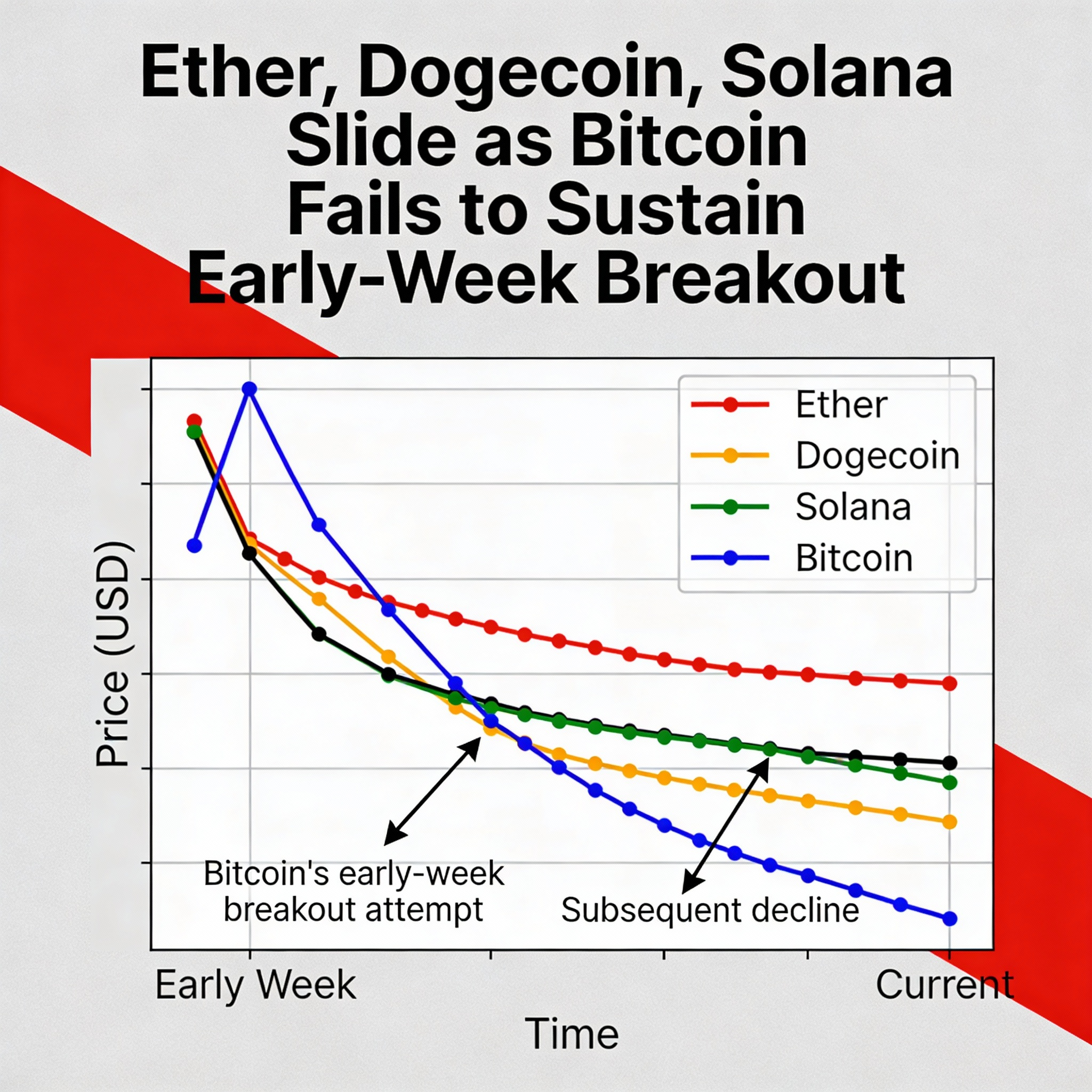

Bitcoin Slides Toward $90K as Early-Week Gains Fade

Bitcoin (BTC) slipped toward $90,000 on Thursday, giving back much of Tuesday’s rebound despite the Federal Reserve’s widely expected rate cut and resumption of Treasury purchases. BTC had briefly surged above $94,500 earlier this week, triggering a minor short squeeze, but failed to break the resistance that has capped price for the past three weeks.

Crypto markets broadly extended losses amid rising volatility, with more than $514 million in leveraged positions liquidated across derivatives venues over 24 hours. BTC traded around $90,250, down 2.4%, while Ether (ETH) fell 3.4% to $3,208, Solana (SOL) dropped 5.8% to $133.84, and Dogecoin (DOGE) slipped 5.5% to $0.139. Seven-day declines were widespread, including XRP (-8.6%), ADA (-7.2%), and BNB (-5.9%), according to CoinGecko.

The pullback pushed BTC back to the middle of its month-long range, where thin liquidity and concentrated liquidation clusters continue to influence price swings. “We’ve seen higher local highs and lows since 21 November,” said Alex Kuptsikevich, senior market analyst at FxPro. “But for sustained capitalization growth, the market cap needs to surpass $3.32 trillion,” roughly 6% above current levels. The global crypto market cap stands near $3.16 trillion.

Leverage played a key role, with CoinGlass reporting $376 million in long liquidations—nearly triple the $138 million in shorts—as BTC slipped below its short-term trend line.

Macro factors offered little support. Despite the Fed’s rate cut, projections indicate fewer reductions over the next two years, revealing committee divisions. Analysts from QCP Capital expect BTC to trade in a wider $84,000–$100,000 range into year-end, while Bloomberg Intelligence’s Mike McGlone warned a “Santa Claus rally” may not materialize.

Traders are watching whether BTC can hold the $90,000–$91,000 support zone. A decisive break lower could test the bottom of the current range, while stabilization may pave the way for another challenge to $94,000 resistance as markets digest post-Fed conditions.

Share this content: