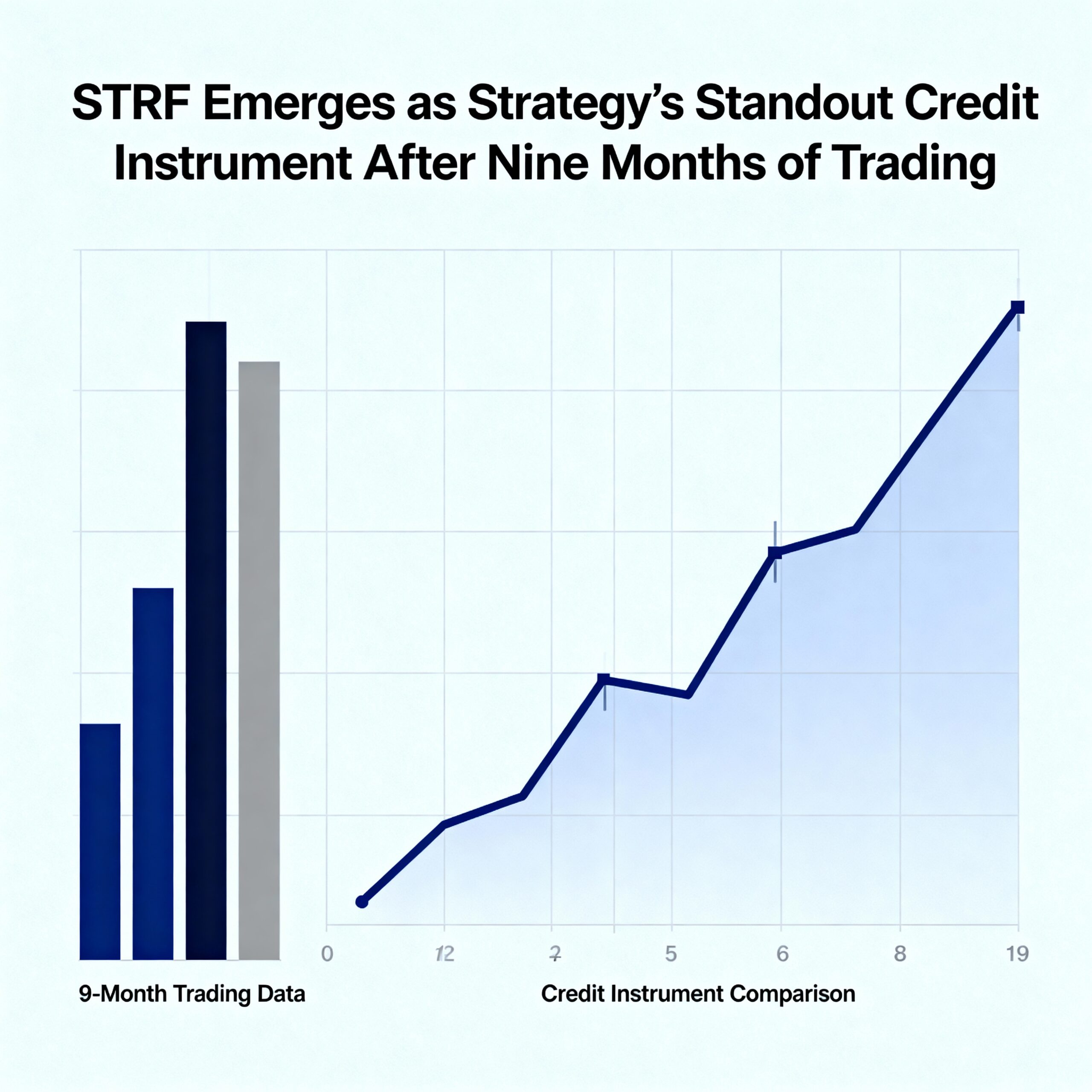

Strategy’s (MSTR) senior perpetual preferred stock, STRF, continues to outperform the rest of the firm’s capital structure, solidifying its position as the company’s leading credit instrument since its March issuance. The security has recovered roughly 20% from its November lows, a move that has exceeded the rebound in Strategy’s junior preferred offerings.

STRF now trades near $110, marking a 36% gain from issuance and a sharp recovery from its Nov. 21 low of $92. That session also marked bitcoin’s local trough near $80,000, underscoring the strong directional link between STRF and the cryptocurrency.

As the senior preferred issue, STRF provides a 10% fixed annual dividend, governance provisions, and penalty-driven coupon step-ups if payments are missed. Although its premium price has reduced the effective yield to roughly 9.03%, demand has stayed firm due to the instrument’s seniority and long-duration credit characteristics.

In late October, Executive Chairman Michael Saylor pointed to the expanding yield gap between STRF and the junior STRD, which widened to 12.5% as investors demanded higher compensation for increased subordination risk. During the Nov. 21 drawdown, the spread reached a record 1.5, with STRD falling to $65 as capital rotated into the senior tranche. The differential has since pulled back to around 1.3.

Divergence is also emerging elsewhere in the preferred suite. The mid-tier STRC has required four dividend increases to maintain buyer interest.

Strategy’s common equity has moved higher as well, rebounding from $155 on Dec. 1 to roughly $185. The recovery reflects improved sentiment toward both the company’s balance sheet and the broader bitcoin market after Strategy established a $1.44 billion cash reserve dedicated to preferred dividend obligations.

Share this content: