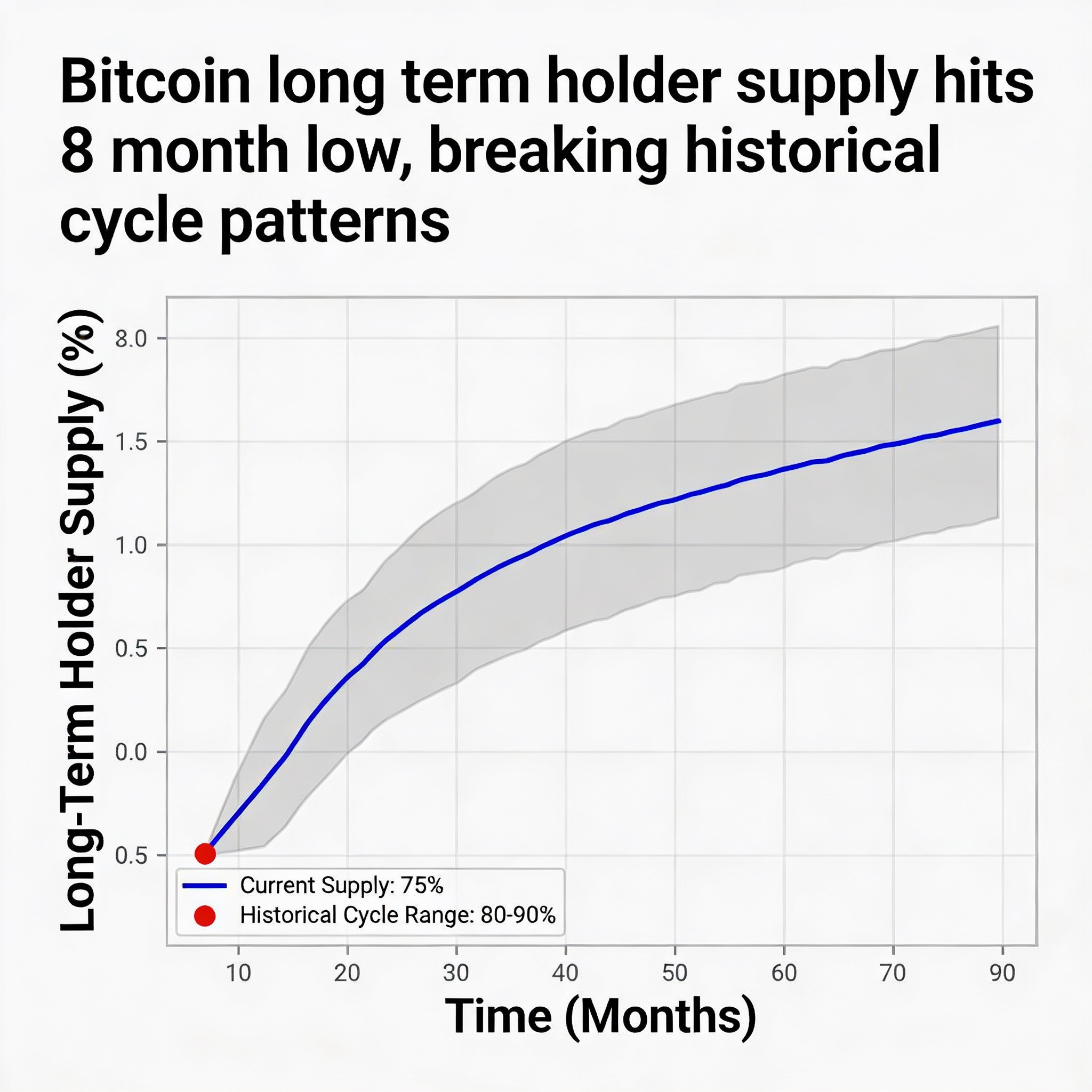

Bitcoin (BTC $88,536.75) long-term holder (LTH) supply has dropped to an eight-month low of 14,342,207 BTC, a level last seen in May, coinciding with a nearly 40% decline from October’s all-time high.

Glassnode defines LTHs as entities holding bitcoin for at least 155 days, placing the current cohort cutoff around mid-July. Any buyer from that period who has held since qualifies as a long-term holder.

This marks the third major wave of LTH distribution in the current cycle, which began in early 2023. The first wave occurred from late 2023 into early 2024 after U.S. spot bitcoin ETFs launched, with LTHs selling into strength as bitcoin rose from roughly $25,000 to near $73,000 by March 2024.

The second wave appeared later in the year as bitcoin neared $100,000, driven by optimism around former President Trump’s election victory. The current third wave has emerged despite bitcoin staying above $100,000 for most of the year.

A cycle unlike previous bull markets

Unlike prior cycles in 2013, 2017, and 2021, where LTH supply typically followed a single boom-and-bust pattern, this cycle has seen multiple waves of distribution without a clear blow-off top. Alec, co-founder of Checkonchain, noted that LTH activity this cycle is unprecedented, with the market absorbing the third wave remarkably well.

LTH distribution remains one of bitcoin’s primary sources of sell-side pressure and a key contributor to the near 40% correction from October’s peak.

Share this content: