XRP Pulls Back From Resistance as Institutional Selling Accelerates

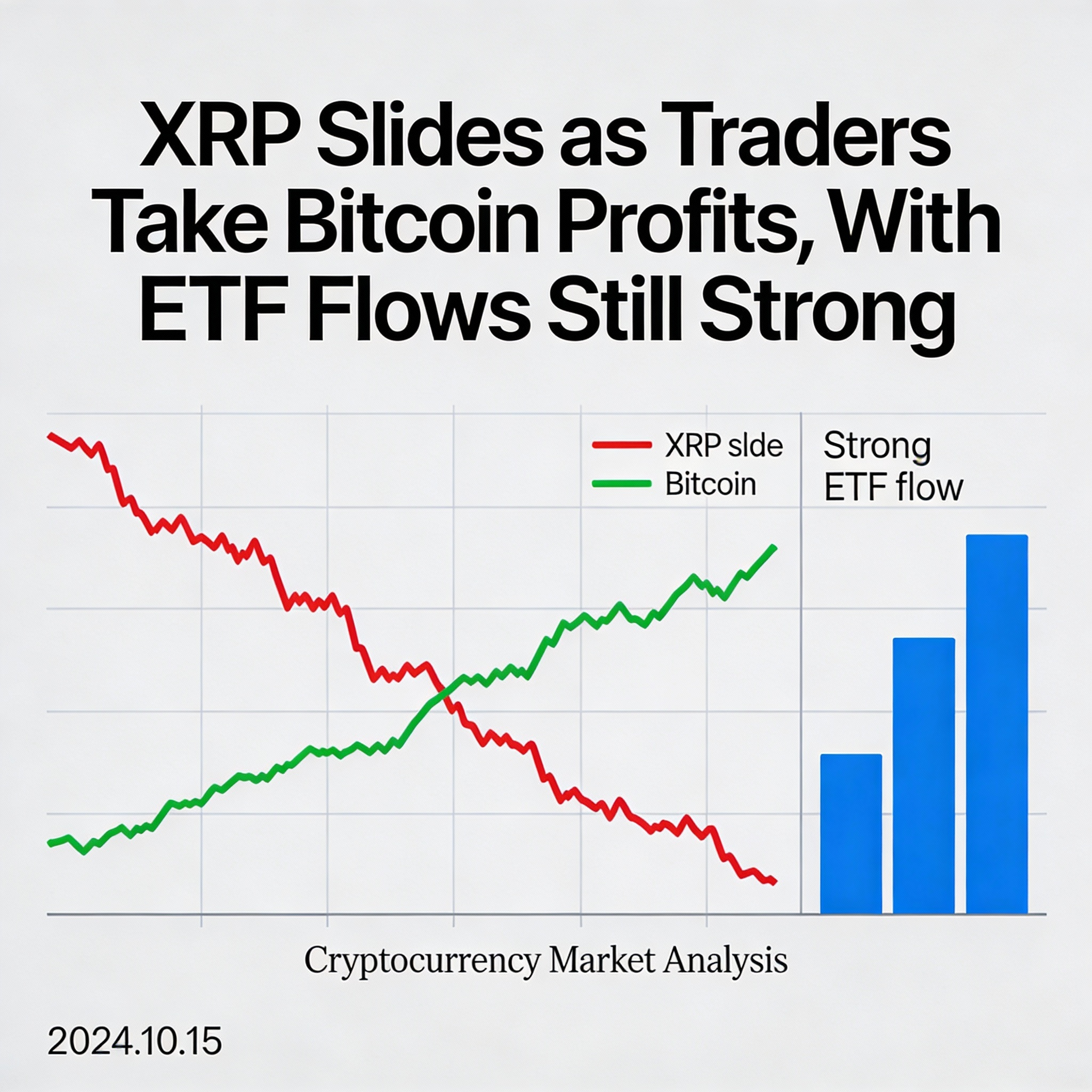

XRP failed to break the $2.09–$2.10 ceiling on Wednesday, retreating to the $2.00 psychological level as institutional flows surged 54% above the weekly average. The move reflects strategic distribution rather than retail panic, while ongoing ETF inflows continue to compress supply beneath the surface.

Key Takeaways

- XRP declined 4.3% from $2.09 to $2.00, underperforming the broader crypto market by roughly 1%.

- Peak intraday volume reached 172.8 million tokens—205% above the daily average—at $2.08, confirming the failed breakout.

- Session volume ran 54% above the 7-day average, signaling institutional distribution rather than emotional selling.

- Exchange balances fell from 3.95B to 2.6B tokens over the past 60 days, tightening supply even as price action remains compressed within a multi-month triangle.

Market Context

- U.S. spot XRP ETFs posted over $170 million in weekly inflows, maintaining a streak of zero outflows.

- Heavy selling persists in the $2.09–$2.10 band, where XRP has repeatedly failed.

- Market makers had highlighted rising distribution pressure above $2.10 ahead of Wednesday’s move.

- XRP lagged broader crypto, with the CD5 index down 3.1%, indicating the weakness was token-specific rather than macro-driven.

Price Action Snapshot

- Intraday range: 5.4%, triggered by resistance rejection and high-volatility unwind

- Peak volume: 172.8M at 19:00 UTC (205% above daily average)

- Resistance: $2.08–$2.10

- Late-session support: $1.999–$2.005

- Relative performance: Lagged broader crypto by ~1%

Share this content: