Bitcoin Slips Below 200-Day Average as Dollar Extends Rally to Three-Month Peak

Bitcoin (BTC) fell beneath a key technical level on Wednesday, breaking below its 200-day simple moving average (SMA) of $109,380 as renewed dollar strength weighed on risk assets. The token last traded near $109,950, down about 2% in the past 24 hours.

The drop signals a potential shift in market structure, with traders warning that sustained weakness below the 200-day SMA could expose BTC to deeper losses toward the $100,000 mark. The U.S. Dollar Index (DXY) climbed to 99.72 — its highest since August — as Federal Reserve Chair Jerome Powell’s hawkish comments reduced expectations for a December rate cut.

The dollar’s gains were further supported by the Bank of Japan’s dovish policy stance, which pressured the yen. Despite these macro developments, bitcoin’s retreat stood out as it came even after a positive breakthrough in U.S.-China trade negotiations. President Donald Trump and Chinese President Xi Jinping agreed to cut tariffs on Chinese goods from 57% to 47%, along with commitments from Beijing to increase imports of U.S. soybeans and secure rare earth supplies.

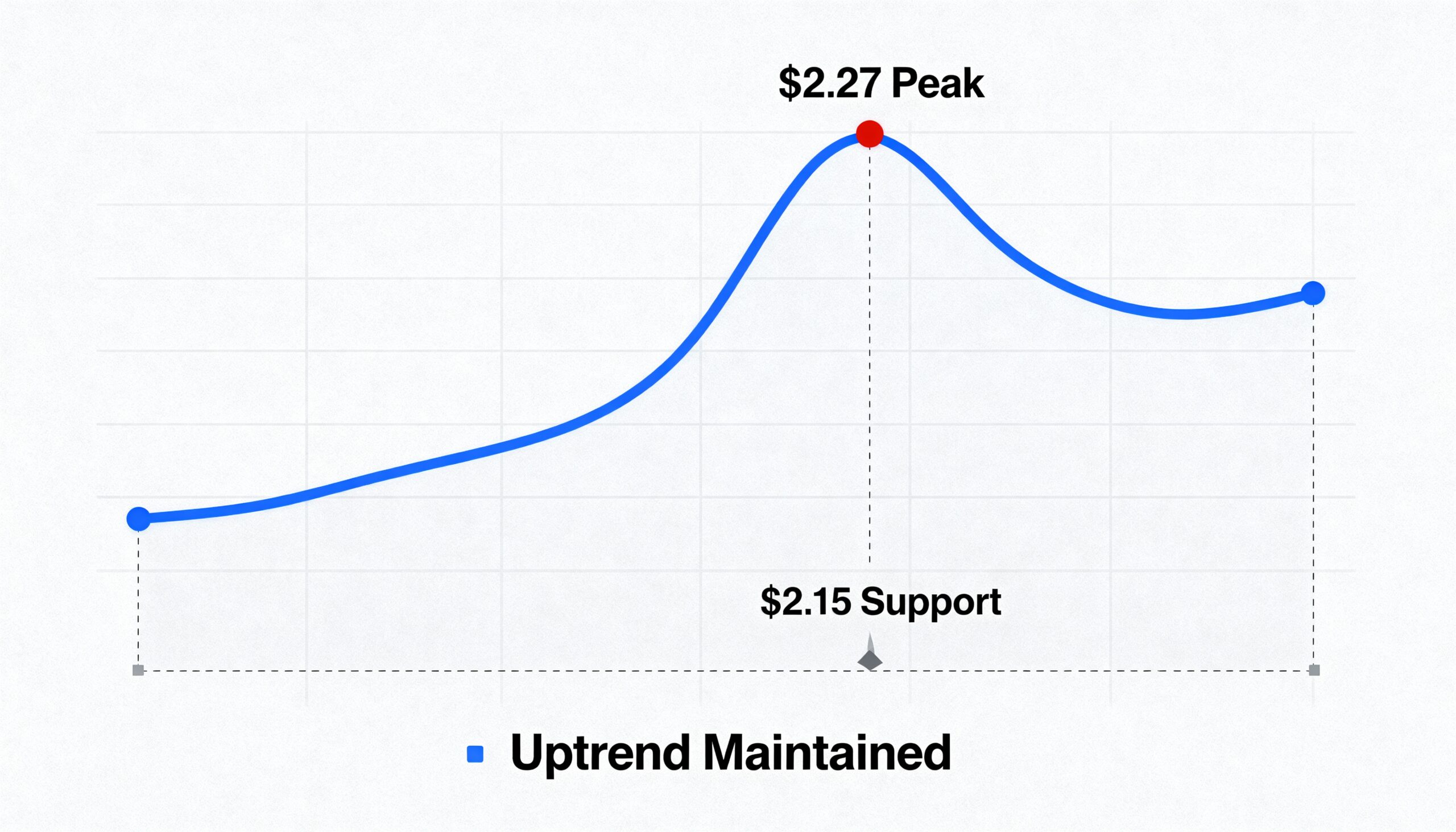

The upbeat trade developments failed to lift sentiment in digital assets, suggesting persistent demand weakness. Broader crypto markets followed BTC lower — XRP (XRP) hovered around $2.50, nearing a “death cross” pattern between its 50- and 200-day moving averages, while Solana (SOL) slipped to $186.36 despite initial enthusiasm around Bitwise’s SOL spot ETF launch.

Market analysts say bitcoin must recover above $110,000 to reassert bullish control. Until then, a stronger dollar and risk-off sentiment remain key headwinds for crypto performance.

Share this content: