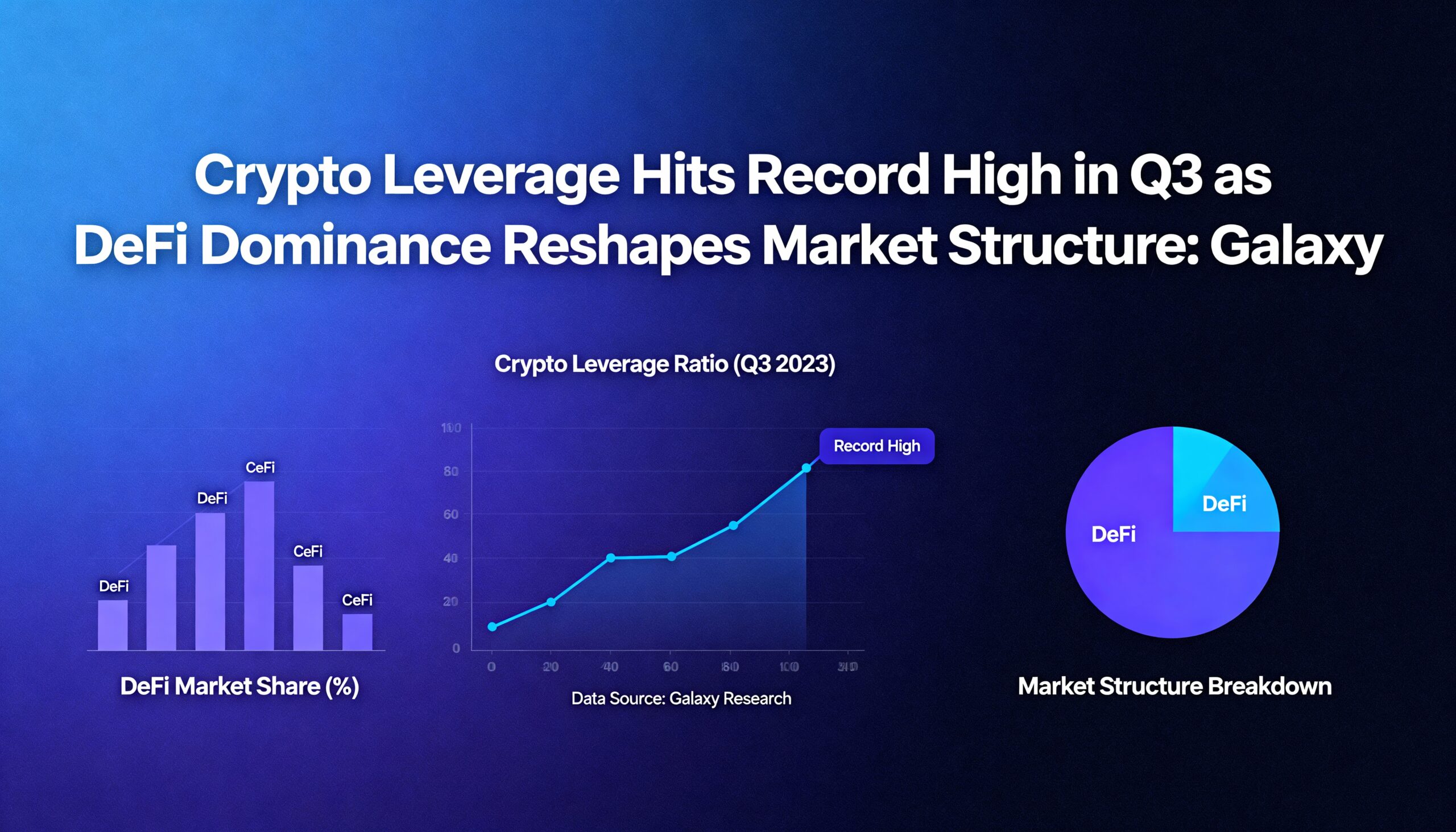

Crypto-Collateralized Borrowing Hits $73.6B in Q3 as Leverage Becomes Healthier, Galaxy Reports

Crypto-collateralized debt surged to a record $73.6 billion in the third quarter, marking the most leveraged period on record. However, according to Galaxy Research, the composition of this leverage is significantly stronger and more transparent than during the 2021–22 cycle.

Onchain lending drove the bulk of the growth, now accounting for 66.9% of total crypto-backed borrowing, up from 48.6% at the previous peak. DeFi lending alone jumped 55% to a new high of $41 billion, supported by incentive programs and improved collateral structures such as Pendle Principal Tokens.

Centralized borrowing rebounded 37% to $24.4 billion but remains roughly one-third smaller than 2022 levels. Market participants that survived prior cycles have increasingly shifted to fully collateralized models to attract institutional capital, with Tether holding nearly 60% of CeFi loans.

Within DeFi, lending applications now command over 80% of onchain activity, while CDP-backed stablecoins fell to 16%. New chain deployments, including Aave and Fluid on Plasma, fueled borrowing growth, with Plasma surpassing $3 billion in just five weeks.

Shortly after the quarter ended, a leverage-induced liquidation wiped out more than $19 billion in a single day—the largest in crypto futures history. Galaxy emphasizes that the selloff reflected mechanical de-risking, not systemic credit weakness.

Corporate digital-asset treasuries also continue to leverage positions, with $12 billion in outstanding debt. Including these, total crypto industry debt reached a record $86.3 billion.

Galaxy concludes that while leverage is rising again, it sits on a firmer, more transparent foundation, with collateralized structures replacing the unbacked credit that fueled previous boom-and-bust cycles.

Share this content: