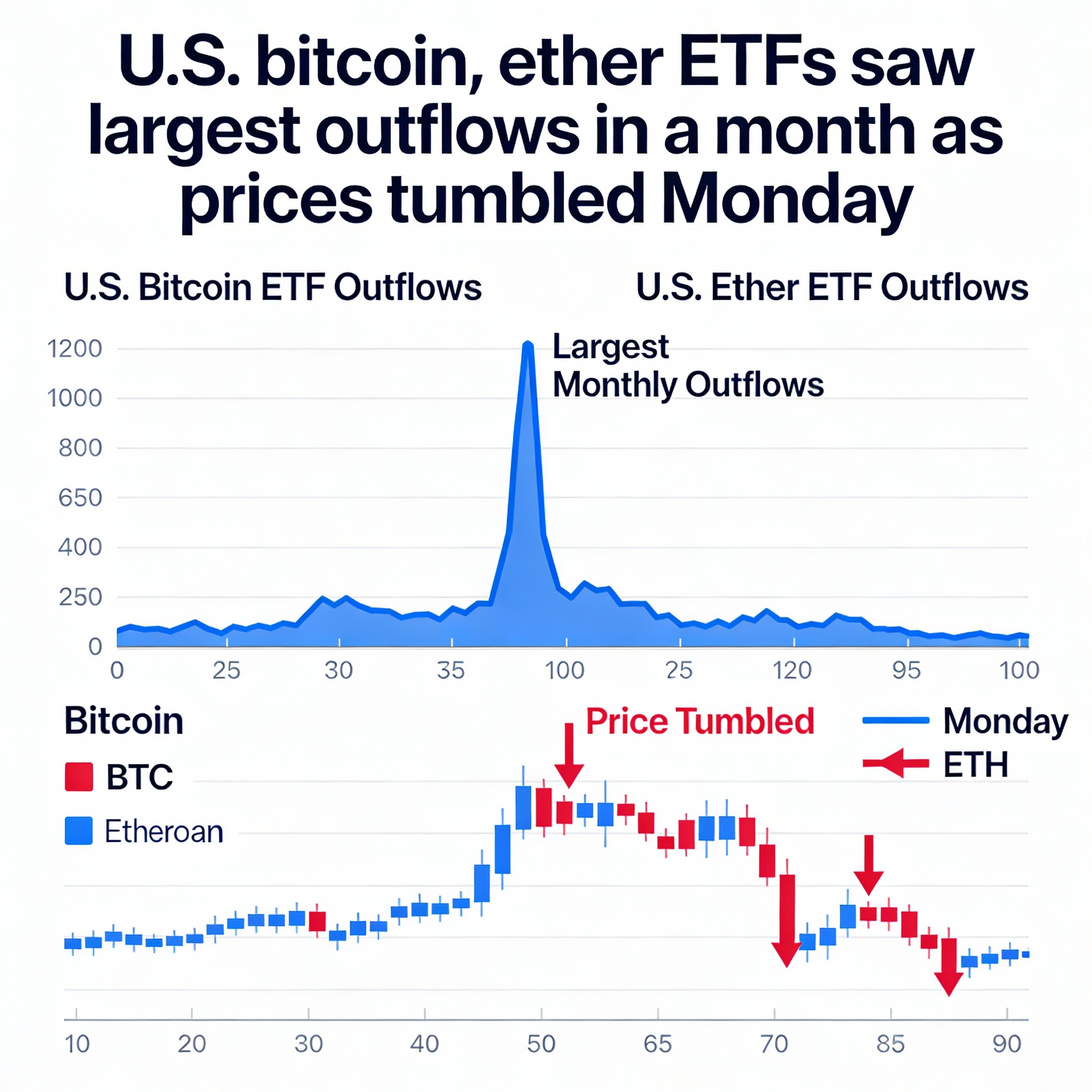

U.S. Bitcoin and Ether ETFs Record Biggest Outflows Since November as Prices Slide

U.S. spot bitcoin (BTC$88,457.49) and ether (ETH$2,961.55) ETFs saw a combined $582 million in net outflows on Monday, the largest since November 20, as crypto markets fell and bitcoin dipped to $85,100.

Bitcoin ETFs led the withdrawals with $357.6 million redeemed—the heaviest in nearly two weeks—while ether ETFs saw $224.8 million exit, marking a third consecutive day of redemptions, according to Farside data.

Mondays have historically been weaker for bitcoin. Velo data shows it is the third-worst performing weekday over the past 12 months, trailing only Thursday and Friday, with several 2025 local lows occurring on Mondays.

The U.S. ETF cost basis, representing the average entry price of bitcoin held by ETFs, currently sits near $83,000. This level has previously provided support during lows on November 21 and December 1, according to Glassnode.

Among bitcoin ETFs, Fidelity Wise Origin Bitcoin Fund (FBTC) saw $230.1 million in outflows, followed by Bitwise Bitcoin ETF (BITB) at $44.3 million and ARK 21Shares Bitcoin ETF (ARKB) at $34.3 million. BlackRock’s iShares Bitcoin Trust (IBIT) reported no net flows.

For ether ETFs, iShares Ethereum Trust (ETHA) accounted for the majority of withdrawals, with $139.1 million redeemed.

Share this content: