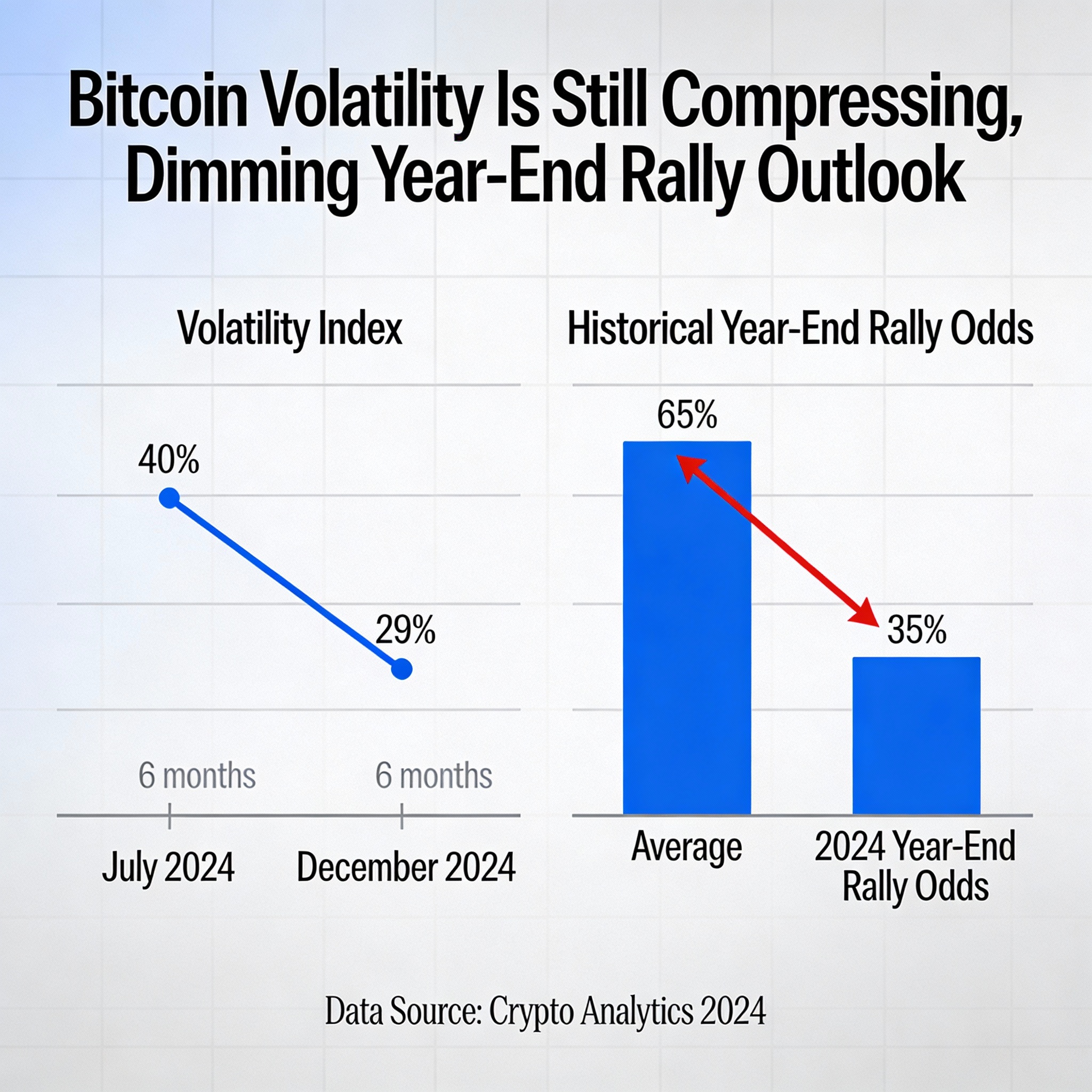

Bitcoin’s volatility continues to decline, mirroring trends in the S&P 500, and dimming prospects for a year-end rally, analysts say.

BTC’s 30-day annualized implied volatility, tracked by Volmex’s BVIV index, has fallen to 49%, reversing a spike from 46% to 65% over the 10 days through Nov. 21, according to TradingView. Implied volatility reflects expected price swings, and the drop signals calmer short-term conditions for bitcoin.

The S&P 500’s VIX index has also eased, sliding from 28% on Nov. 20 to 17%.

Matrixport noted that this volatility compression reduces the likelihood of a year-end breakout. “Implied volatility continues to compress, and the probability of meaningful upside into year-end is lower,” the firm said Wednesday. “The FOMC meeting is the final major catalyst, but volatility is expected to drift lower afterward.”

Historically, bitcoin’s price has moved in step with volatility, though the correlation has shifted negative since November 2024. On Wall Street, low implied volatility often signals a potential bullish reset, underscoring the mixed signals for bitcoin heading into year-end.

Share this content: