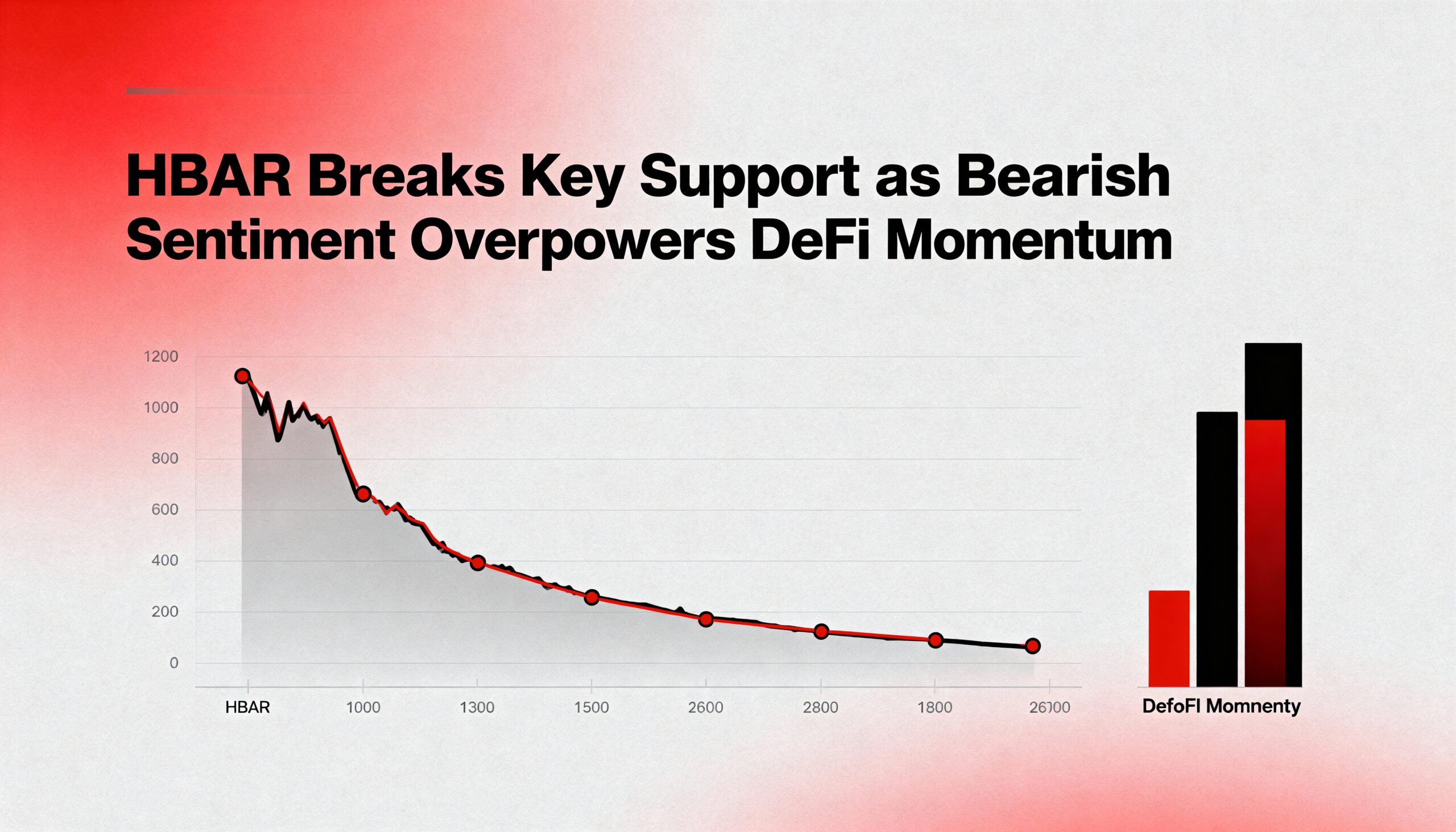

HBAR extended its decline on Tuesday as a decisive breakdown below support ignited a burst of heavy selling across short-term timeframes. The token slipped 2.5%, falling from $0.1518 to $0.1480, after a high-volume selloff late on Nov. 16 pushed 168.9 million tokens through the market — nearly double the typical daily activity and a clear signal of institutional distribution.

Selling pressure continued to build into the next session. HBAR dropped another 2.2% to $0.1472, with trading volume jumping to 180% above average as bears pressed the advantage. Intraday charts show a well-defined sequence of lower highs forming a descending channel, reinforcing a bearish structure that traders used to drive momentum-based short positions.

The pullback comes despite improving sentiment around Hedera’s upcoming Wrapped Bitcoin integration, which aims to expand DeFi functionality into 2025. For now, technical signals remain dominant, and bulls are attempting to defend support at $0.1457 — a key volume-weighted level that now stands as the market’s near-term line in the sand.

Technical Overview: Breakdown Confirms Shift in Momentum

Support & Resistance

- Primary support sits at $0.1457, established after a high-volume rejection.

- Immediate resistance holds near $0.1488, where sellers repeatedly overwhelmed buy-side flows.

- The descending channel pattern remains intact as lower highs continue to define the trend.

Volume Dynamics

- A 168.9M-token spike (94% above the 24-hour average) marked the initiation of the breakdown.

- Peak hourly selling hit 6.2M tokens during the steepest leg lower.

- A 180% surge in volume during the decline confirms a clear distribution phase.

Chart Structure

- The earlier consolidation between $0.1460–$0.1530 has resolved to the downside.

- The descending channel underscores ongoing bearish control.

- Institutional selling remains visible across multiple timeframes.

Key Levels Going Forward

- Major support: $0.1457 — crucial for preventing a deeper move lower.

- Risk marker: $0.1465 — the low of the latest sharp decline.

- Upside cap: $0.1488 — the zone where repeated high-volume rejection has occurred.

Share this content: