Robinhood’s crypto business continued to struggle in the fourth quarter, as falling digital asset prices weighed on trading activity despite efforts to expand its platform.

The brokerage reported $221 million in crypto transaction revenue, down 38% from $358 million a year earlier, highlighting how retail-driven trading remains sensitive to market conditions.

Over the past year, Robinhood has expanded its crypto offerings, adding a broader range of tokens and enabling transfers across more regions. The company has promoted these moves as steps toward becoming a comprehensive gateway to digital assets rather than just a trading app. However, lower crypto prices limited trading activity, keeping revenue under pressure.

Beyond crypto, Robinhood’s broader business showed more resilience. Total transaction-based revenue climbed 15% year over year to $776 million, driven by gains in equities and options trading, which helped offset the slump in crypto revenue.

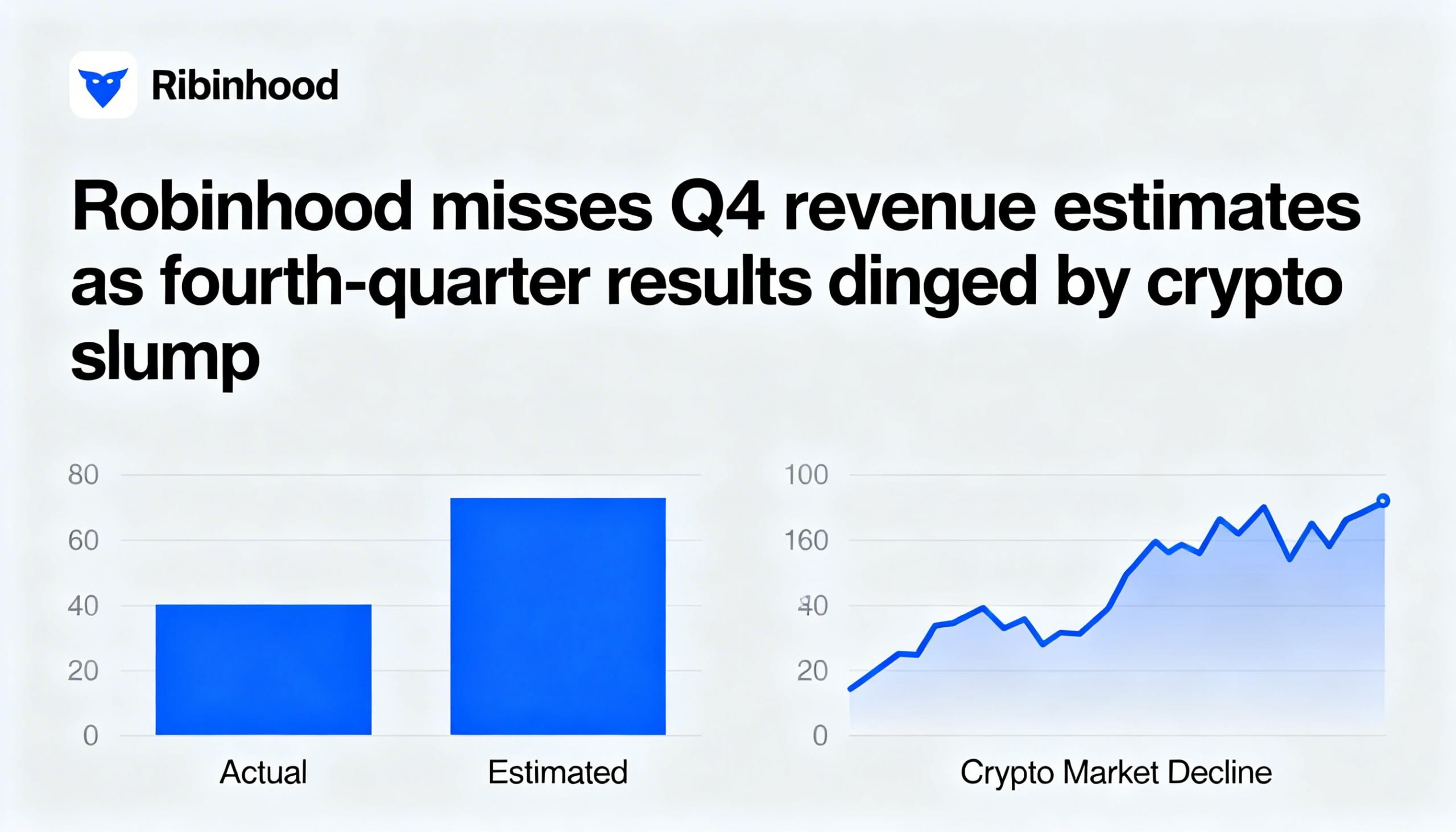

For the quarter, the company reported earnings per share of $0.66, surpassing analyst expectations of $0.63. Total revenue came in at $1.28 billion, slightly below forecasts of $1.33 billion.

Shares fell 7.7% in after-hours trading, continuing a decline that began after crypto markets peaked in October 2025. At around $79, the stock is down nearly 50% from its all-time high.

Investors now turn to Coinbase, which reports earnings Thursday. Analysts expect similar pressure from lower crypto trading volumes, and its shares fell modestly following Robinhood’s results.

Share this content: