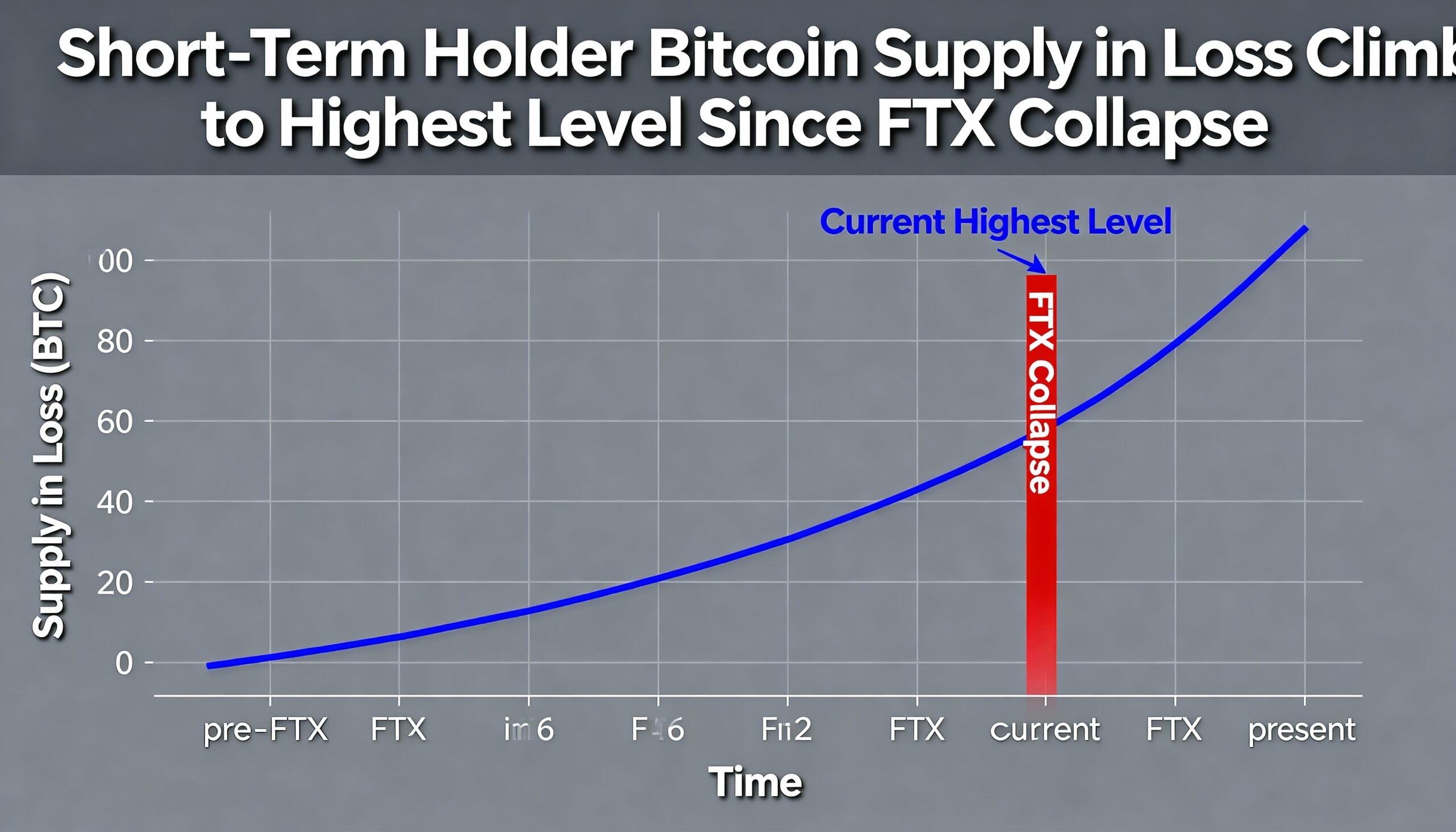

U.S. spot bitcoin ETFs are showing surprising resilience even as short-term investors face their deepest unrealized losses since the FTX collapse.

Bitcoin’s recent pullback has pushed nearly all short-term holder (STH) positions underwater. Glassnode categorizes STHs as wallets that have held BTC for fewer than 155 days. With bitcoin trading at around $84,700, every coin acquired since June 15 — when BTC hovered near $104,000 — now sits above current market prices.

According to Glassnode, roughly 2.8 million BTC held by STHs are currently at a loss, the largest amount since November 2022, when bitcoin plunged toward $15,000 during the FTX fallout. The latest correction amounts to a 25% drawdown from October’s all-time high, aligning with the historically typical 20%–30% retracement seen during bull markets.

In contrast to STHs, long-term holders (LTHs) have been steadily reducing their holdings in recent months. LTH supply has dropped from 14,755,530 BTC in July to 14,302,998 BTC as of Nov. 16 — a net decline of 452,532 BTC.

“Many long-standing holders have chosen to sell in 2025 after many years of accumulation,” said Bitcoin OG and Fragrant Board Director Nicholas Gregory. He added that these sales appear to be driven by lifestyle needs rather than pessimism, and that the launch of U.S. ETFs and bitcoin’s surge toward $100,000 provided an attractive liquidity window.

ETF Flows Present a Strong Contradiction

Despite the broader market drawdown, U.S.-listed spot bitcoin ETFs have held steady. Total ETF AUM has fallen only about 4% in BTC terms, compared with bitcoin’s 25% price decline over the same period — a notable divergence.

Current holdings stand at 1.33 million BTC, only slightly below the 1.38 million BTC peak recorded on Oct. 10, according to checkonchain — a modest 3.6% dip. Measuring AUM in BTC rather than dollars removes price-related distortions and shows that ETF investors have not been net sellers during this correction.

The data suggests that ETF outflows are not driving the latest downturn. Instead, the selling pressure appears to be coming from longer-term holders reducing exposure, combined with short-term investors increasingly sitting on unrealized losses.

Share this content: