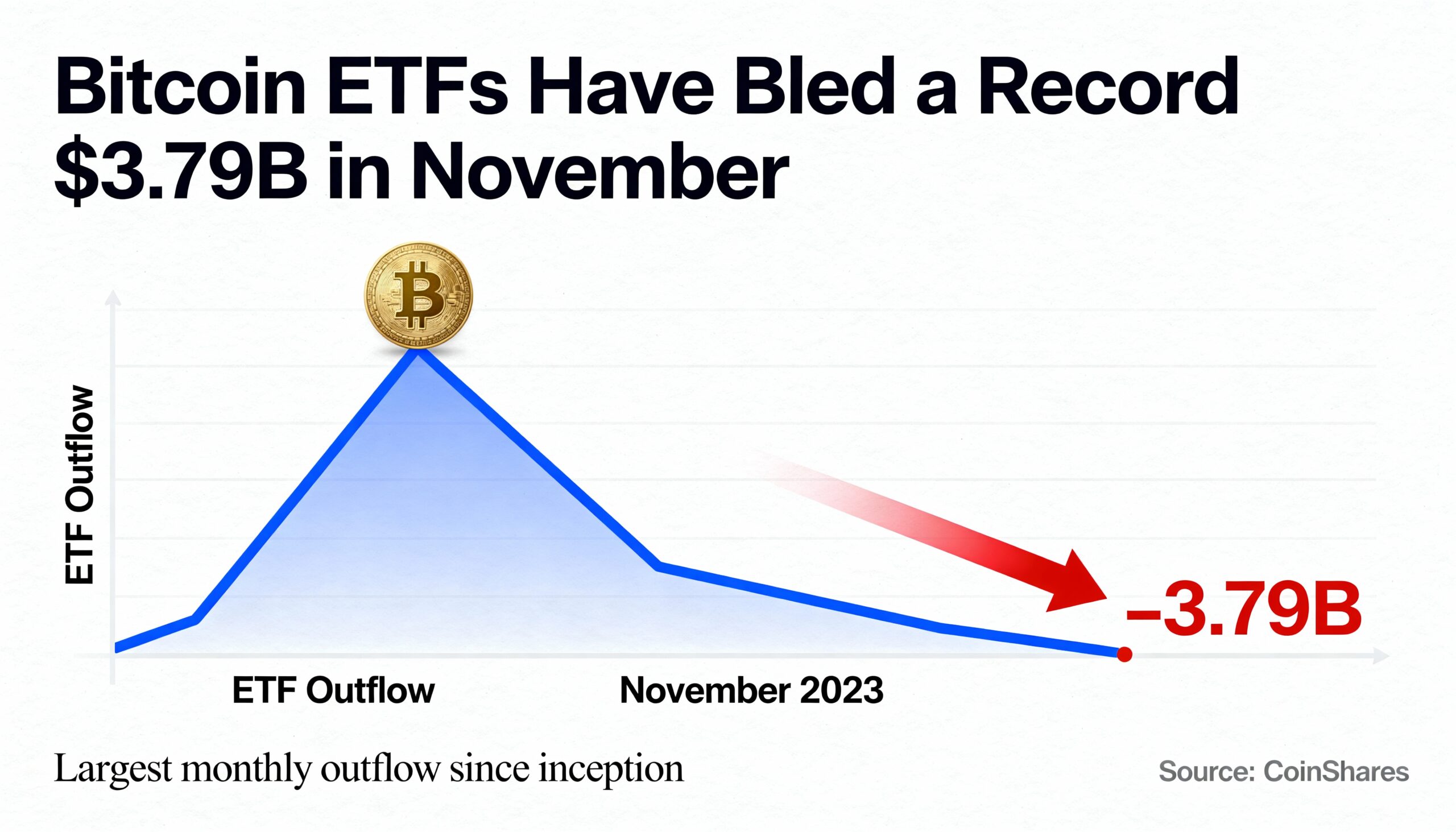

Spot bitcoin ETFs in the U.S. are experiencing their steepest wave of redemptions to date, with the 11 listed products collectively losing $3.79 billion this month—surpassing the prior record of $3.56 billion set in February.

BlackRock’s IBIT, the world’s largest bitcoin ETF, has led the downturn, recording more than $2 billion in monthly outflows, according to data from SoSoValue.

The selloff accelerated on Thursday, when the group saw over $900 million withdrawn in one session, marking the second-biggest single-day outflow since spot bitcoin ETFs launched in January 2024.

Ether ETFs have faced similar pressure, registering an unprecedented $1.79 billion in redemptions.

The widespread retreat underscores a cooling appetite for the two largest crypto assets. At the same time, newly introduced Solana and XRP ETFs have attracted renewed investor interest, with net inflows of $300.46 million and $410 million, respectively.

Share this content: