Bitcoin is set to record its weakest weekly performance since March as U.S. demand softens, reflected in a widening negative Coinbase premium and surging activity across spot bitcoin ETFs.

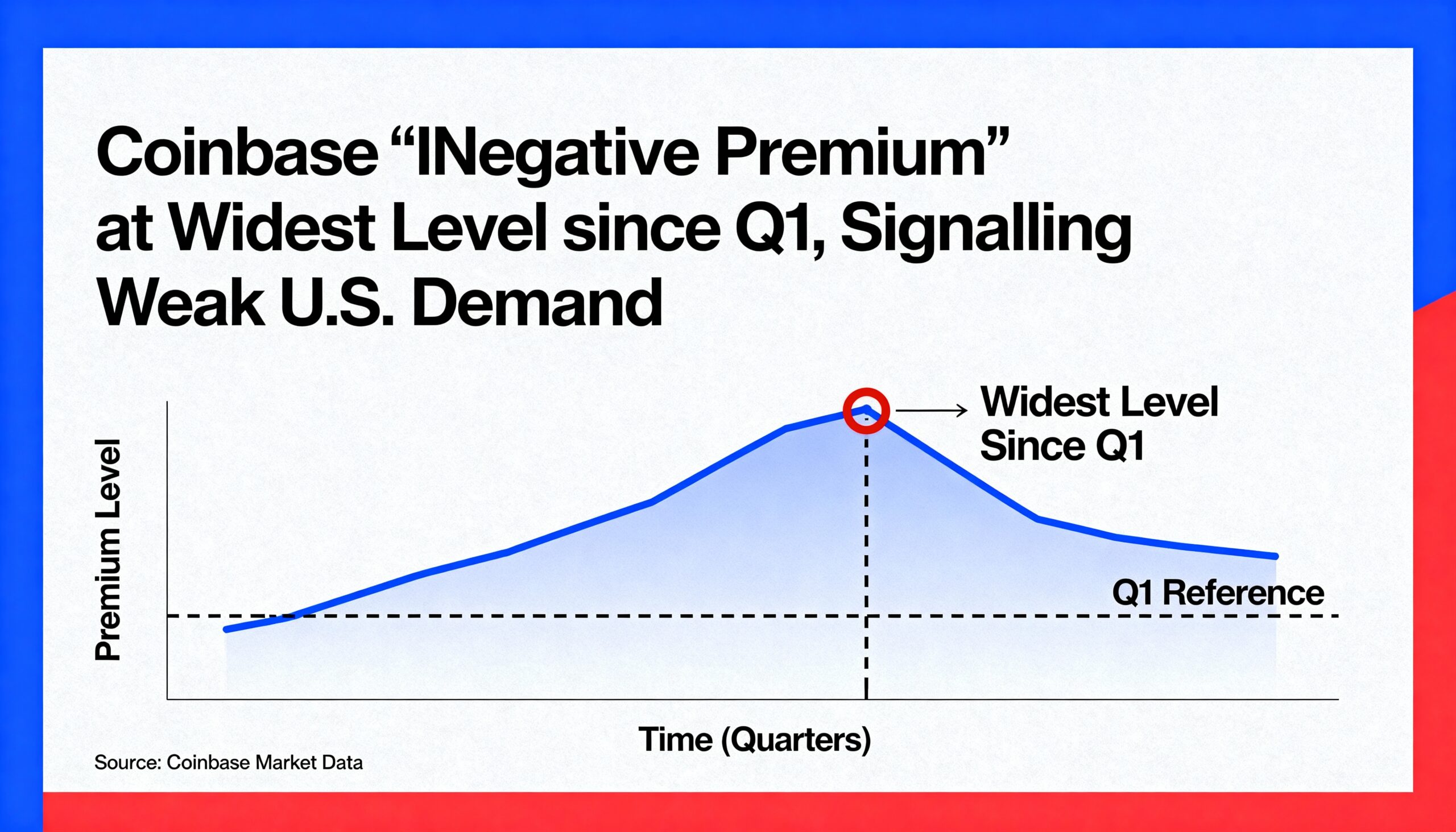

The Coinbase Bitcoin Premium Index, which tracks the price difference between bitcoin on Coinbase and the global market, has slipped to -0.15%—its most negative level since the first quarter. A discount on Coinbase typically points to lagging U.S. demand, increased selling pressure, and reduced institutional participation. The downtrend began after the major liquidation event on Oct. 10 and has continued throughout November.

These sentiment shifts coincide with a difficult stretch for BTC$90,722.88. Bitcoin has dropped more than 11% this week, briefly touching $81,000 before recovering toward $84,000. November has been even harsher: BTC is down 23%, marking its worst monthly performance since June 2022, when it tumbled 38%.

A Capitulation Signal Forming?

Weak U.S. demand has also shown up in spot bitcoin ETFs, which experienced steady outflows for most of the month.

Read more: Bitcoin ETFs Have Bled a Record $3.79B in November

Friday broke that pattern, with ETFs pulling in $238.4 million—the strongest inflows since Nov. 11, according to Farside data. It also marked a record trading day for the products, generating $11.5 billion in combined volume, Bloomberg’s Eric Balchunas reported. BlackRock’s IBIT alone accounted for $8 billion of that activity.

Balchunas noted that IBIT also saw record put-option volume this week, suggesting investors are hedging their long exposure rather than fully exiting. “It’s one way for people to stay invested—they can buy puts as protection while holding their positions,” he said.

After a 36% drop from its October all-time high, Friday’s high-volume flush may represent a capitulation-style event, which often accompanies local market bottoms. While it’s not definitive, bitcoin may be attempting to stabilize in the low $80,000 range.

Adding to that narrative, Glassnode reported more than $4 billion in realized bitcoin losses on Friday—its largest reading since March 2023 during the Silicon Valley Bank collapse—providing another potential capitulation indicator.

Share this content: