Derivatives positioning in bitcoin is increasingly pointing to a period of sideways trading, as options traders prioritize premium income over bets on a sharp rally or sell-off.

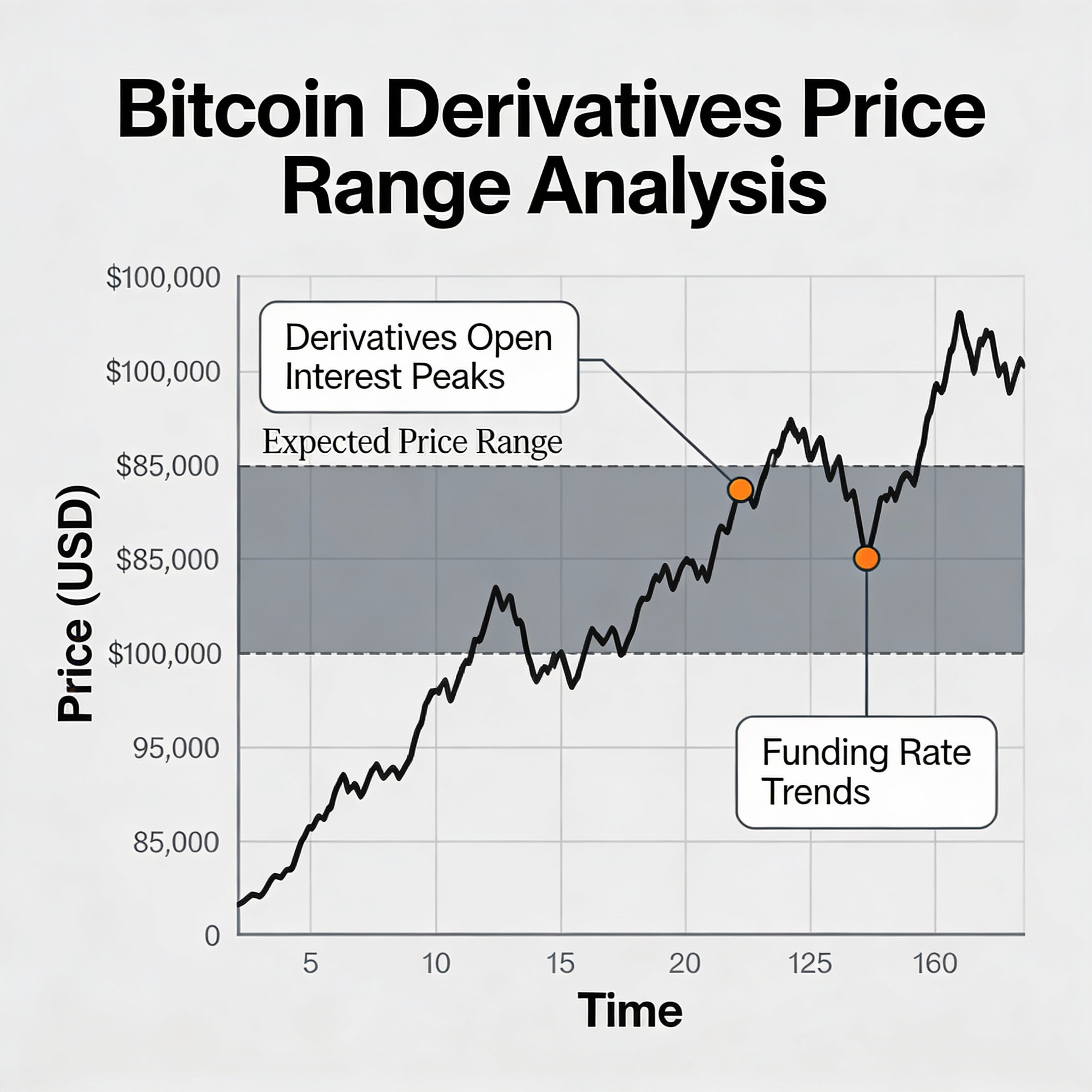

Options activity on Deribit highlights a well-defined support zone near $85,000, where consistent put selling suggests traders are comfortable underwriting downside risk. Data compiled by market maker Wintermute indicates this level has become a key reference point for near-term price expectations.

The $85,000 strike is now among the most heavily traded options across all expiries, ranking second by notional open interest at more than $2 billion. When bitcoin drifts toward heavily sold put levels, sellers often hedge by accumulating spot or futures positions, helping stabilize prices.

Upside positioning, meanwhile, suggests resistance is developing between $95,000 and $100,000. Bitcoin holders have been selling call options at these strikes to generate yield, a strategy that caps gains while obligating sellers to deliver BTC if prices rise beyond those levels. This dynamic can introduce selling pressure as prices approach six figures, limiting breakout potential.

Reflecting this stance, the $100,000 call is currently the single largest options position on Deribit, with roughly $2.37 billion in notional open interest—an indication that traders see limited odds of a rapid move higher.

“Put selling around 85k remains strong, with secondary buffers at 80k and 75k, while call overwrites are containing upside around 95k to 100k. Volatility is being harvested inside this range,” said Wintermute desk strategist Jasper De Maere in an email.

The combination of heavy put and call selling underscores a volatility-harvesting approach, in which traders profit from muted price swings as options decay. If bitcoin remains range-bound, these contracts lose value and expire worthless, allowing sellers to retain the premiums.

Bitcoin was last trading near $87,400, according to CoinDesk data.

Share this content: