An accumulation of positions at lower strike prices is highlighting a growing push for downside hedges in bitcoin following its steep correction.

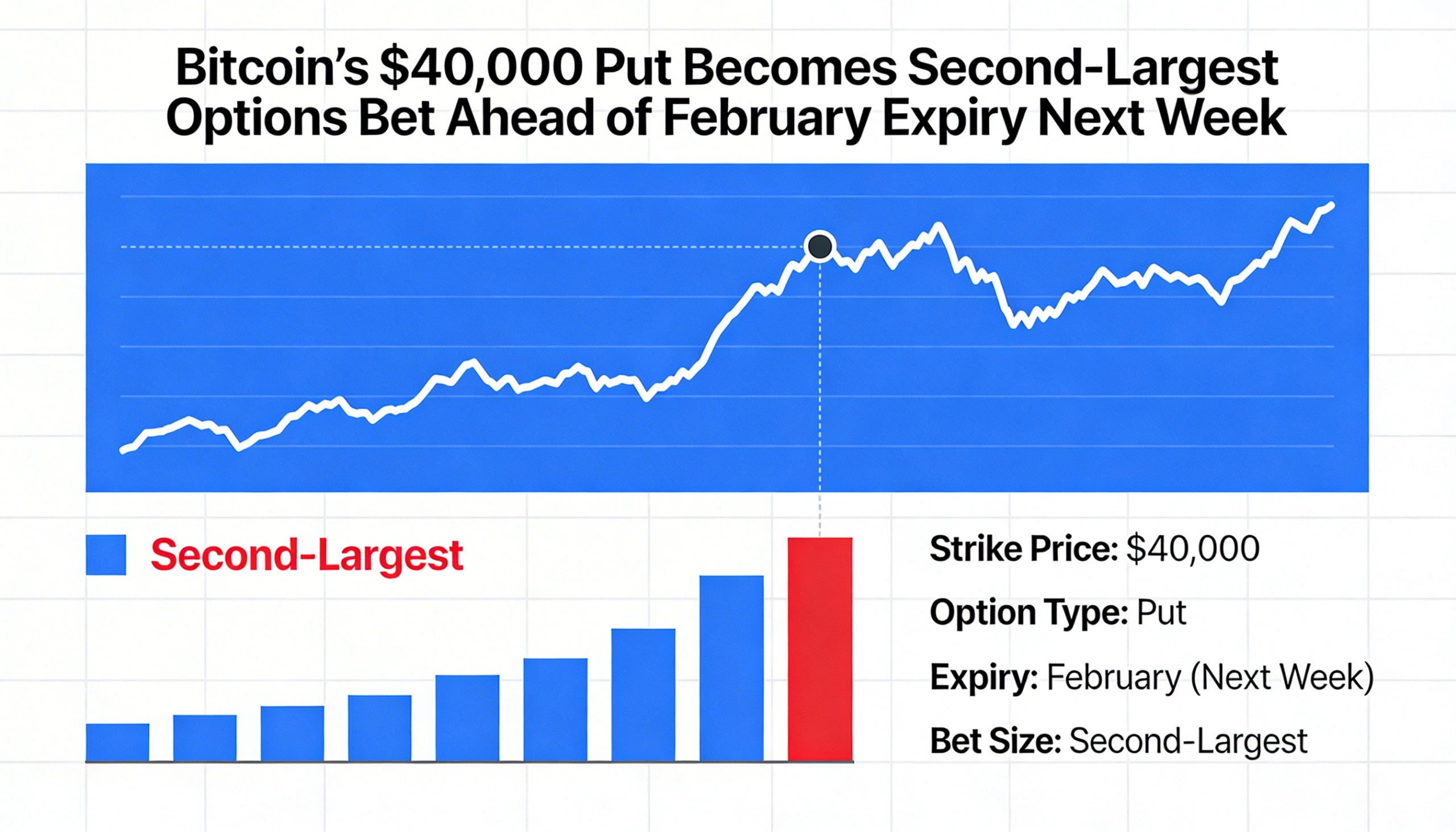

The $40,000 put option has emerged as one of the most significant strikes ahead of the Feb. 27 expiry, underscoring strong demand for protection against further declines. Put options provide the right, though not the obligation, to sell bitcoin at a predetermined price before expiration, offering a safeguard if the market falls beneath the strike level.

Open interest at the $40,000 strike totals roughly $490 million in notional terms, making it the second-largest concentration in the options market. The size of that exposure points to heightened concern about deep downside risks. Bitcoin has retreated by as much as 50% from its October peak and is currently trading near $66,000, reshaping derivatives positioning as traders brace for potential additional weakness.

Figures from Deribit — the Dubai-based platform owned by Coinbase — show that about $7.3 billion in bitcoin options notional value is set to expire at month-end.

At the same time, approximately $566 million in open interest is clustered around the $75,000 strike, which also represents the so-called “max pain” level. That is the price where the largest share of options contracts would expire worthless, limiting payouts to buyers. With spot prices below $75,000, a rally toward that level into expiry could reduce losses for call sellers.

While calls continue to outnumber puts — 63,547 call contracts compared with 45,914 puts — positioning is not unambiguously bullish. A put-to-call ratio of 0.72 indicates upside exposure still leads overall, yet the substantial buildup of put open interest at lower strikes signals a clear appetite for downside insurance.

Traders, in effect, are maintaining exposure to a potential rebound while simultaneously hedging against the risk of another pronounced leg lower.

Share this content: