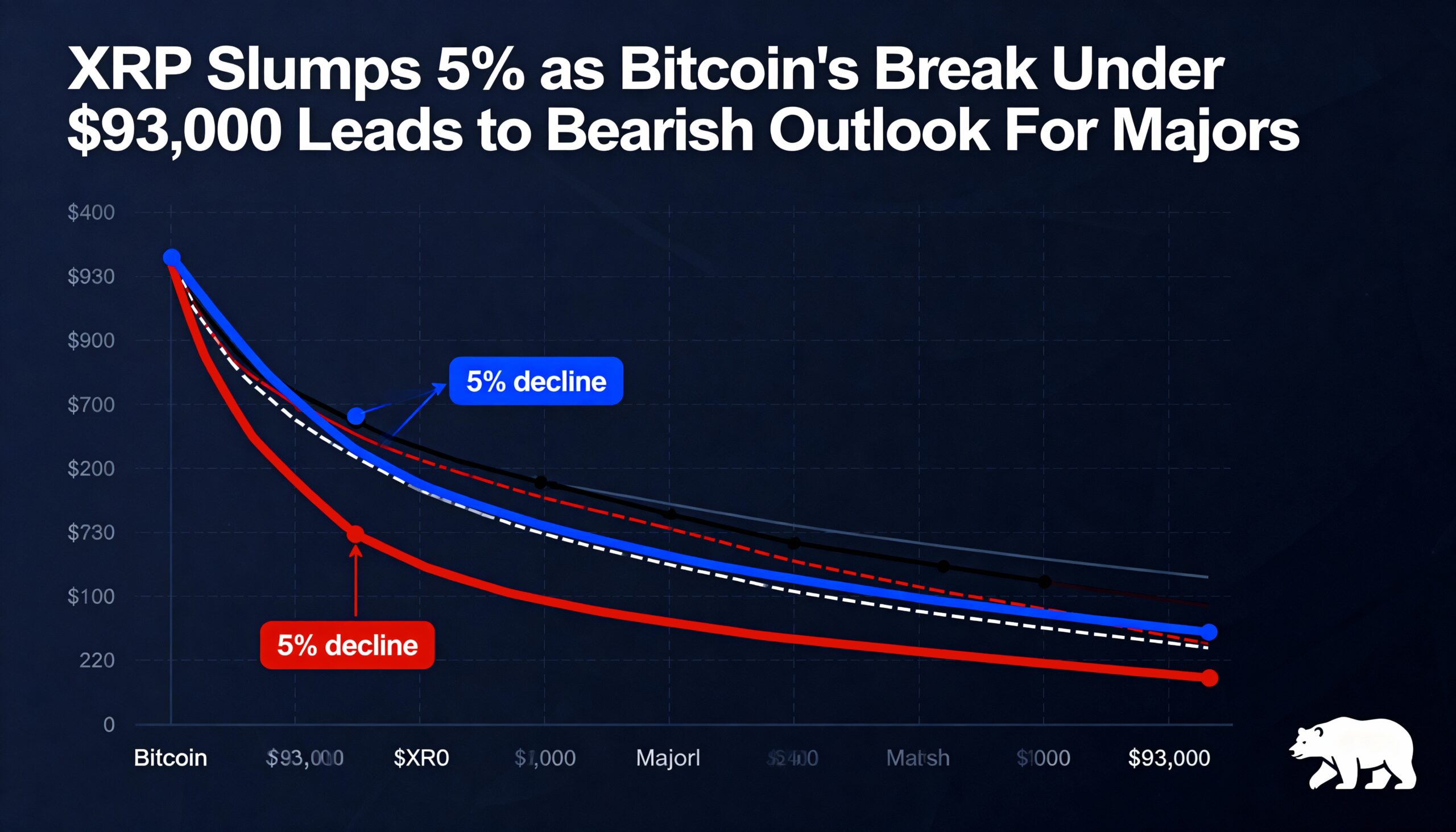

Bitcoin (BTC) is rapidly approaching the $100,000 mark, fueled by optimism surrounding a possible major trade deal announced by U.S. President Donald Trump, with reports speculating the deal may involve the U.K.

The recent price surge aligns with broader positive technical indicators in the cryptocurrency market, as well as a generally upbeat risk sentiment across traditional markets. As of the latest market data, Asian stock markets are trading higher, and S&P 500 futures are up 0.6%, further supporting the bullish outlook for risk assets, including Bitcoin.

However, despite the upbeat market sentiment, there are several factors suggesting the $100,000 breakout may not be as smooth as it may initially appear.

Wall Street Journal Casts Doubt on the Trade Deal

A Wall Street Journal report has cast some doubt on the optimism surrounding Trump’s trade deal. According to the article, the much-anticipated announcement could end up being merely a framework for discussions, potentially involving tariff adjustments, rather than the complete trade deal many are hoping for. If this turns out to be the case, the initial bullish excitement in the market could diminish quickly as traders realize that the full details of the deal may take weeks or months to unfold, dampening short-term momentum.

Potential Resistance at $99,900

As Bitcoin approaches the $99,900 price level, it could face significant resistance. This resistance is driven by profit-taking by long-term holders and increased selling pressure from early buyers who are sitting on significant gains. As a result, the final push to break through the $100K threshold could encounter headwinds if market participants decide to cash in their profits.

Weakening Coinbase Premium Signals Slower U.S. Demand

The Coinbase premium, which tracks the price difference between Bitcoin on Coinbase and Binance, is another key indicator of U.S. investor demand. Historically, sustained bullish periods for Bitcoin have been accompanied by an increase in the Coinbase premium. However, since late April, the seven-day moving average of the premium has shown a bearish divergence with Bitcoin’s price, indicating that demand from U.S.-based investors may be losing steam, which could limit Bitcoin’s upside momentum in the short term.

RSI Bearish Divergence Signals Potential Weakness

Despite Bitcoin reaching a new multi-week high during the Asian session, the 14-hour relative strength index (RSI) failed to confirm the rally. This divergence indicates that momentum may be weakening, suggesting that the current price movement could be losing strength, and the upward trend may not be as sustainable as it appears at first glance.

In conclusion, while Bitcoin is approaching the psychologically significant $100,000 mark, these factors suggest that the journey to that level could be more challenging than expected. With concerns about the pace of the trade deal, resistance at key price levels, weakening demand from U.S. investors, and bearish divergences in momentum indicators, the path forward for Bitcoin may not be a straight line.

Share this content: