Dogecoin has slipped into an oversold territory, trading below both its 50-day and 200-day moving averages — a configuration that points to continued bearish momentum.

Market Overview

• Crypto markets remain in extreme fear as Bitcoin drops below $85,000.

• The total crypto market lost nearly $120 billion in 24 hours amid broad risk-off sentiment.

• Meme coins are undergoing widespread deleveraging, with liquidity across major exchanges thinning.

• Whale buying, active over the past two weeks, has slowed significantly.

• Forced liquidations are occurring across altcoins as macro pressures mount.

DOGE Price Action

• DOGE fell 11.2%, from $0.1578 to $0.1401, breaking multiple support layers.

• Trading volume spiked to 2.52B, a 263% increase over the 24-hour SMA.

• The decline began around 07:00 UTC, following rejection at $0.1595, triggering sustained downward momentum.

• Capitulation occurred between 07:33–07:36 UTC, with over 500M in turnover as price gapped from $0.144 to $0.138.

• The token attempted to stabilize near $0.140, forming a tentative short-term floor.

• The session printed consecutive lower highs and lower lows, confirming structural weakness.

Technical Analysis

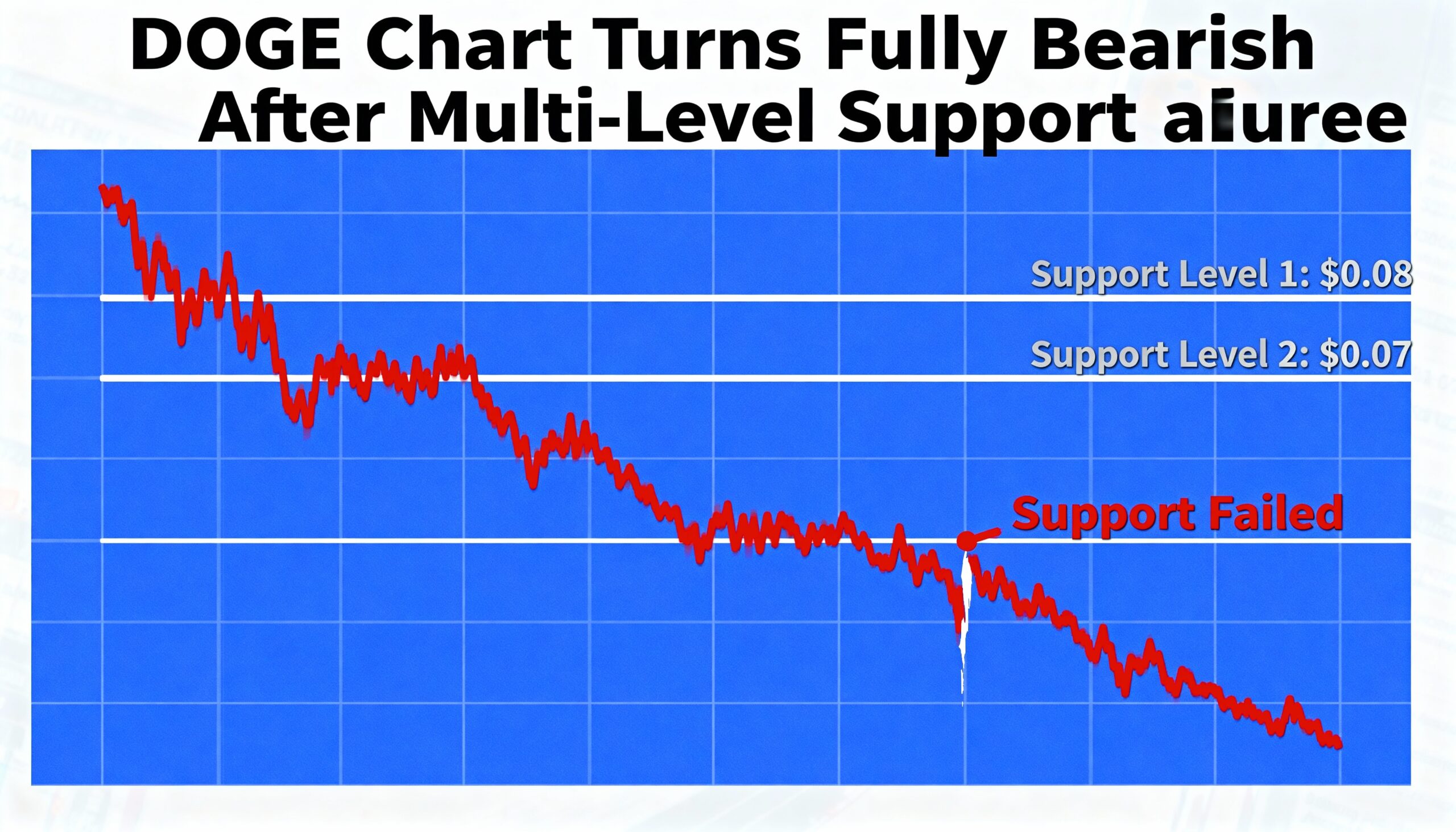

Dogecoin’s chart shows clear bearish damage driven primarily by technical breakdowns. Rejection at $0.1595 triggered selling pressure that intensified as liquidity dried up across meme-coin order books.

The rapid drop from $0.144 to $0.138 reflects algorithmic or institutional sell programs, with minute-by-minute gaps pointing to displaced liquidity likely requiring future backfills.

Volume metrics underscore the severity: 2.52B total volume, including 500M during the crash, indicates large-scale distribution rather than retail panic. Despite stabilization attempts near $0.140, the ongoing pattern of lower highs and lower lows keeps the trend decisively bearish.

Momentum indicators are deeply oversold but show no bullish divergence. Trading below downward-sloping 50-day and 200-day moving averages confirms that the downtrend remains intact.

Key Levels to Watch

• $0.138 is critical support; a breach could open the path to $0.135 and $0.128.

• $0.140 must hold as a base to prevent deeper structural damage.

• Backfilling the $0.144 liquidity gap would indicate early recovery attempts.

• Further Bitcoin weakness could accelerate downside pressure on DOGE.

• Whale inactivity adds near-term caution.

• Any DOGE ETF-related news could spike volatility but is unlikely to reverse the broader trend immediately

Share this content: