Treasury Secretary Janet Yellen recently indicated that the U.S. is expected to hit its debt ceiling between January 14 and January 23, coinciding with President-elect Donald Trump’s inauguration. In a letter to House Speaker Mike Johnson, Yellen warned that once the debt ceiling is reached, the Treasury would begin taking “extraordinary measures” to manage borrowing.

“I respectfully urge Congress to act to protect the full faith and credit of the United States,” Yellen wrote. In June 2023, Congress suspended the debt limit until January 1, 2025, but with the ceiling approaching, action is required to avoid potential financial instability.

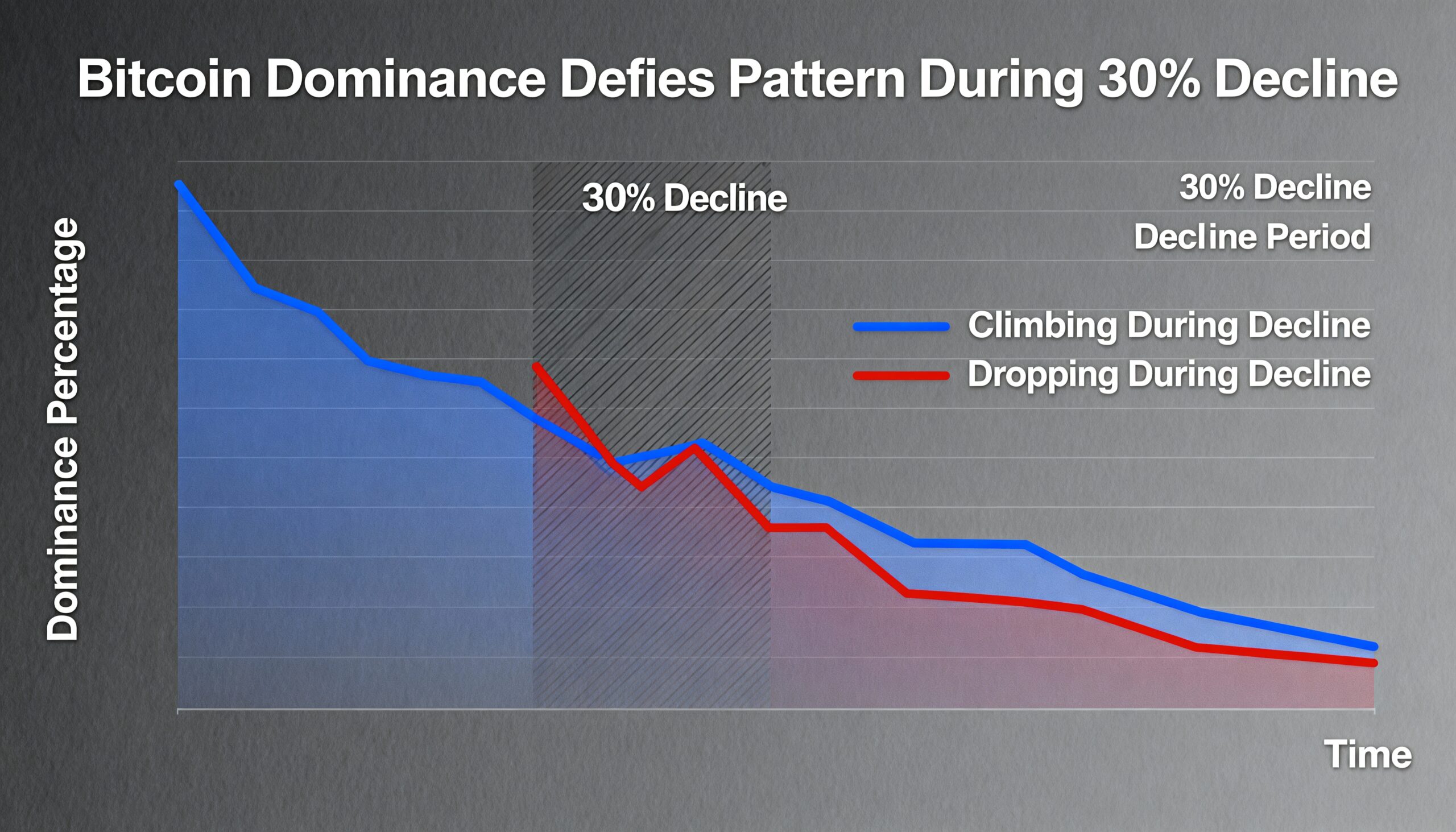

The news had an immediate impact on the markets. Risk assets weakened as U.S. equities saw losses across major indices, including the S&P 500, Nasdaq 100, and Dow Jones Industrial Average, all dropping around 1%. Bitcoin also saw a dip, falling as much as 4% from its intraday high.

Historically, Bitcoin has reacted negatively to debt ceiling raises. On the five occasions when the debt ceiling was increased, Bitcoin has typically underperformed or declined in value in the days following the announcement.

Bitcoin has faced challenges this December, with a 3% decline, marking its first losing month since August. To add to the uncertainty, President-elect Donald Trump’s inauguration on January 20 falls within the critical period Yellen outlined, further amplifying market concerns.

The U.S. debt limit, established at $45 billion in 1939, has been raised 103 times since then, as government spending continues to exceed tax revenues. The current national debt stands at over $36.2 trillion, according to Zerohedge.

Bitcoin’s price action is also being influenced by its historical cycles. Since the low seen after the FTX collapse in November 2022, Bitcoin’s performance has mirrored that of previous cycles. With an almost 500% return from that point, the cryptocurrency is now at a similar stage to the previous cycles, which were followed by significant drawdowns.

Given the past cycles, there is speculation that the upcoming debt ceiling resolution and Trump’s inauguration may signal a potential bottom for Bitcoin, similar to previous market corrections.

Share this content: