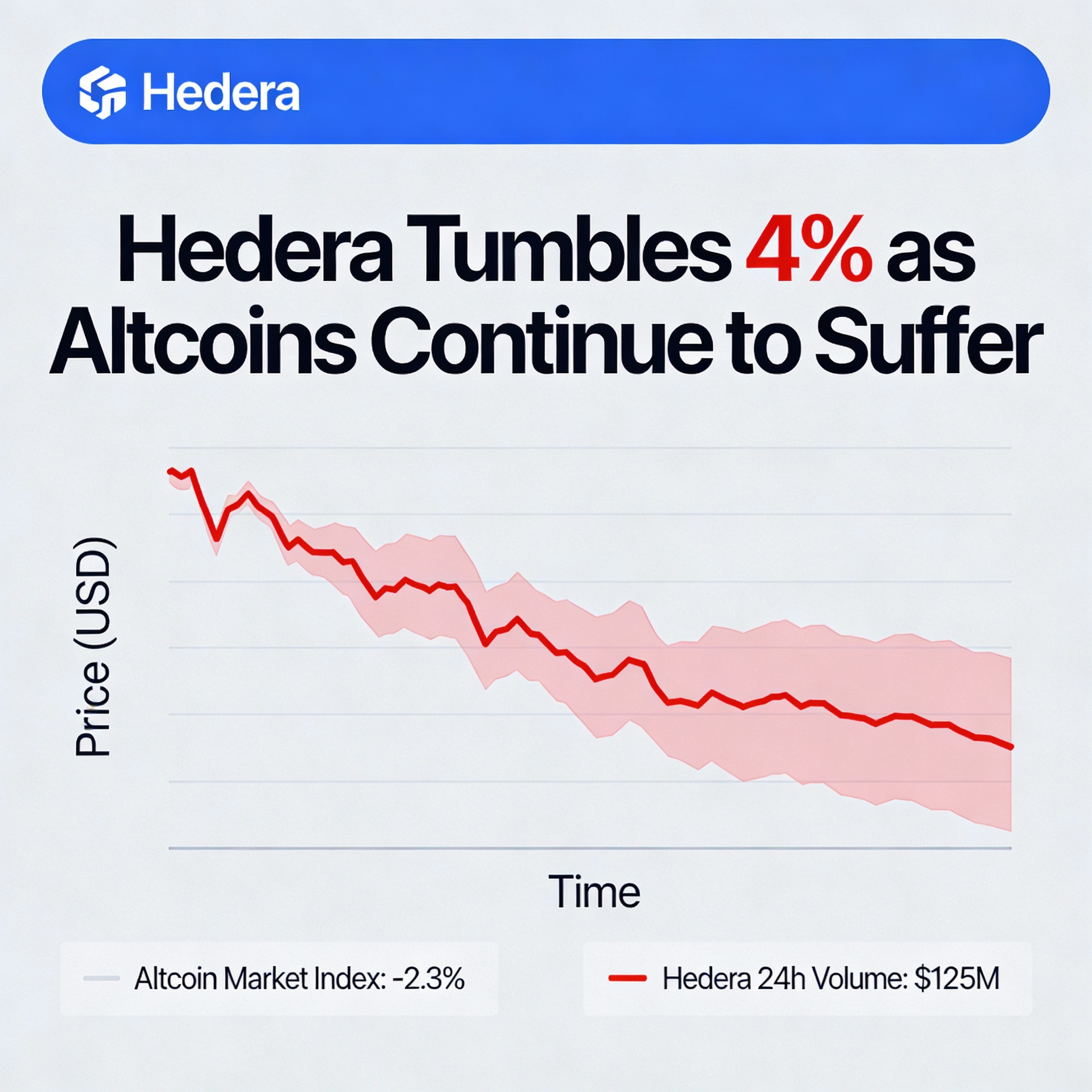

Hedera’s HBAR came under renewed pressure on Thursday after failing to hold above a key resistance area, as a surge in high-volume selling triggered a sharp intraday reversal.

The token fell 4% to $0.1247 during an afternoon downturn that erased earlier gains and pushed prices through several technical markers. HBAR traded within a $0.0082 range—around 6.4% volatility—after bulls were turned back repeatedly at the $0.1320 level.

Trading activity accelerated well beyond normal levels, pointing to strong institutional participation rather than thin liquidity-driven moves. The volume spike suggests active price discovery as larger traders repositioned during the decline.

The selloff established a lower high relative to the Dec. 11 peak, further weakening the technical structure. As downside momentum built, HBAR slipped through previously defended support zones, deepening losses.

Price action has since steadied near $0.1235, now a critical support level. Following a brief capitulation, HBAR consolidated between $0.124 and $0.125, creating room for a short-term rebound toward $0.126.

Despite the stabilization, market sentiment remains guarded. The decisive break of higher-timeframe support, paired with unusually strong sell-side volume, points to conviction-driven selling and limits near-term upside even as buyers attempt to stabilize prices.

HBAR Technical Outlook: Range-Bound Near Support

Support and Resistance

- Immediate support seen at $0.1235 after the afternoon decline

- Strong resistance confirmed at $0.1320 following multiple failed breakout attempts

- Near-term range developing between $0.123 and $0.125 on 60-minute charts

Volume Activity

- Session volume surged to 165.9 million tokens, roughly 175% above the 24-hour average

- Hourly flash-crash volume peaked at 15.7 million tokens, about 700% above normal

- Sustained elevated activity highlights institutional involvement

Chart Patterns

- Lower-high formation from the Dec. 11 peak reinforces a bearish bias

- Flash-crash-and-recovery setup hints at accumulation near support

- Breakdown across multiple support levels signals weakening momentum

Targets and Risk

- Immediate upside target near $0.126 on a mean reversion attempt

- Downside risk toward $0.123 if current consolidation breaks

- Key overhead resistance remains at $0.1285, where the initial breakdown occurred

Share this content: