Strategy’s Balance Sheet Stable, but Raising Capital May Face Challenges

Strategy (MSTR) is not facing immediate financial distress, but continued weakness in Bitcoin and the company’s stock, which has fallen nearly 70% from last year’s peak, could make future capital-raising more difficult.

Throughout 2025, Strategy has primarily relied on perpetual preferred stock to fund Bitcoin purchases, while using at-the-market (ATM) common share issuance mainly to cover preferred dividend obligations.

Under Executive Chairman Michael Saylor, the company issued four U.S.-listed preferred series this year:

- Strike (STRK): 8% fixed dividend, convertible at $1,000 per share.

- Strife (STRF): 10% fixed non-cumulative dividend, senior-most preferred.

- STRD: 10% cumulative dividend, junior preferred.

- Stretch (STRC): 10.5% fixed cumulative dividend, debuted at $90 in August and trades just above the offer price.

As of Nov. 21, STRK trades near $73 (11.1% yield), STRD at $66 (15.2% yield), and STRF at $94, the only series still above issuance.

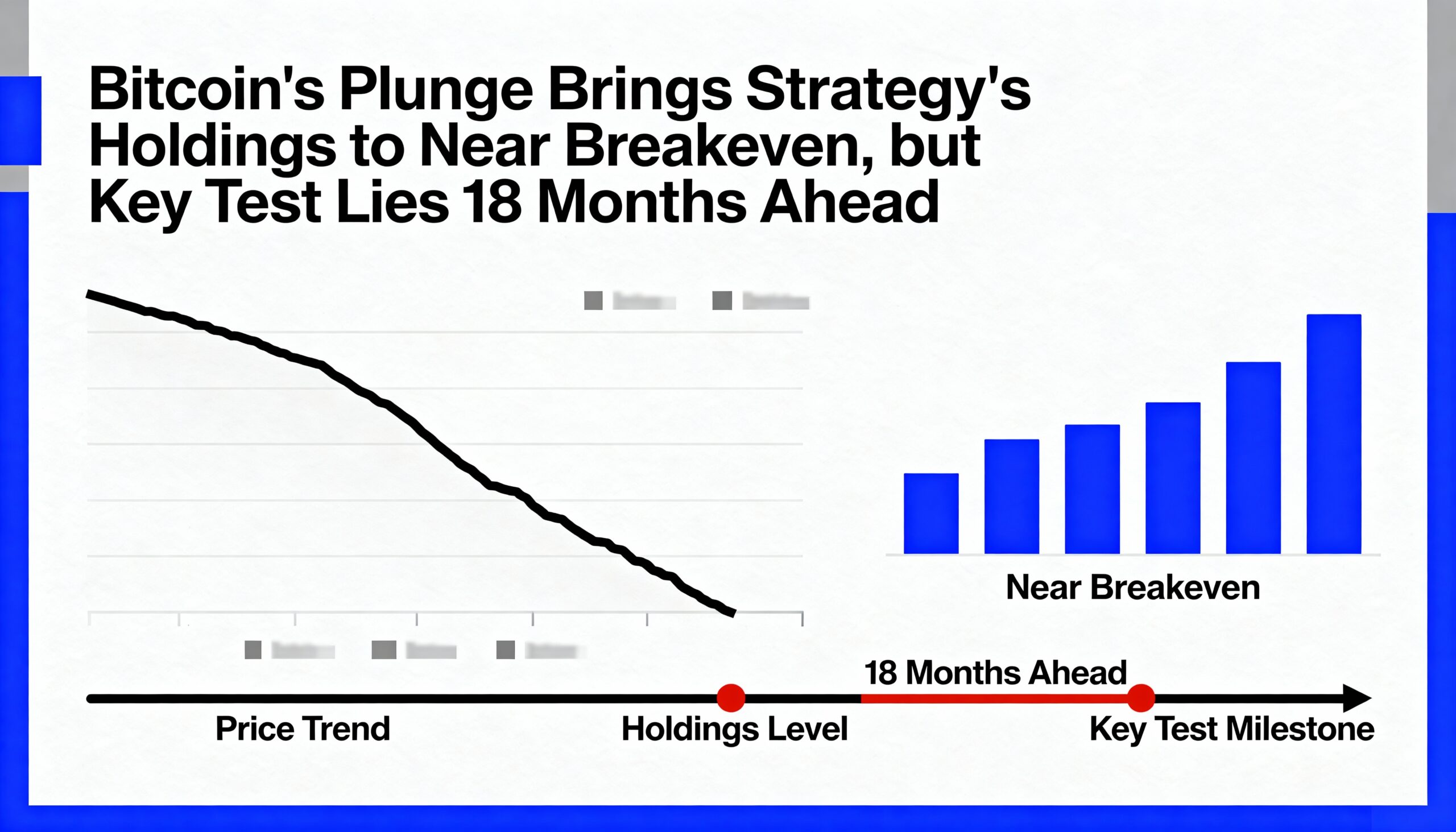

Bitcoin Holdings Near Breakeven

Recent Bitcoin weakness highlights the $74,400 level, where Strategy would technically be in the red on its Bitcoin holdings. However, falling below this threshold does not trigger margin calls or force sales.

The next major structural pressure point is September 15, 2027, when holders of $1 billion in 0.625% convertible senior notes can exercise a put option. The notes, priced when MSTR traded at $130.85 with a conversion price of $183.19, are unlikely to be converted at today’s stock price (~$168). Holders would likely seek cash repayment, potentially requiring Strategy to raise funds or sell assets unless the share price rises before then.

Options to Maintain Dividend Payments

Even if MSTR’s market valuation relative to Bitcoin holdings (mNAV) declines further, the company has several ways to cover preferred dividends:

- Issue ATM common shares

- Sell portions of its Bitcoin treasury

- Pay dividends in-kind using newly issued stock

While dividends are not at immediate risk, relying on these options could weaken investor confidence and temporarily limit the company’s ability to raise additional capital for Bitcoin purchases.

Share this content: