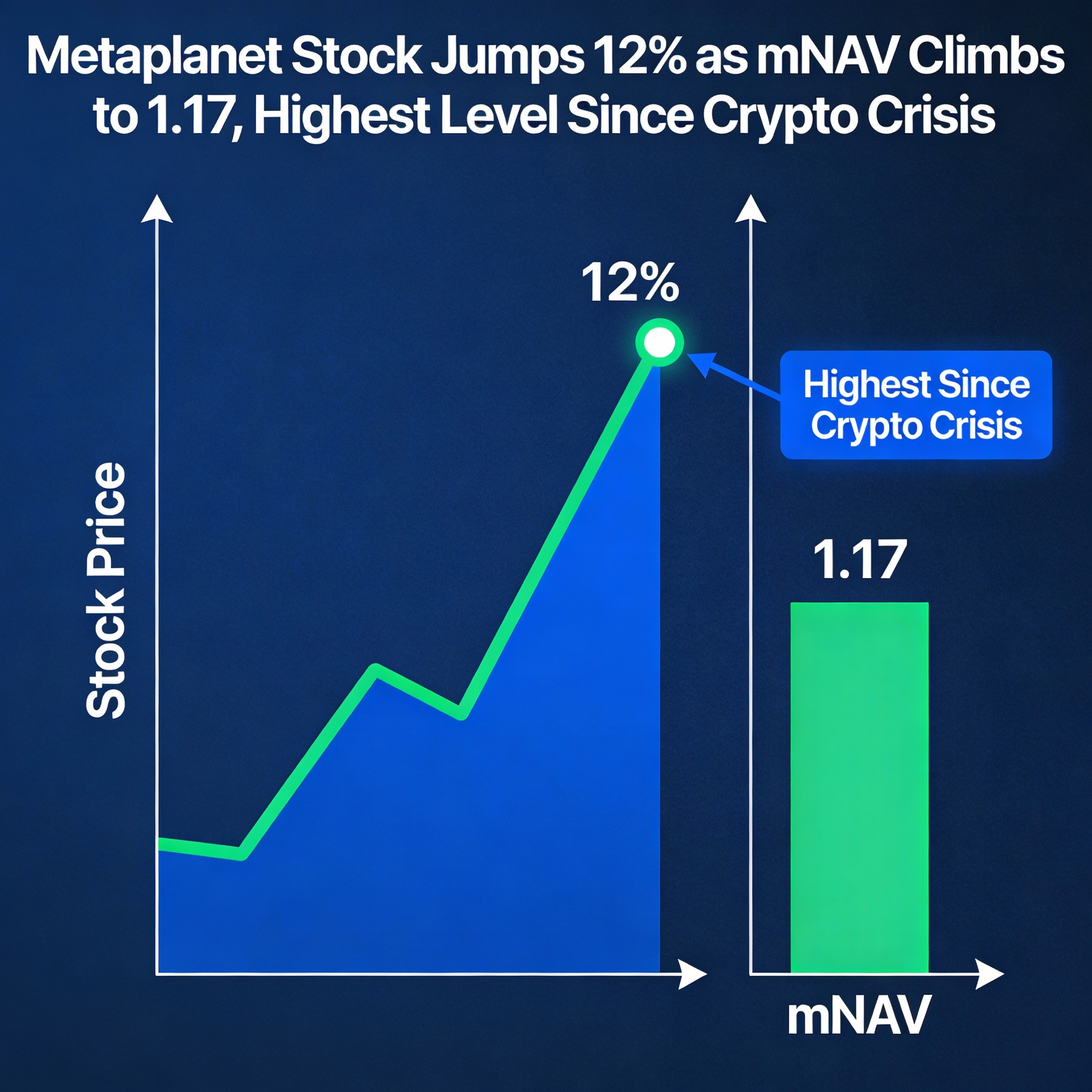

Metaplanet’s valuation premium has surged to its highest point since early October, supported by bitcoin’s upswing and renewed momentum in broader equity markets. The company’s multiple to net asset value (mNAV) has climbed to 1.17, according to its dashboard—its strongest reading since before the liquidation-driven crypto turmoil that began on Oct. 10.

The mNAV gauge assesses how richly investors are valuing Metaplanet by comparing the enterprise value of the business with the market value of its bitcoin holdings.

Metaplanet holds 30,823 BTC—worth about $2.86 billion—placing it as the fourth-largest publicly traded bitcoin holder. With an enterprise value of roughly $3.33 billion, the company’s mNAV comes in at around 1.17. Metaplanet’s market cap sits near $3.43 billion alongside approximately $304 million in outstanding debt.

Between mid-October and early December, the company’s mNAV remained under 1, bottoming at 0.84 in November. Metaplanet has not added to its treasury since late September, when it made two major acquisitions of 5,268 BTC and 5,419 BTC.

Since bitcoin’s Nov. 21 low near $80,000, the cryptocurrency has rebounded by roughly 15%. Metaplanet’s stock has rallied even more sharply, gaining nearly 30% over the same period.

The firm has also submitted filings for perpetual preferred equity as it continues to evolve toward a strategy similar to MicroStrategy’s.

Metaplanet’s shares closed 12% higher on Wednesday at 471 yen.

Share this content: