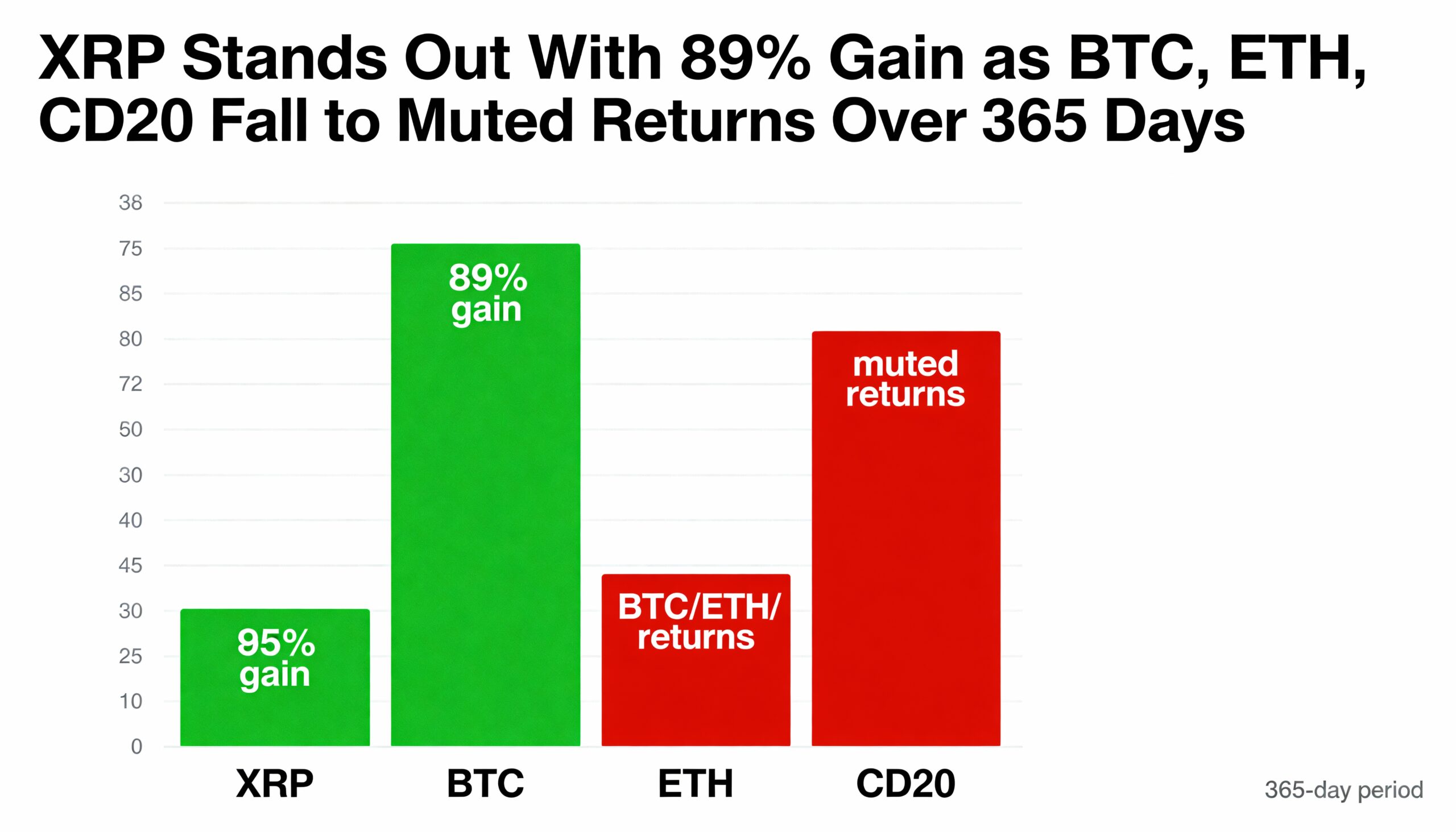

XRP continues to defy broader market weakness, standing out as one of the few major cryptocurrencies to post a substantial gain over the past year. Despite its recent pullback, the token is still up 89% on a 365-day basis.

The same cannot be said for much of the market. The latest slump has dragged bitcoin (BTC), ether (ETH), and most major CoinDesk indices into flat or negative territory over the past year. XRP is the notable exception: its 89% annual rise sharply outperforms the modest 3.6% gains recorded by both bitcoin and the CoinDesk 20 (CD20) Index.

Only a couple of benchmarks have eked out any meaningful progress. The CoinDesk 5 Index (CD5) advanced slightly above 2%, while ether added around 2%. Meanwhile, several leading altcoins have endured steep losses. Solana (SOL) and cardano (ADA) each tumbled more than 36%, and the CoinDesk Meme Index plunged 78%, underscoring the heavy damage across high-risk assets.

XRP is also the only major crypto asset with a positive return so far this year.

Its strong relative performance is even more notable given that XRP remains 36% below the all-time high above $3.60 reached just four months ago. Bitcoin has also corrected sharply, falling 24% since peaking above $126,000 on Oct. 8.

XRP’s strength has been supported by a wave of catalysts on the regulatory and technology fronts. The resolution of the SEC’s lawsuit against Ripple removed a major obstacle that had hindered XRP’s U.S. adoption for years, opening the door for more institutional participation. Many analysts view the ruling as a pivotal moment for XRP’s positioning in the mainstream financial ecosystem.

Ripple has also advanced key infrastructure initiatives. The rollout of the XRPL EVM sidechain and the rapid growth of RLUSD — Ripple’s stablecoin, which reached a $1 billion market cap within a year of its December 2024 launch — have expanded XRP’s relevance beyond payments and into DeFi applications.

Strategic moves such as Ripple’s partnerships in the Middle East and its application for a U.S. banking license have further fueled interest. Last week’s introduction of Canary Capital’s spot XRP ETF in the U.S. — which debuted with the highest first-day volume of any ETF launched this year — has added to the momentum.

Industry leaders expect institutional demand for XRP products to grow. “It would be a massive product; interest in XRP is enormous,” Bitwise CEO Hunter Horsley told CoinDesk TV. He highlighted that over $100 trillion still sits in traditional financial systems, with more capital steadily moving into blockchain-based assets. ETFs, he noted, often provide the first access point for investors exploring new digital asset exposure. “If investors can gain exposure to XRP, it will be an extremely useful and highly sought-after product,” he said.

Still, XRP’s gains have come with considerable volatility. Its annualized 365-day volatility stands at 91%, more than double bitcoin’s 44%. Only the CoinDesk Meme Index (115.85%) and cardano (100.55%) rank higher.

That turbulence may moderate over time. Analysts suggest that rising institutional involvement and the potential approval of more XRP-linked ETFs could help stabilize price swings as steadier, longer-term capital flows into the market.

Share this content: