Crypto markets experienced another bout of volatility on Tuesday, dropping alongside U.S. equities at the open before quickly clawing back most of the losses.

Bitcoin briefly slid but stabilized near $69,200 by mid-session, little changed over the past 24 hours. Ether underperformed with a sharper decline, while XRP and Solana also traded lower.

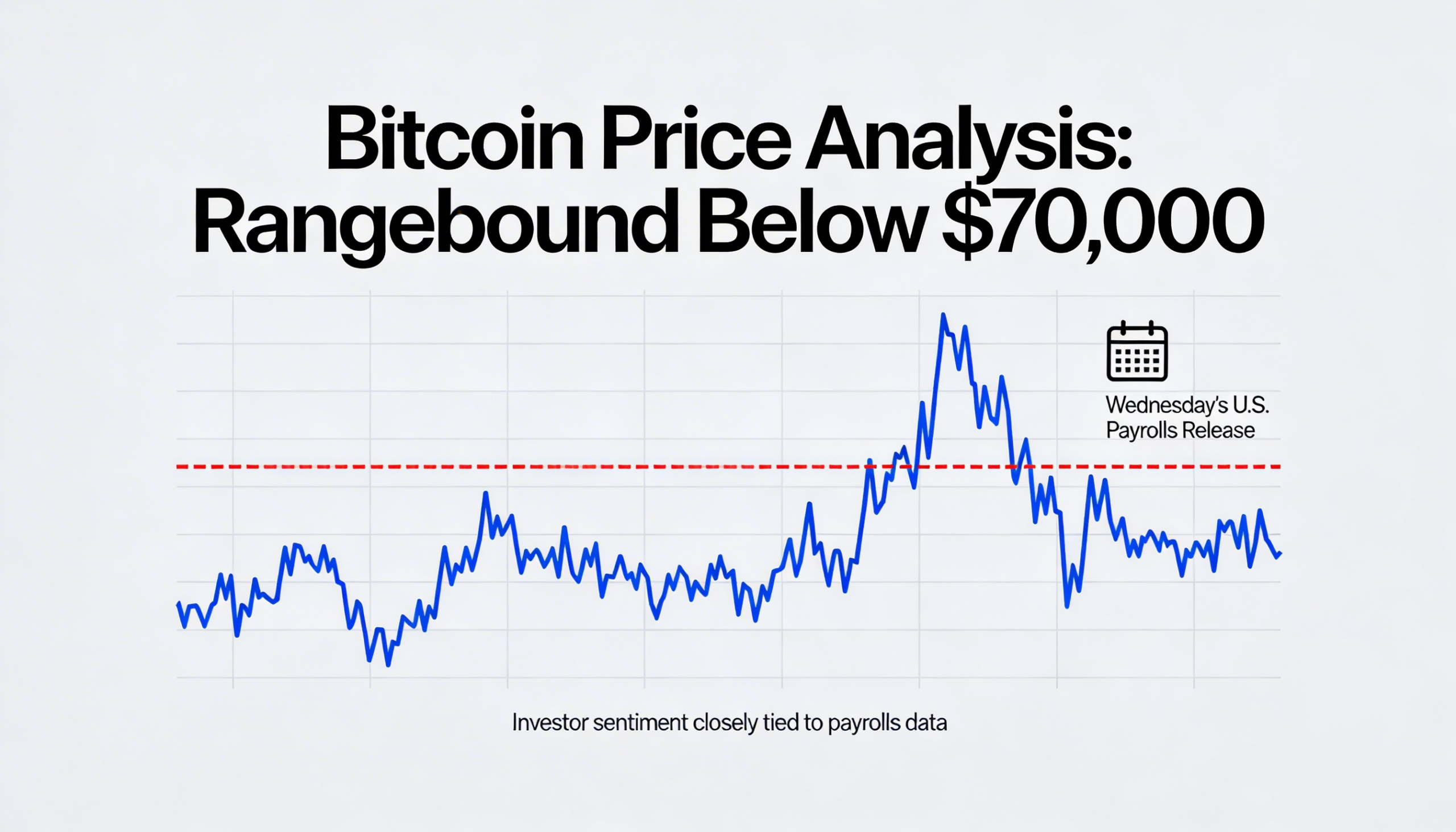

Although bitcoin is now in its deepest pullback since the 2024 halving, the downturn has not been accompanied by heavy selling activity. Data from Kaiko shows subdued trading volumes during the slide, suggesting retail investors have largely retreated to the sidelines rather than exiting positions aggressively.

From a technical perspective, bitcoin is nearing key support areas that could determine whether its long-observed four-year market cycle remains intact, Kaiko analyst Laurens Fraussen said. A sustained break below those levels would raise questions about that framework.

Derivatives positioning appears to be amplifying price swings. According to trading firm Wintermute, recent volatility has been driven more by leveraged futures markets than by spot demand. Limited spot liquidity has left bitcoin vulnerable to sharp moves when crowded positions unwind. The firm characterized last week’s rebound as a short squeeze in perpetual futures, noting that the sudden return of volatility caught many traders unprepared after a relatively calm stretch.

Attention is now shifting to Wednesday’s January Nonfarm Payrolls report, delayed from last week because of a brief federal government shutdown. Economists expect job growth of around 70,000, an increase from December’s 50,000, with the unemployment rate projected to hold steady at 4.4%.

However, comments from Trump administration officials have introduced uncertainty around those expectations. White House trade counselor Peter Navarro indicated that payroll figures could fall short of forecasts, echoing earlier remarks from economic adviser Kevin Hassett urging markets not to panic over weak data.

Treasury markets appear to be adjusting to that possibility. The 10-year yield declined roughly 5 basis points to 4.14%, reflecting growing demand for bonds.

Under normal conditions, falling yields and expectations of easier Federal Reserve policy would provide support for bitcoin and other risk assets. Yet the relationship has been less straightforward this cycle. Despite rate cuts totaling 75 basis points in recent months, bitcoin has struggled to regain sustained upward momentum, highlighting the influence of leverage, positioning and broader risk sentiment on crypto markets.

Share this content: