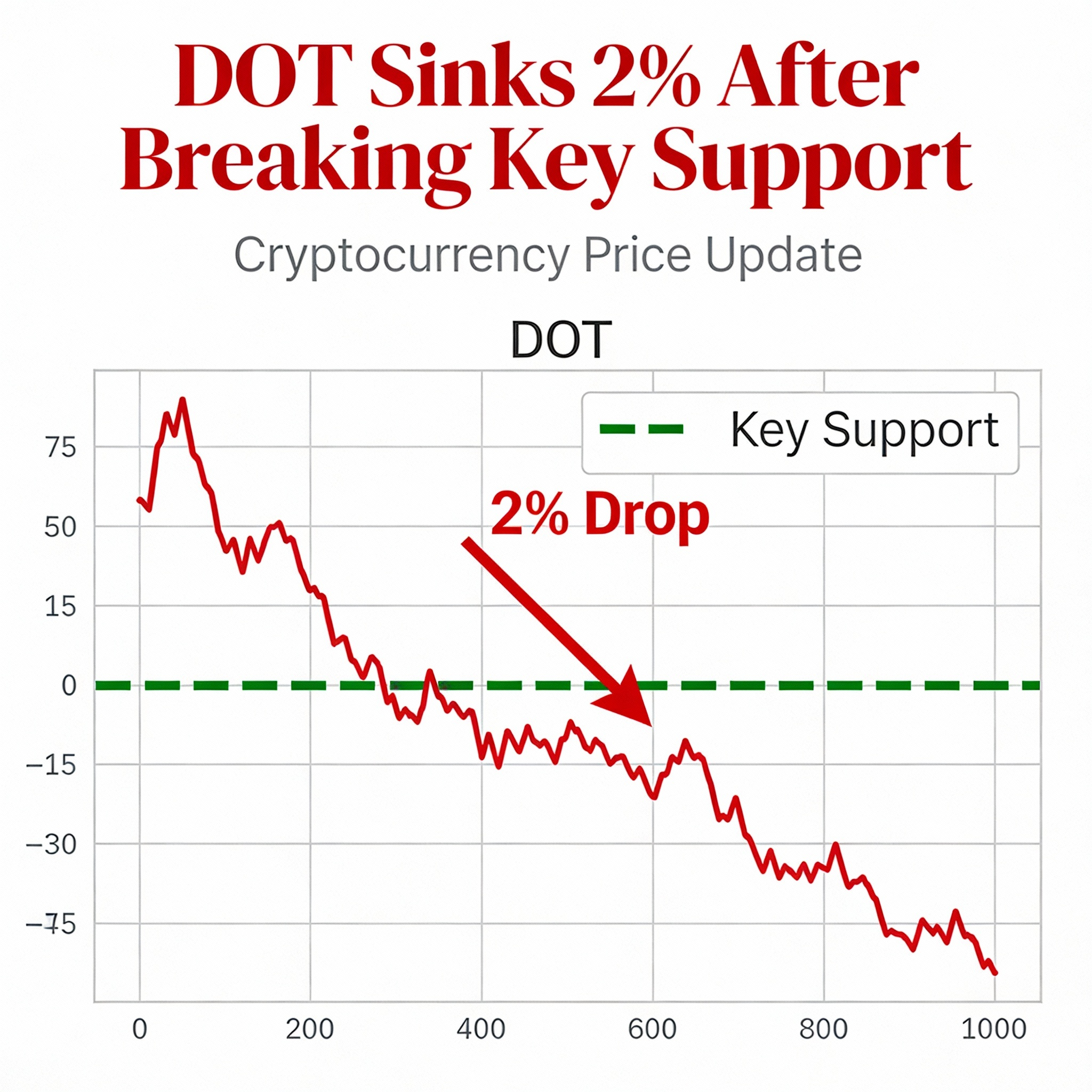

Polkadot’s DOT reversed course on Friday as heavy selling wiped out earlier gains, with elevated volume confirming a decisive technical breakdown.

The token fell from an intraday high of $2.09 to $1.97, ending its recent advance. According to CoinDesk Research’s technical analysis model, the selloff unfolded on unusually strong volume, running nearly three times above typical levels.

Selling pressure accelerated once DOT slipped below the $2.05 support area, a level that had been tested repeatedly in recent sessions. The breach triggered a sharp increase in activity, with roughly 10.3 million tokens traded, confirming a clean break of the ascending trendline that had supported the prior bullish setup.

Price action showed a forceful rejection from higher levels after DOT traded within an ascending channel between $2.01 and $2.09. The failure at the upper end of that range marked a shift in market control as sellers overwhelmed buyers, the model indicated.

Following the decline, DOT stabilized near the $1.95 psychological level, where price action has compressed into a narrow consolidation. Recovery attempts have so far stalled below $1.985, keeping near-term resistance intact.

The broader crypto market also weakened, with the CoinDesk 20 index down 0.6% at the time of publication.

Technical Takeaways: DOT Breaks Lower

Support and Resistance

- Key support holding near $1.95 after the loss of $2.05

- Immediate resistance at $1.985 following failed bounce attempts

- Short-term consolidation range forming between $1.95 and $2.01

Volume Trends

- Breakdown driven by 10.3 million tokens in volume, 284% above the 24-hour average

- Peak hourly volume of 995,000 tokens, around 400% above the session baseline

- Elevated activity confirms the breakdown’s validity

Chart Structure

- Ascending trendline support decisively broken

- Ascending channel from $2.01 to $2.09 completed with a sharp rejection

- Market structure shift points to weakening bullish momentum

Targets and Risk

- Downside risk toward $1.90 if $1.95 support fails

- Recovery requires reclaiming the $2.00 level with volume confirmation

Share this content: