JPMorgan Launches IBIT-Linked Structured Note Aligned with Bitcoin’s Halving Cycle

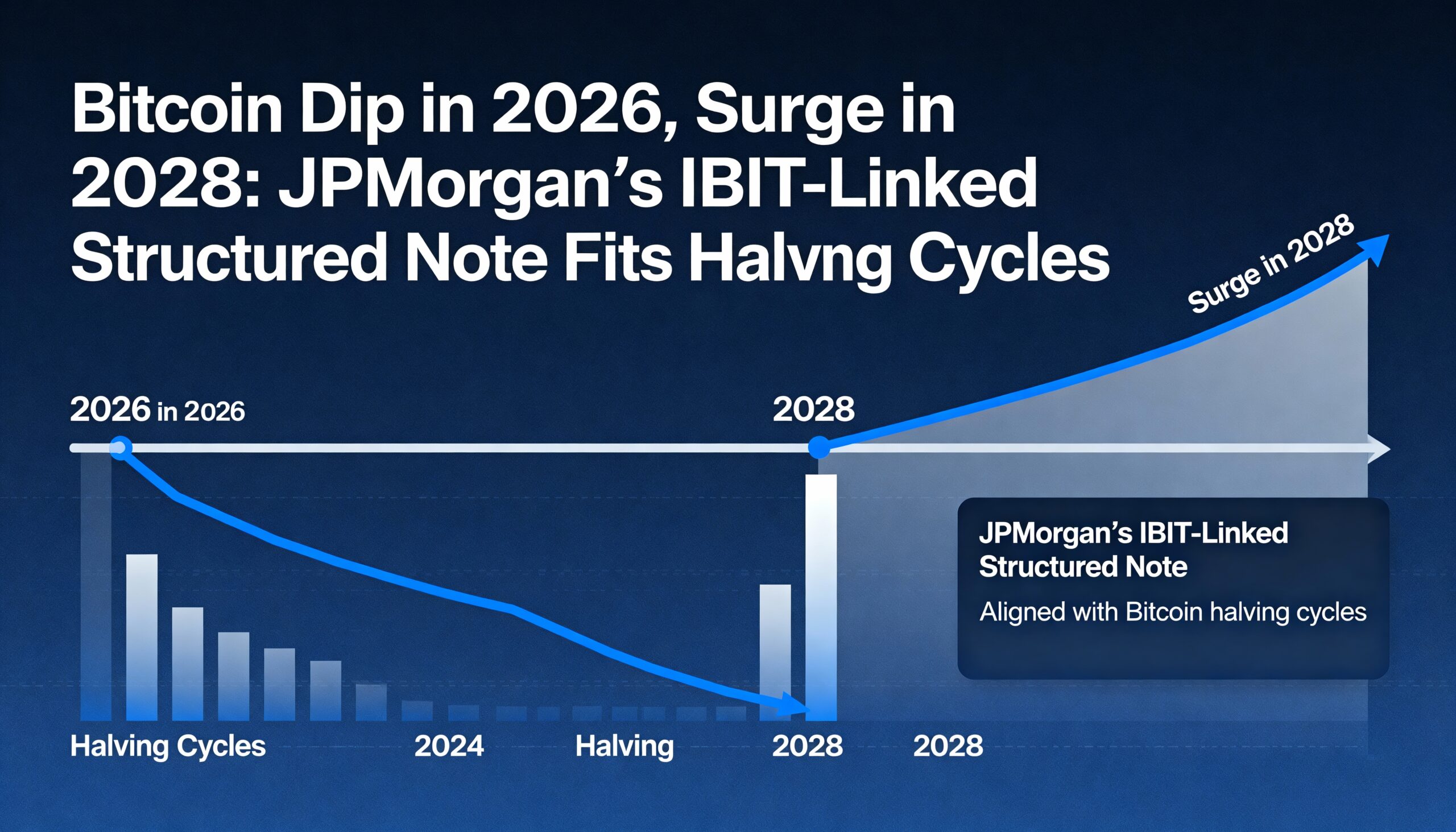

JPMorgan Chase has rolled out a structured note tied to BlackRock’s IBIT, designed around Bitcoin’s four-year halving cycle. The note targets investors looking to capitalize on BTC’s historical pattern of post-halving dips followed by rallies.

Filed with regulators this week, the product offers potentially unlimited returns if BTC remains below a set level in 2026 but rallies by the end of 2028. Historically, Bitcoin enters a bear phase roughly two years after a halving, followed by a bull run in the next cycle. With the last halving in 2024, BTC is projected to dip in 2026 before rebounding in 2028.

If the IBIT ETF hits JPMorgan’s 2026 target, investors receive a guaranteed 16% return. If not, the note remains active until 2028, offering exposure to amplified gains. Should IBIT surpass the 2028 target, investors could earn 1.5 times their initial investment with no cap.

The note also includes downside protection: investors recover their principal as long as IBIT doesn’t drop more than 30%. Losses beyond that scale proportionally, with the potential to exceed 40% or even reach total principal loss.

This structured note provides institutional and sophisticated investors a way to strategically participate in Bitcoin’s halving-driven cycles while managing both upside potential and risk.

Share this content: