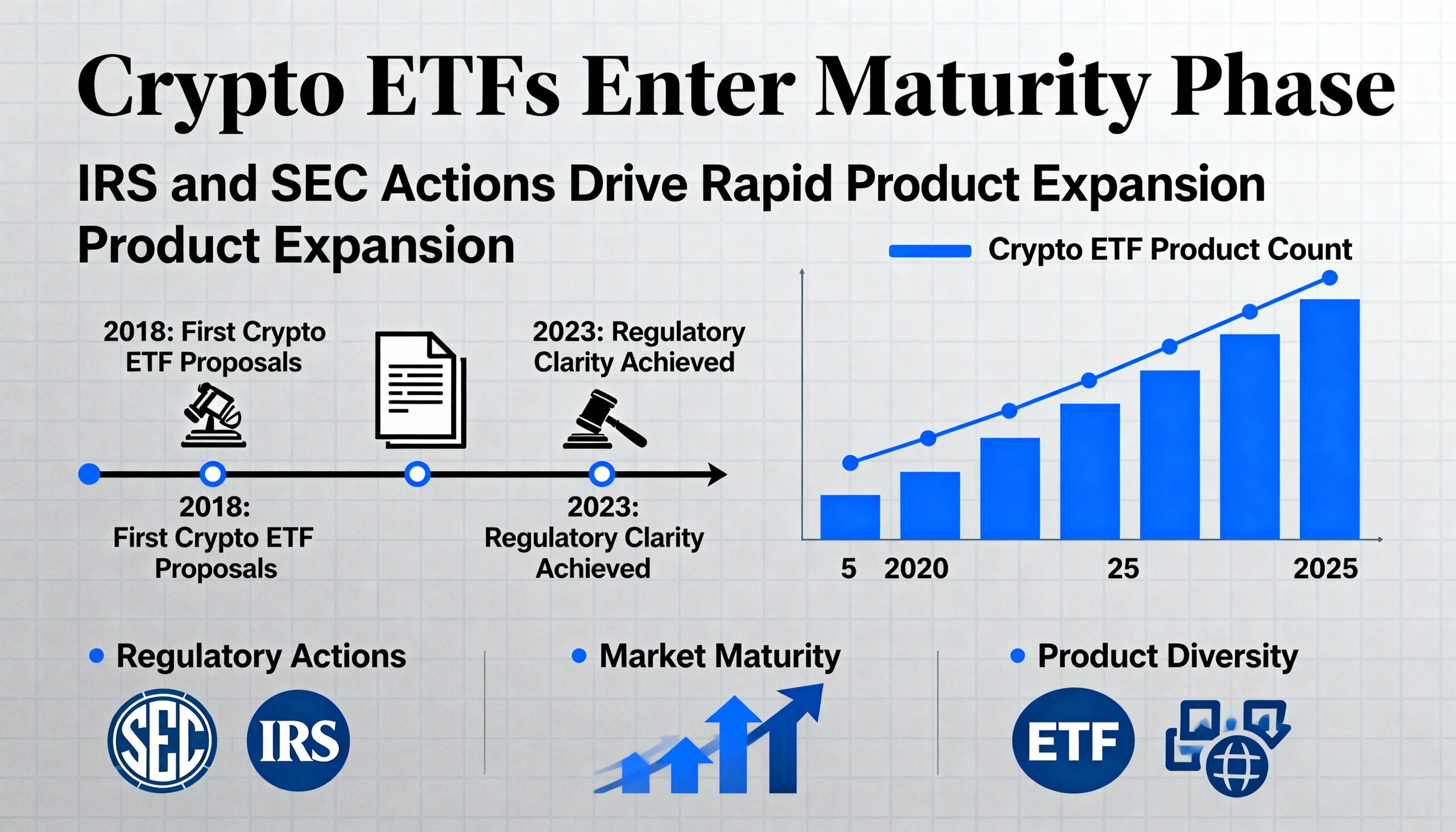

Crypto ETFs Mature as Regulation, Staking, and Indexes Transform the Market

Crypto ETFs are moving from novelty investments to mainstream portfolio tools, driven by staking guidance, standardized listing rules, and diversified index products.

At Tuesday’s ETP Forum in New York, a panel of ETF issuers, auditors, lawyers, and derivatives experts highlighted the forces shaping the market and the operational infrastructure supporting rapid growth.

From Speculation to Core Investment

The panel emphasized crypto’s evolution from a momentum-driven trading asset to a long-term investment class. ETFs now hold a significant portion of bitcoin’s ($86,124) market cap, and new spot funds for ether ($2,815) and major altcoins have broadened access through mainstream brokerages. Investors increasingly expect ETFs to behave as core holdings rather than isolated bets.

Staking Unlocks Yield

IRS guidance now allows ETFs to stake assets like ether and solana ($129) without jeopardizing tax compliance. Staking secures blockchain networks and generates predictable yields, which funds can distribute while managing liquidity and redemption processes.

SEC Listing Standards Expand Access

Generic SEC listing rules enable faster approvals for ETFs, with products for Solana, Litecoin ($83), and Hedera (HBAR) launching quickly. Reliance on surveillance agreements and volume data reassures regulators, and more approvals are expected.

Operational and Index Innovation

Auditors handle reporting and tax events, while swap desks provide leverage, staking yields, and synthetic exposure without holding underlying tokens. Diversified index ETFs offer automated rebalancing and tax efficiency, appealing to investors seeking broad exposure without picking individual coins.

Digital Asset Treasuries and Derivatives

DATs offer leveraged exposure but differ in structure, transparency, and risk compared to ETFs. Futures and derivatives remain complex for retail investors, although CFTC oversight may encourage adoption. ETFs remain the most accessible regulated option.

Conclusion

Crypto ETFs have matured, operating within a robust regulatory and operational framework. The focus has shifted from launching products to sustaining infrastructure for a growing ecosystem of strategies, assets, and investors.

Share this content: