Uniswap’s “UNIfication” proposal could transform the protocol’s massive trading volume into direct value for UNI holders.

The plan, presented by Uniswap Labs and the Uniswap Foundation, would activate delayed protocol fees, burn up to 100 million UNI (roughly $940 million at current prices), and merge Labs and the Foundation under a unified operational and economic model.

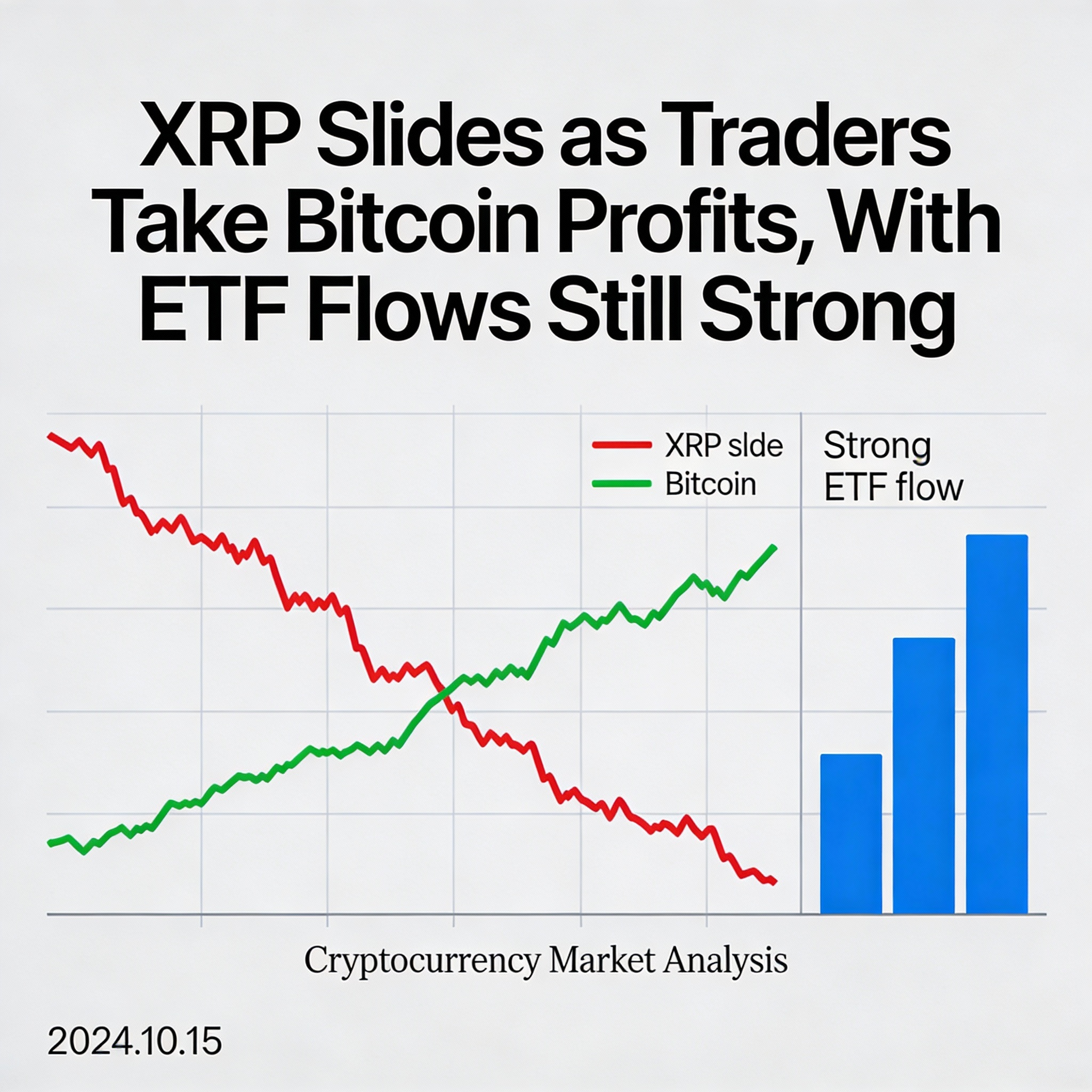

Currently, Uniswap holds $5.05 billion in total value locked (TVL) and has a $5.9 billion market cap, with a fully diluted valuation of $9.4 billion. Its price-to-fees ratio sits at 4.7x, lower than comparable Layer 1 and Layer 2 networks.

Over the past 30 days, Uniswap processed $148.5 billion in trading across 36 chains. Ethereum accounted for $15.9 billion, BNB Chain $4.7 billion, and Arbitrum $3.3 billion. These trades generated roughly $227.4 million in fees—annualized at $2.77 billion—none of which currently flows to UNI holders.

UNIfication Mechanics

The proposal directs roughly one-sixth of trading fees into a protocol revenue pool, approximately $130 million per year, paired with a 2.5% annual supply reduction via token burns. This creates a quasi-buyback effect, tying network activity directly to token scarcity. Analysts estimate an implied annual yield of 3% under moderate trading growth.

Structural Implications

Merging the Foundation into Labs shifts Uniswap from a grant-based governance model to an execution-focused entity. While some purists may see this as centralization, it brings clarity, accountability, and measurable value capture.

If implemented, UNIfication could redefine DeFi token economics—moving UNI from governance hype toward real protocol-driven value.

Share this content: