Crypto Markets Slip Amid Year-End Caution and Weak Tech Sentiment

Cryptocurrency markets eased on Sunday as investors remained cautious ahead of the final full trading week of 2025. Concerns over stretched technology valuations, slowing U.S. equity momentum, and mixed signals from the Federal Reserve weighed on risk appetite.

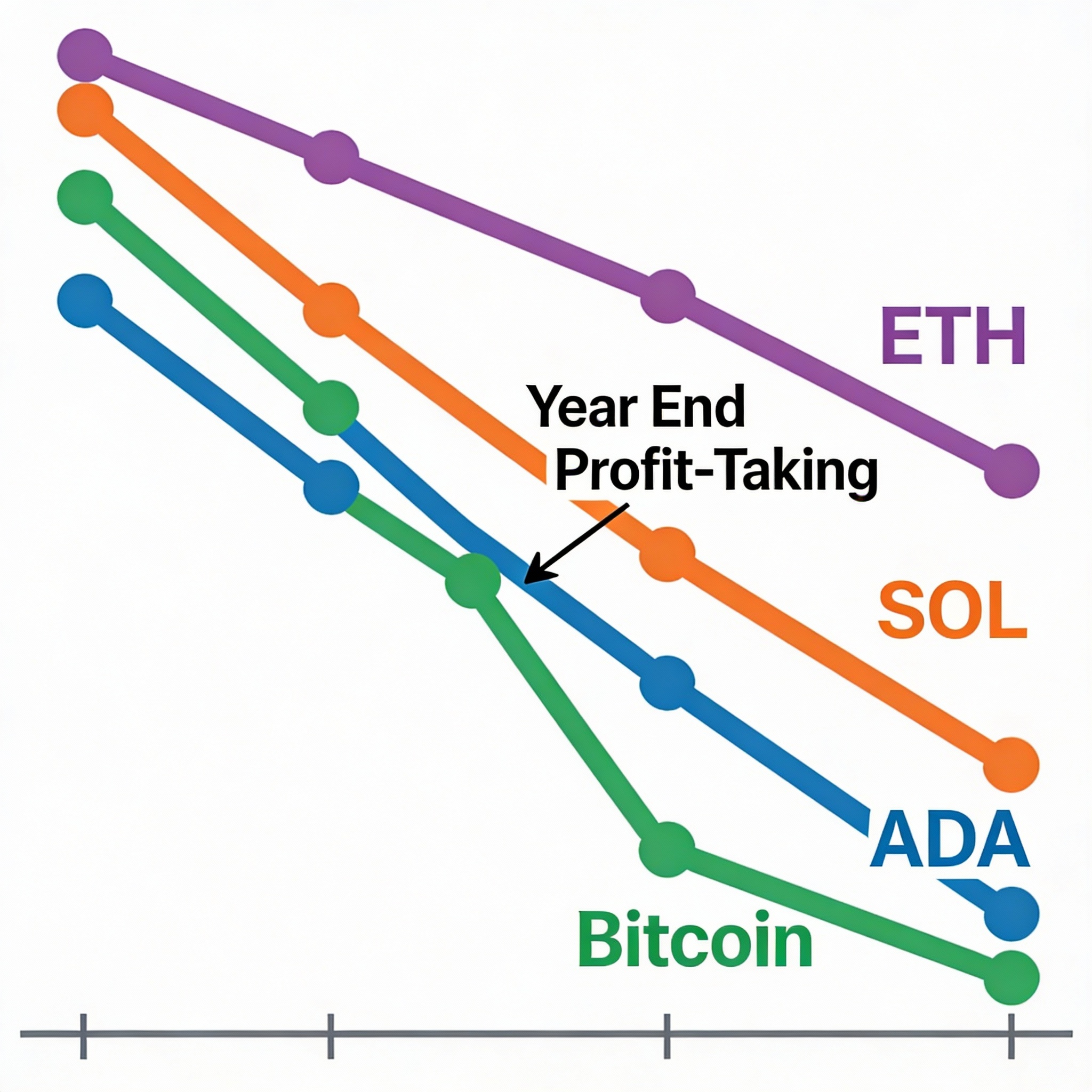

Bitcoin fell about 0.5% to around $89,600, just above last week’s lows, while ether declined slightly to $3,120. Other major tokens, including XRP, Solana, and Dogecoin, posted losses of up to 2%, according to market data.

The dip followed a modest rebound in U.S. equity-index futures after last week’s tech-led selloff, triggered by scrutiny over AI spending and earnings sustainability. S&P 500 and Nasdaq 100 futures rose roughly 0.2% in Asian trading on Monday, but investors remain cautious as they reassess high tech valuations ahead of 2026.

Crypto markets have struggled to regain momentum since October’s sharp drawdown. Thinner trading volumes have amplified price swings and reinforced a defensive tone. “Investors are hesitant due to October’s decline, overvalued U.S. stocks, and mixed Fed signals,” said Jeff Mei, COO of crypto exchange BTSE. He noted that Bitcoin ETF inflows remain net positive and that central bank liquidity could eventually support both crypto and equities.

Year-end profit-taking is also weighing on the market. “Traders are locking in gains now and will re-evaluate new positions at the start of 2026,” Mei said. Analysts warned that thin liquidity could exaggerate downside moves. Augustine Fan, head of insights at SignalPlus, said, “BTC and ETH are acting as hedges for other tokens amid broadly negative sentiment and low trading volumes.”

Fan cautioned against reading too much into short-term swings. “Daily or hourly moves can be misleading in these thin conditions, but overall sentiment points to softer prices into year-end,” he added.

Despite near-term weakness, U.S.-listed bitcoin ETFs and ongoing central bank support could provide a more constructive backdrop when markets reopen in early 2026.

Share this content: