XRP Under Pressure Despite Strong ETF Inflows

Spot XRP ETFs have attracted nearly $850 million since their mid-November debut, marking one of the strongest starts for an altcoin ETF and signaling steady accumulation by long-term investors.

Market Context

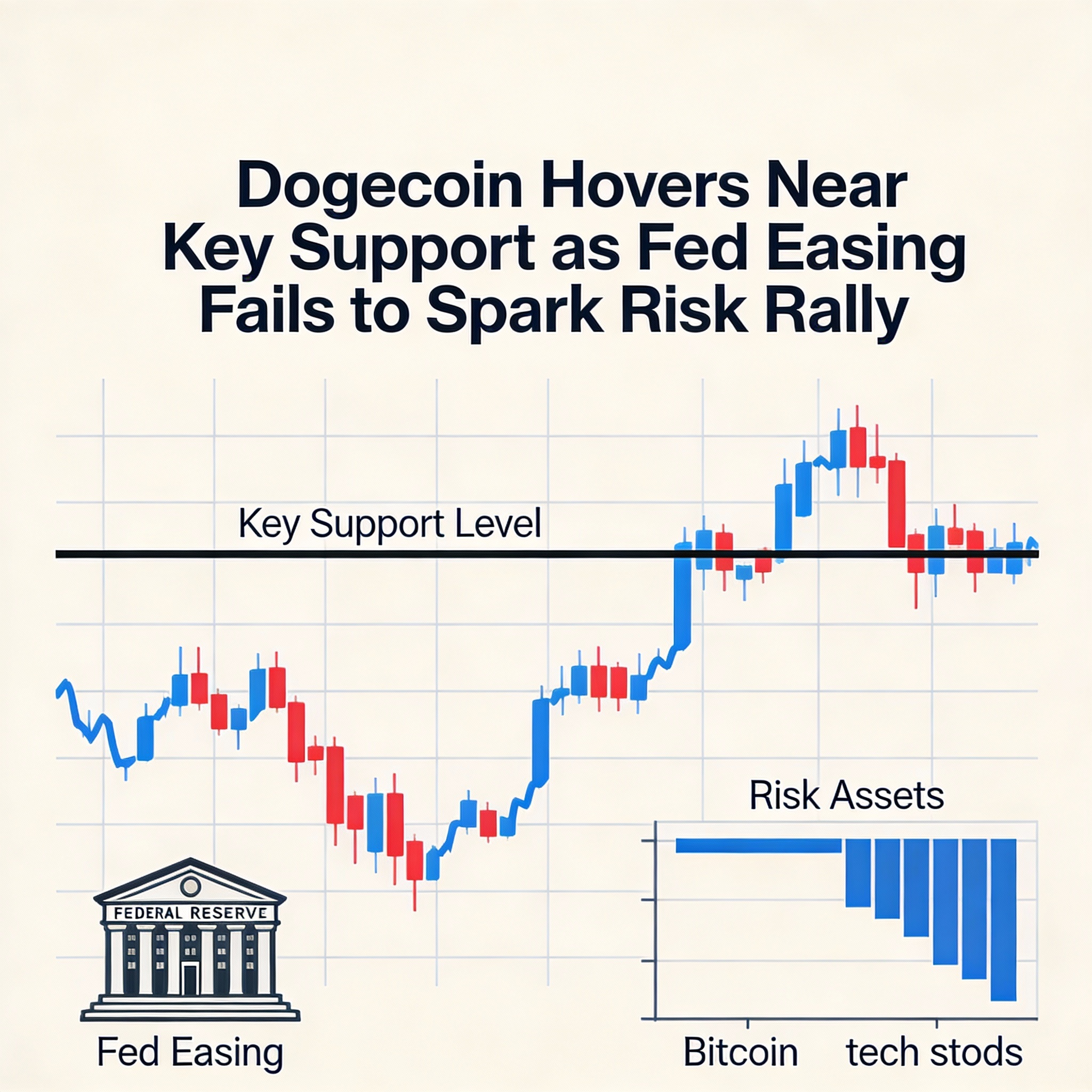

XRP faces a tug-of-war between institutional adoption and short-term technical weakness. Liquidity remains thin, and declining open interest on major exchanges points to a risk-off environment, while Bitcoin’s ongoing volatility keeps altcoins like XRP sensitive to technical breakdowns despite fundamental demand.

Technical Developments

XRP struggled to hold $2.07, forming a pattern of lower highs that suggested weakening buyer momentum. Rejections near $2.11–$2.13 occurred on rising volume, confirming seller control.

The critical breakdown came late in the session as $2.07 support gave way on heavy volume, followed by a secondary surge around 03:24 GMT that pushed XRP briefly toward $2.00. Momentum indicators are now firmly bearish, with RSI declining and MACD turning more negative. The previous $2.07 floor now acts as immediate resistance.

Price Action

XRP fell from $2.20 to $2.10, a 5.7% drop over 24 hours with nearly 6% volatility. Volume spiked to 94M at 19:00 UTC, 68% above normal, confirming the rejection at $2.13. XRP later tested $2.09 and briefly touched $2.00, consolidating in the $2.10–$2.12 range, leaving downside pressure intact despite strong ETF inflows.

Share this content: