$4B Bitcoin ETF Outflows Linked to Arbitrage, Not Institutional Panic

Recent outflows from U.S.-listed spot bitcoin ETFs were largely driven by mechanical arbitrage trade closures rather than broad institutional selling.

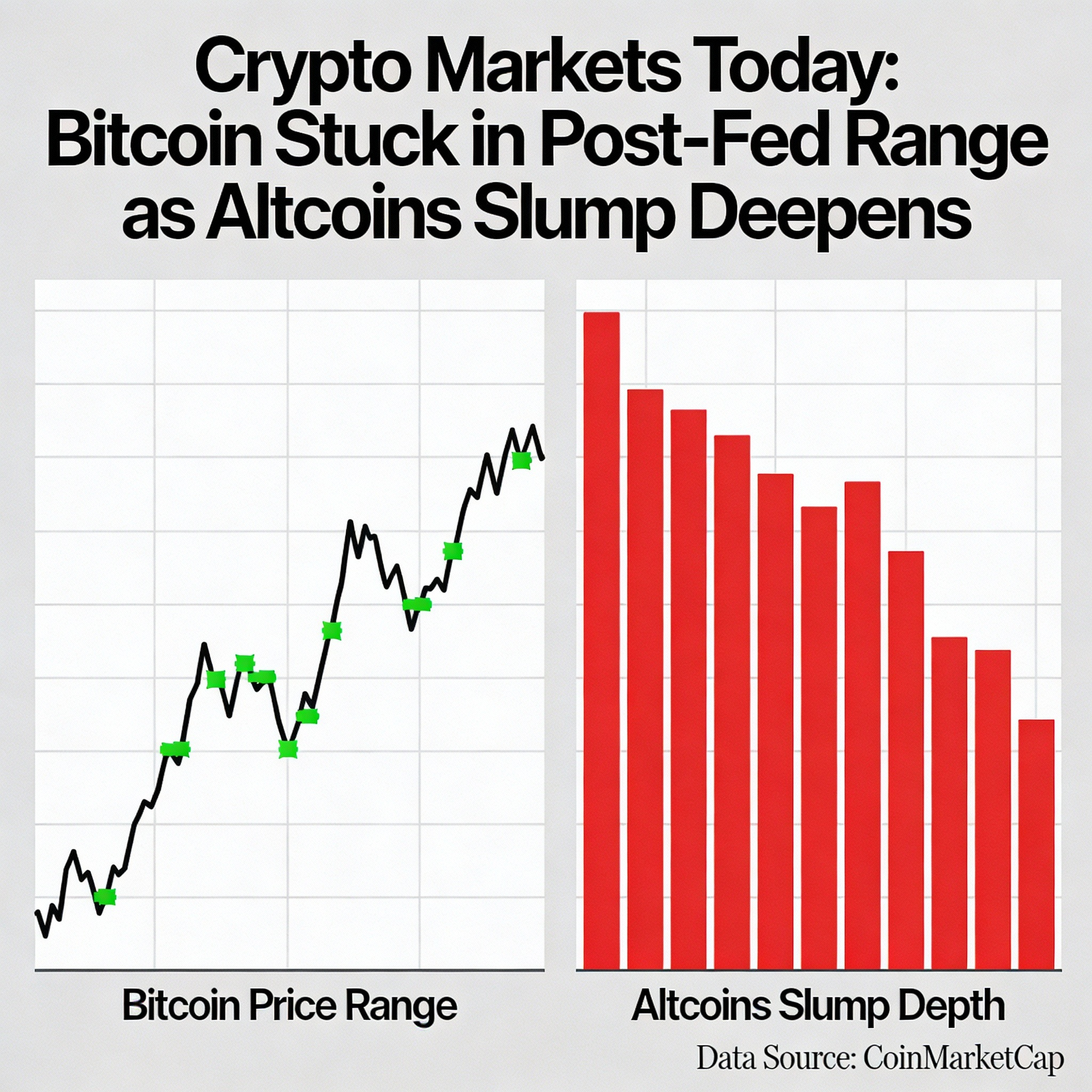

Despite a 35% BTC price drop from $125,000 to the low $80,000s, which sparked speculation of institutional capitulation, Amberdata’s analysis shows that most redemptions came from “basis trade” unwinds, while total ETF holdings remained healthy at 1.43 million BTC.

“Nearly $4 billion in Bitcoin ETF outflows since mid-October coincided with a sharp price decline, but the activity was concentrated among a few issuers and tied to basis trade mechanics, not widespread investor panic,” said Michael Marshall, head of research at Amberdata.

BlackRock accounted for 97%-99% of recent weekly outflows despite holding 48%-51% of assets, while Fidelity’s FBTC ETF saw inflows and smaller ETFs remained steady. From October 1 to November 26, Grayscale, 21Shares, and Grayscale Mini accounted for almost 90% of total outflows.

The outflows were driven by falling spot-futures basis spreads, which fell from 6.63% to 4.46%, forcing carry traders to unwind positions—selling ETFs and buying back futures. BTC perpetual futures open interest fell 37.7% ($4.23B), closely tracking ETF outflows and confirming that the activity reflected arbitrage adjustments rather than panic selling.

Share this content: