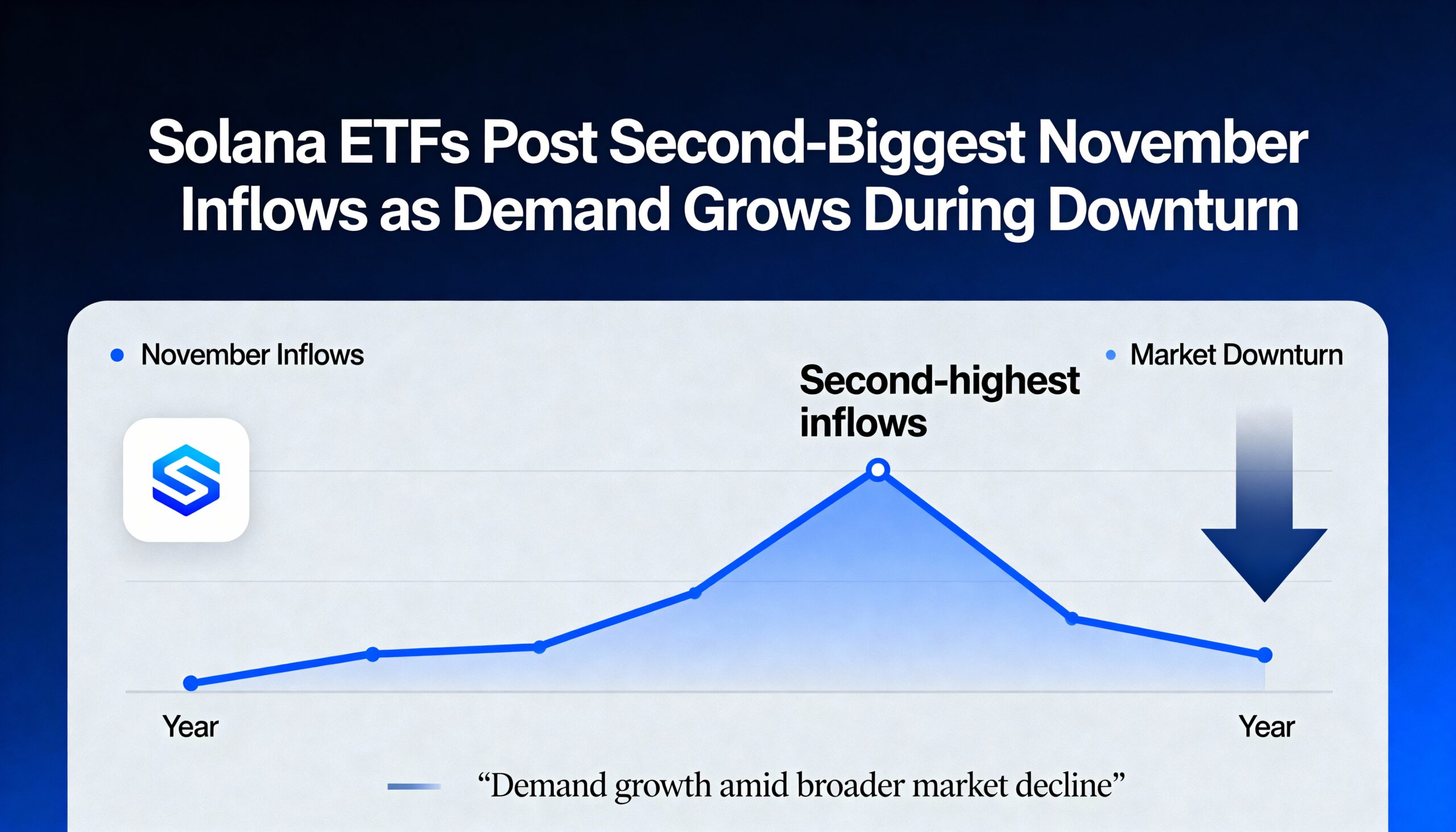

U.S. spot Solana exchange-traded funds continued to attract steady investor demand on Wednesday, extending their unbroken inflow streak to 17 trading days since launching on Oct. 28 — even as bitcoin and ether ETFs see heavy withdrawals.

The funds brought in another $48.5 million on Wednesday, pushing total net inflows to $476 million, according to data from Farside. It was the second-largest daily inflow for SOL products so far this month.

Solana’s consistent momentum stands in sharp contrast to the broader crypto ETF market. In November, bitcoin ETFs have recorded nearly $2.96 billion in net outflows, while ether ETFs have lost about $107 million.

Bitwise’s BSOL once again led the day with $35.9 million in new capital. Grayscale’s GSOL followed with $12.6 million, with more modest additions reported by Fidelity’s FSOL and VanEck’s VSOL.

Despite a weakening crypto backdrop — the CoinDesk 20 Index (CD20) has fallen 12% over the past week — Solana ETFs continue to attract fresh capital, signaling growing investor appetite for SOL exposure even during a downturn.

Share this content: