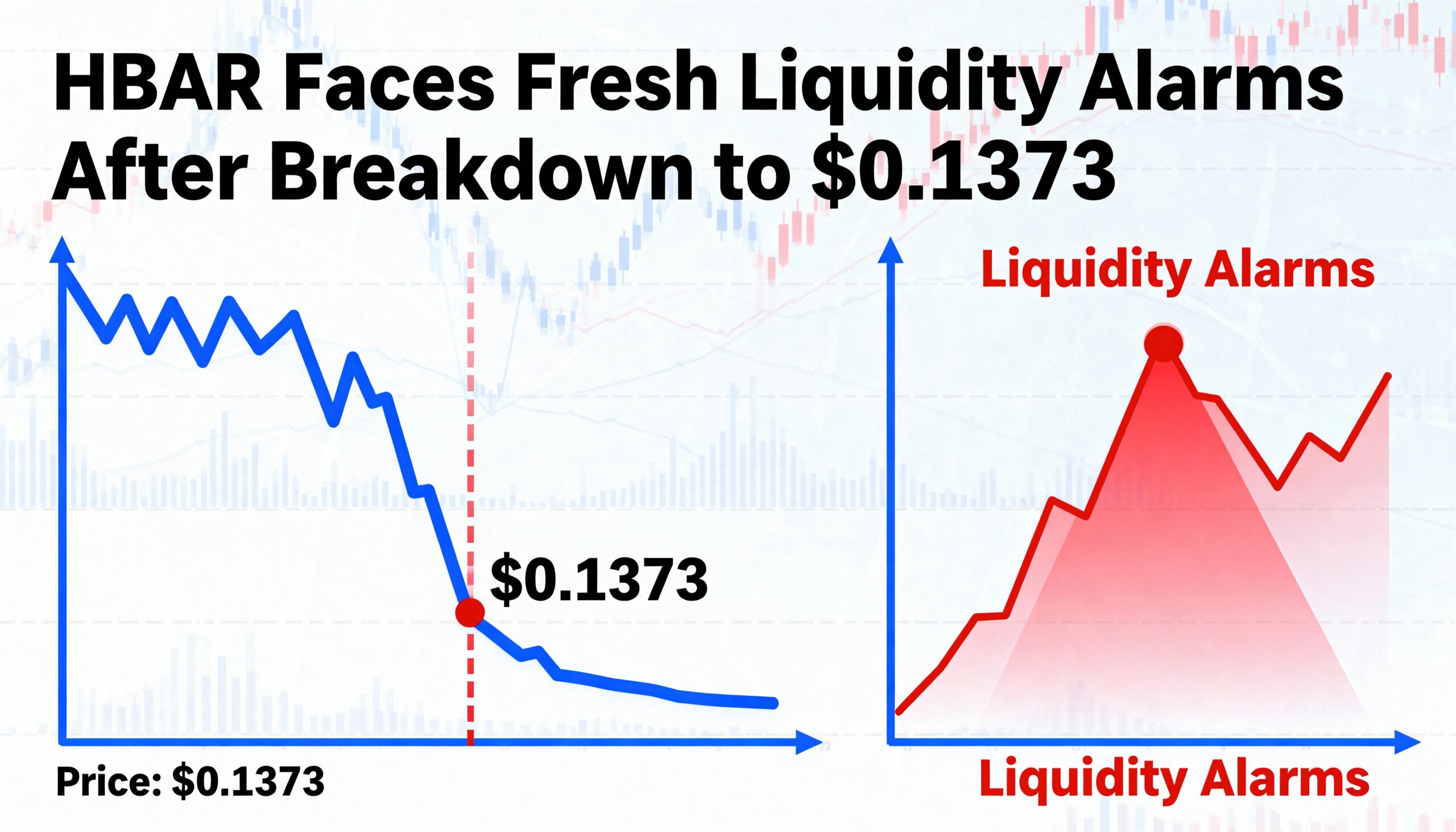

Hedera’s HBAR token extended its slide after losing critical support, with a late-session trading freeze, collapsing activity, and repeated failed rebounds signaling growing liquidity fragility and structural pressure.

HBAR fell to $0.1373, a decisive break below the long-held $0.145 support zone after buyers failed to defend the recent consolidation band. The late-day downturn confirmed a shift from neutral conditions to a clearly bearish market structure, with price action weakening steadily into the close.

Liquidity deteriorated sharply in the final hour of trading. A brief halt between 14:12 and 14:14—during which no trades were executed—flagged potential structural problems or a short-term liquidity vacuum. Such disruptions can intensify downward momentum when market stress is already elevated.

Earlier in the session, trading activity surged 138%, exposing firm resistance at $0.1486. Although HBAR managed a sharp V-shaped recovery from its $0.1382 intraday low, the rebound quickly lost traction, leaving the token vulnerable to renewed selling pressure.

Technical Landscape Signals Elevated Breakdown Risk

Support & Resistance

- The $0.1382 support level becomes pivotal after the consolidation structure gave way.

- Former support at $0.1445 is now expected to act as overhead resistance.

- Strong resistance remains at $0.1486, where the earlier volume spike marked heavy rejection.

Volume Dynamics

- A 146.94 million token surge—138% above the 61.8 million average—indicates a distribution phase.

- Volume collapse to 9.76 million preceded the breakdown.

- The zero-volume trading halt highlights extreme short-term liquidity stress.

Chart Setup

- The consolidation channel between $0.1446 and $0.1477 has been invalidated.

- The sharp rebound from $0.1382 failed to develop into sustainable momentum.

- A daily trading range of $0.0096 (6.5%) underscores heightened volatility.

Risk/Reward Outlook

- Continued trade below $0.1440 keeps downside targets centered on the $0.1382 support.

- Attempts at recovery face immediate resistance at the former $0.1445 support level.

- The brief trading suspension raises broader concerns about liquidity depth and structural resilience.

Share this content: