Bitcoin Battles Key $107K–$110K Support as Market Awaits Direction

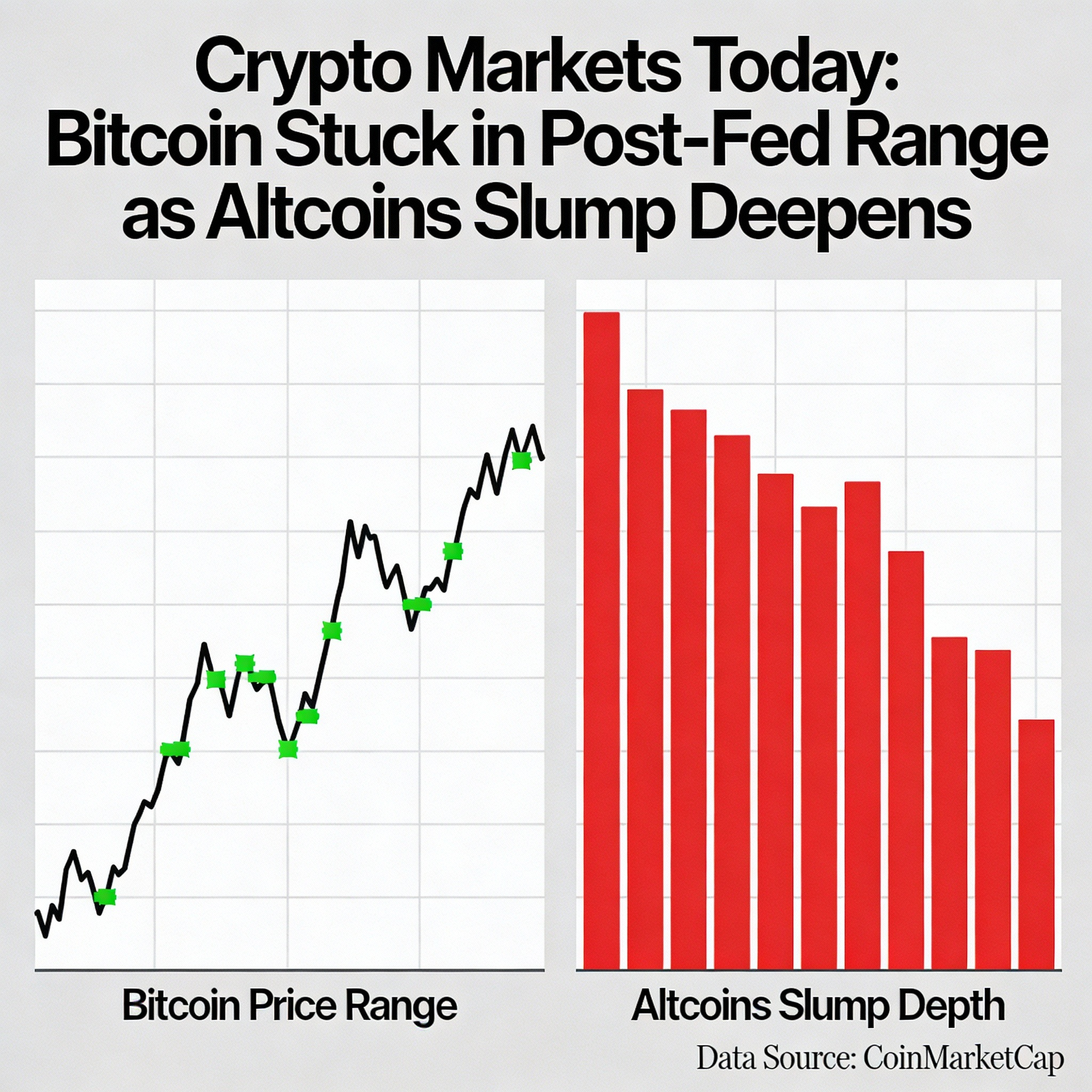

Bitcoin (BTC) is hovering near the critical $107,000–$110,000 support zone, a level that could determine the next major market move. Following last Friday’s sharp decline, BTC’s rebound has been muted, leaving prices close to a potential inflection point.

After falling to nearly $105,000, Bitcoin briefly rallied to $116,000, only to retreat back toward $110,000 amid bearish signals from key momentum indicators. The $107K–$110K range coincides with intraday highs from December–January and lows from September, marking it as a pivotal battleground for bulls and bears. Adding weight to the level, the 200-day simple moving average (SMA) sits at roughly $107,500.

Should this support fail, BTC could face a deeper correction. The first downside target would be $98,330, the swing low from June 22, followed by the lower boundary of the long-term ascending channel around $82,000.

Signs Pointing to Potential Pullback

BTC has been trading within a well-defined ascending channel since October 2023, with repeated attempts to breach the upper boundary signaling overbought conditions and buyer fatigue. Historical patterns suggest that failed tests above resistance, like those seen in December–January, often precede sharp declines—as was the case when BTC dropped to $75,000.

While Bitcoin’s long-term uptrend remains intact, the current consolidation warns of increased volatility. A decisive break below $107K would likely shift momentum to the bears, while a rebound above $116K could reignite bullish momentum and set the stage for a challenge to all-time highs.

Traders are closely watching the $107K–$110K support zone, as its fate will likely dictate Bitcoin’s next major directional move.

Share this content: