Technical traders are flagging a potential compression setup in XRP, identifying $1.39 as critical support and $1.44 as near-term resistance. A sustained move above that ceiling could pave the way for a rally toward $1.50 and possibly $1.62.

XRP was trading around $1.42 as volatility cooled to levels last seen ahead of a major 2024 advance, prompting debate over whether the broader downtrend is beginning to lose momentum.

Market backdrop

The token has fallen approximately 61% from its all-time high during the latest bout of market turbulence. However, recent price behavior suggests the intensity of the selloff may be fading. Sharp directional moves have given way to tighter consolidation, with modest gains on shorter timeframes replacing aggressive declines.

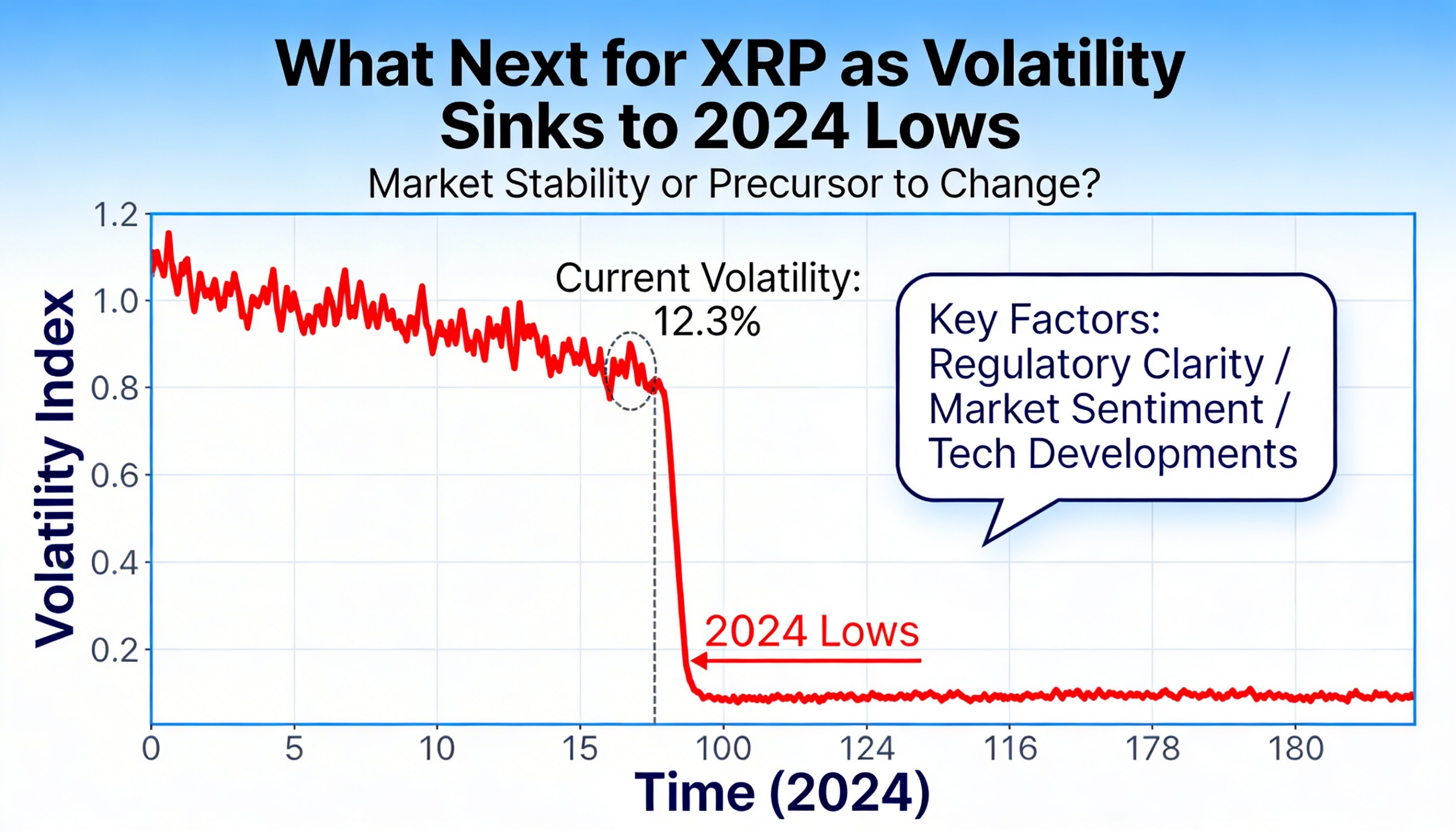

Notably, XRP’s historical volatility has dropped to 96 — a reading last recorded in June 2024, when the market carved out a bottom before rallying into November. That decline in volatility has sparked speculation that XRP may be entering another base-building phase.

Some analysts also see echoes of prior cycle structures, including the prolonged consolidation that preceded the 2017 breakout.

Price action recap

- XRP edged down 0.14% to $1.42

- Price tested and held support near $1.39

- Trading volume spiked roughly 94% above average during the dip

- The rebound stalled in the $1.428–$1.431 resistance zone

Technical picture

The session’s pivotal moment came when XRP probed $1.3915 on elevated volume before stabilizing. The subsequent rebound marked a 38.2% retracement, but upside momentum weakened as the price approached the $1.44 area — aligned with the daily pivot and acting as near-term resistance.

While the broader structure remains cautious below the $1.44–$1.45 band, the successful defense of $1.39 indicates that sellers may be losing urgency. Additionally, declining volume during consolidation points to tightening conditions rather than renewed distribution pressure.

What traders are watching

Market participants characterize the current setup as compression — a period of narrowing ranges that often precedes a volatility expansion.

- A decisive reclaim of $1.44 could open the door to $1.50 and potentially $1.62.

- A break below $1.39 would shift focus to downside risk toward $1.35.

With volatility hovering near prior cycle lows, traders suggest the next major move may hinge less on immediate direction and more on how long the range can persist before a breakout unfolds.

Share this content: