Dogecoin Climbs as Bitcoin Nears $110K Amid Hopes for Rate Cuts and Eased Tariff Tensions

Dogecoin rose more than 6% in the past 24 hours, spearheading a broader cryptocurrency rally as traders grew optimistic about a potential Federal Reserve rate cut and reduced fears over U.S. trade tensions.

The well-known memecoin was recently trading at approximately $0.1698, reflecting a renewed wave of retail interest. Simultaneously, Bitcoin (BTC) advanced past $109,000, up 1.1% on the day, after news that the timeline for proposed U.S. tariffs would be extended.

The crypto market rebound followed U.S. officials’ confirmation that President Trump’s planned tariff increases won’t be imposed immediately. Instead, the deadline has shifted from July 9 to August 1, giving countries additional time to negotiate trade deals, Treasury Secretary Scott Bessent announced. This move eased fears of a sudden jolt to global trade.

“Markets are rallying after it was revealed countries will have more time to negotiate before tariffs take effect,” said Jeff Mei, COO at BTSE.

“If we see a soft CPI print on Tuesday, that could open the door for a Fed rate cut later this year,” Mei noted on Telegram.

This more dovish outlook has buoyed investor sentiment as markets gear up for a pivotal week. Traders are watching the upcoming U.S. Consumer Price Index (CPI) data set for release Wednesday. A cooler-than-expected inflation reading could increase the likelihood of a Fed rate cut as early as September.

The prospect of easing monetary policy has boosted risk assets, including cryptocurrencies.

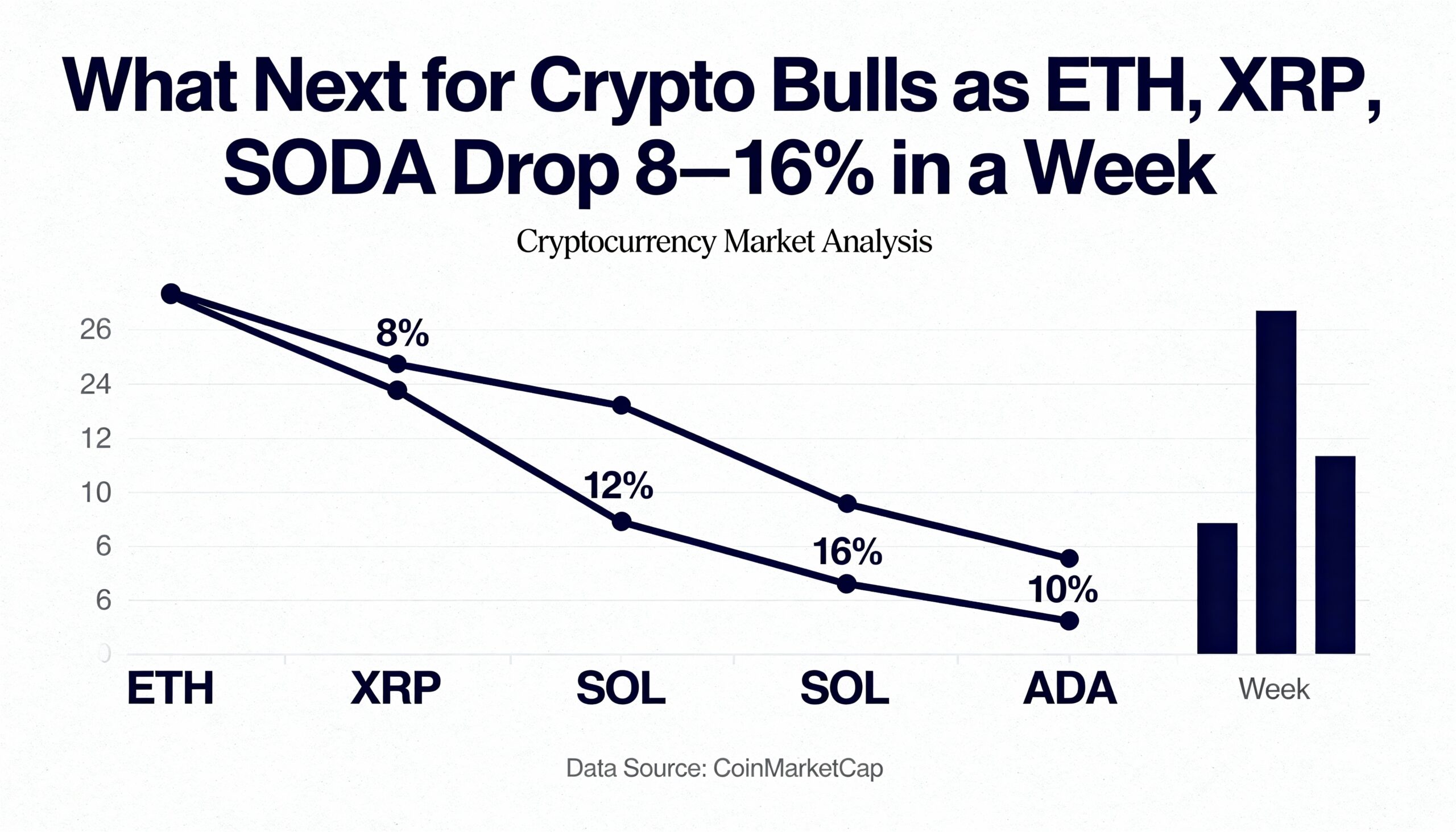

Ethereum (ETH) gained 2.5% to reach roughly $2,570, while other major altcoins also moved higher:

- Solana (SOL): $152.03 (+4%)

- XRP: $2.2901 (+3%)

- Cardano (ADA): $0.5826 (+2.5%)

- Tron (TRX): $0.2870 (+2.2%)

“The BTC bounce and ETH inflows show traders are rotating into long-term value assets,” commented Eugene Cheung, Chief Commercial Officer at OSL.

“We’re optimistic that more investors will look to Bitcoin and Ethereum to escape macro volatility and potential inflation increases as the Fed signals high potential to cut interest rates this year.”

Dogecoin Sparks Retail Enthusiasm

Dogecoin’s rally was particularly notable for its trading activity, with volume surpassing $1.5 billion over the past day—a significant spike, especially for a weekend session after a relatively quiet week.

Further fueling chatter was Elon Musk, a prominent Dogecoin supporter, who announced plans to launch an “America Party,” igniting speculation about potential crypto-friendly policies tied to his political ambitions.

Share this content: