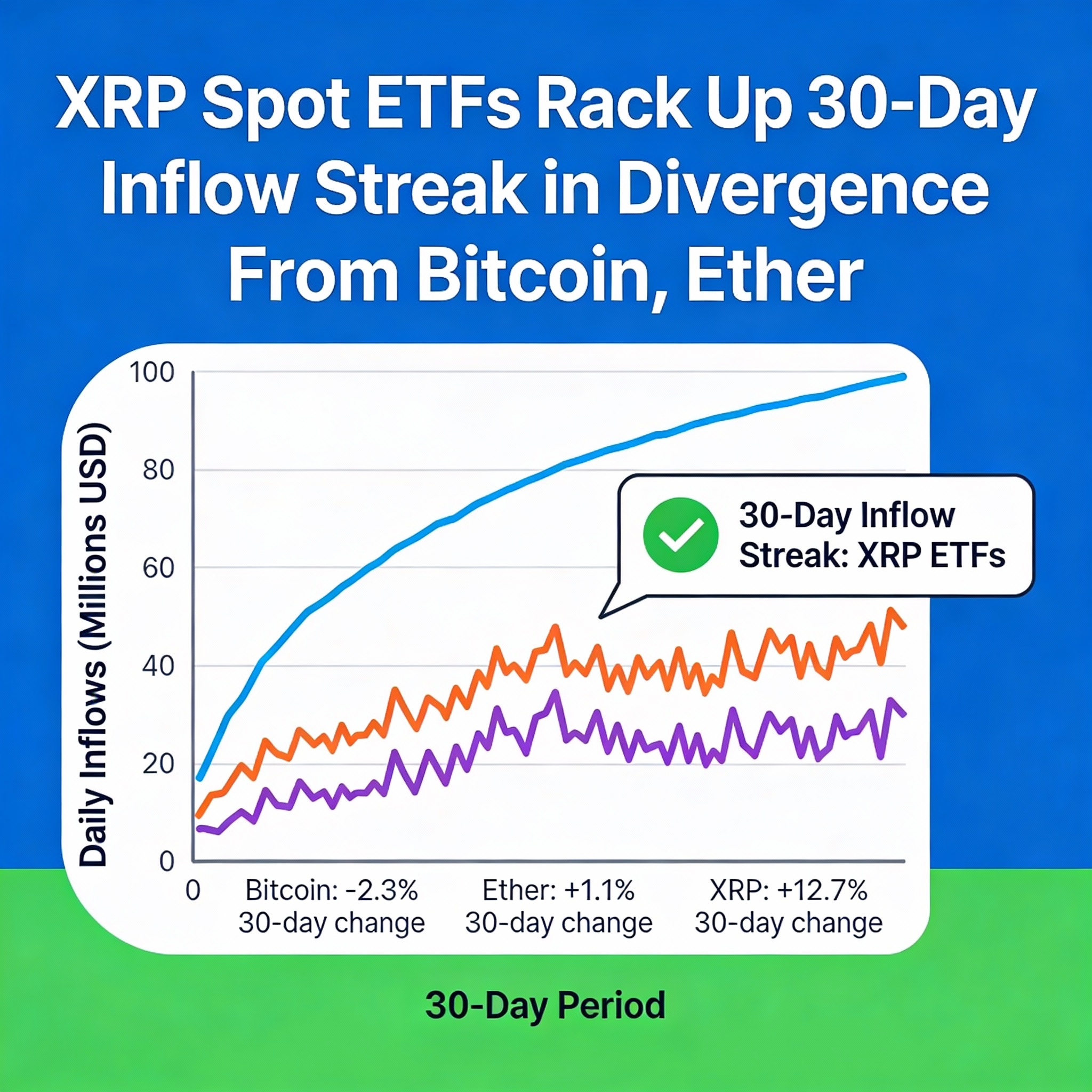

XRP Spot ETFs Post 30-Day Inflow Streak, Approaching $1 Billion in Cumulative Capital

U.S.-listed spot XRP $1.93 ETFs have seen daily net inflows since their launch on Nov. 13, marking a 30-day streak that distinguishes them from bitcoin and ether ETFs, which experienced intermittent outflows during the same period.

Data from SoSoValue shows cumulative inflows into XRP ETFs have reached roughly $975 million as of Dec. 12, with total net assets climbing to around $1.18 billion. Notably, no session has recorded net redemptions since inception.

This uninterrupted inflow pattern contrasts with bitcoin and ether ETFs, which have seen stop-start flows amid interest-rate shifts, equity-market volatility, and tech-sector concerns.

The consistency suggests XRP ETFs are being used as structural positions rather than short-term trading vehicles. Unlike bitcoin ETFs, which are often influenced by macro liquidity trends, XRP funds attract investors seeking exposure to assets with tangible use cases in payments and settlement infrastructure.

The trend highlights broader diversification in the crypto ETF market, as investors increasingly expand beyond bitcoin and ether into alternative digital assets

Share this content: