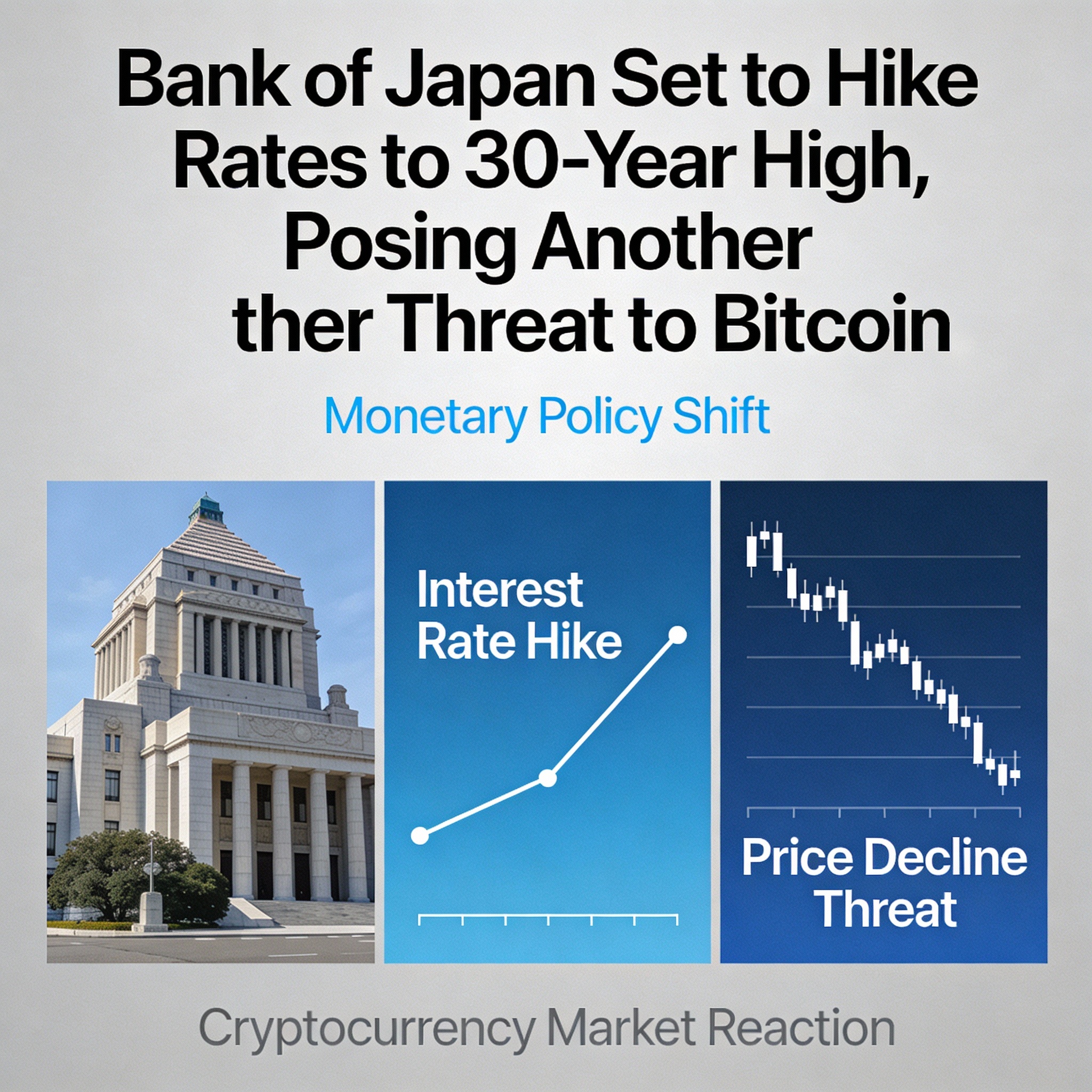

Japan’s rising interest rates and a strengthening yen could pose new headwinds for global risk assets, including cryptocurrencies, even as U.S. policy turns more accommodative.

The Bank of Japan is expected to raise its policy rate by 25 basis points to 0.75% from 0.50% on Dec. 19, marking its first increase since January, according to Nikkei. If implemented, this would push Japanese borrowing costs to their highest level in nearly 30 years.

While the full market impact remains uncertain, Japan’s monetary moves have historically weighed on bitcoin and the broader crypto market. Periods of yen strength have typically coincided with downward pressure on BTC, whereas a weaker yen has tended to support higher prices. A firm yen generally tightens global liquidity—a condition to which bitcoin has historically been sensitive. The yen currently trades near 156 against the dollar, slightly firmer than its late-November peak above 157.

The rate hike could also influence cryptocurrencies indirectly through equities by reducing the attractiveness of yen carry trades. Investors have long borrowed yen at ultra-low or negative rates to fund positions in higher-risk assets such as U.S. stocks and Treasurys. Higher rates could make these trades less profitable, potentially reversing flows and prompting broader risk aversion across financial markets.

Past experience supports this view. When the BoJ last raised rates to 0.5% on July 31, 2024, the yen rallied, triggering a risk-off move in early August that sent bitcoin from roughly $65,000 to $50,000.

Why this time may be different

The upcoming hike may not produce the same market shock. Speculators are currently net long on the yen, reducing the potential for a sharp post-hike rally. Additionally, Japanese government bond yields have climbed steadily throughout 2024, reaching multi-decade highs at both short and long maturities. The expected rate increase therefore largely reflects alignment with market pricing rather than a surprise tightening.

Meanwhile, U.S. monetary policy is moving in the opposite direction. The Federal Reserve this week cut rates by 25 basis points to a three-year low and introduced additional liquidity measures, while the dollar index fell to a seven-week low. Together, these factors suggest the likelihood of a large yen carry unwind or pronounced year-end risk-off is limited.

Still, Japan’s long-term fiscal position remains a potential source of volatility. With debt approaching 240% of GDP, investors are closely monitoring for signs that fiscal pressures could affect markets in 2025.

“Under Prime Minister Sanae Takaichi, large fiscal expansion and tax cuts are arriving while inflation hovers near 3% and the BoJ maintains an overly loose stance,” MacroHive said in a recent note. “High debt and rising inflation expectations raise questions about central bank credibility, which could steepen JGB yields, weaken the yen, and shift Japan from a safe-haven profile toward fiscal risk.”

Share this content: