JPMorgan: Index Uncertainty, Not Bitcoin Moves, Is Driving Strategy’s Sell-Off

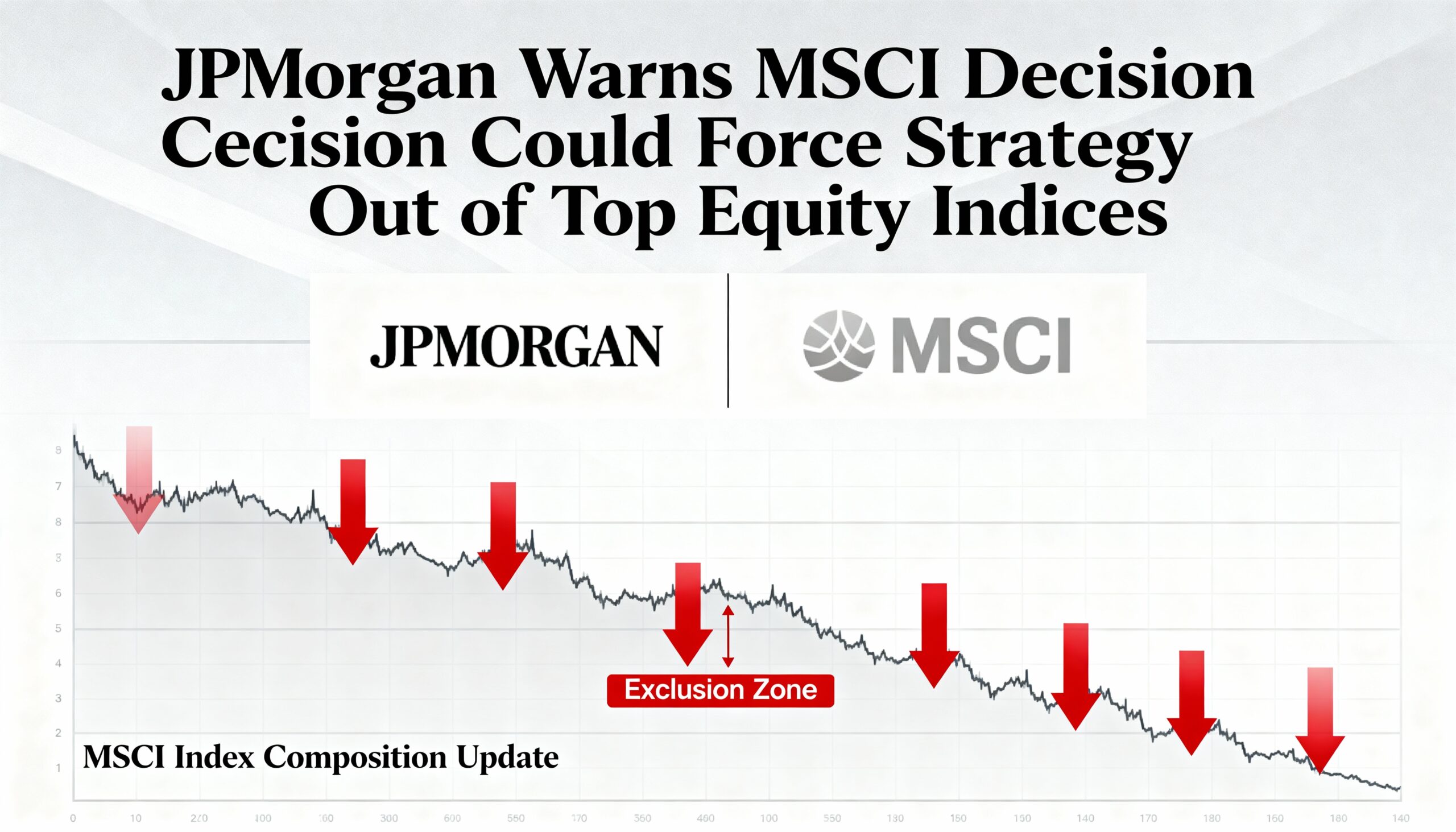

Strategy’s (MSTR) pronounced slump against bitcoin BTC$86,349.64 has little to do with the crypto market itself and everything to do with potential index exclusion, according to a new report from JPMorgan (JPM).

The bank noted Wednesday that the company’s once-sizeable premium over its bitcoin holdings has largely disappeared. But the latest drop, it said, is tied to rising expectations that MSCI could drop Strategy from major benchmarks when it releases its Jan. 15 reconstitution update.

Strategy, founded by Michael Saylor, currently features in heavyweight indices such as the Nasdaq 100, MSCI USA and MSCI World. JPMorgan estimates that roughly $9 billion of the firm’s $59 billion market cap is held by passive products—ETFs and mutual funds—that track those indices.

This index exposure has quietly funneled bitcoin-linked allocations into mainstream portfolios. Should MSCI remove Strategy, JPMorgan projects passive outflows of about $2.8 billion, expanding to as much as $8.8 billion if other index providers adopt similar rules on companies holding digital assets as core treasury reserves.

While discretionary fund managers are not required to sell, the analysts said losing index status would still be damaging. It could weaken Strategy’s access to equity and debt markets, diminish liquidity and erode the stock’s appeal to large institutional players.

JPMorgan also pointed out that Strategy’s combined equity, debt and preferred market value—relative to its underlying bitcoin—has fallen to its lowest level since the pandemic era. A negative MSCI decision in January would likely push that ratio closer to one, effectively making the company’s valuation almost a direct reflection of its bitcoin holdings.

In pre-market trading, Strategy shares were up 3.5% at about $193.

Share this content: