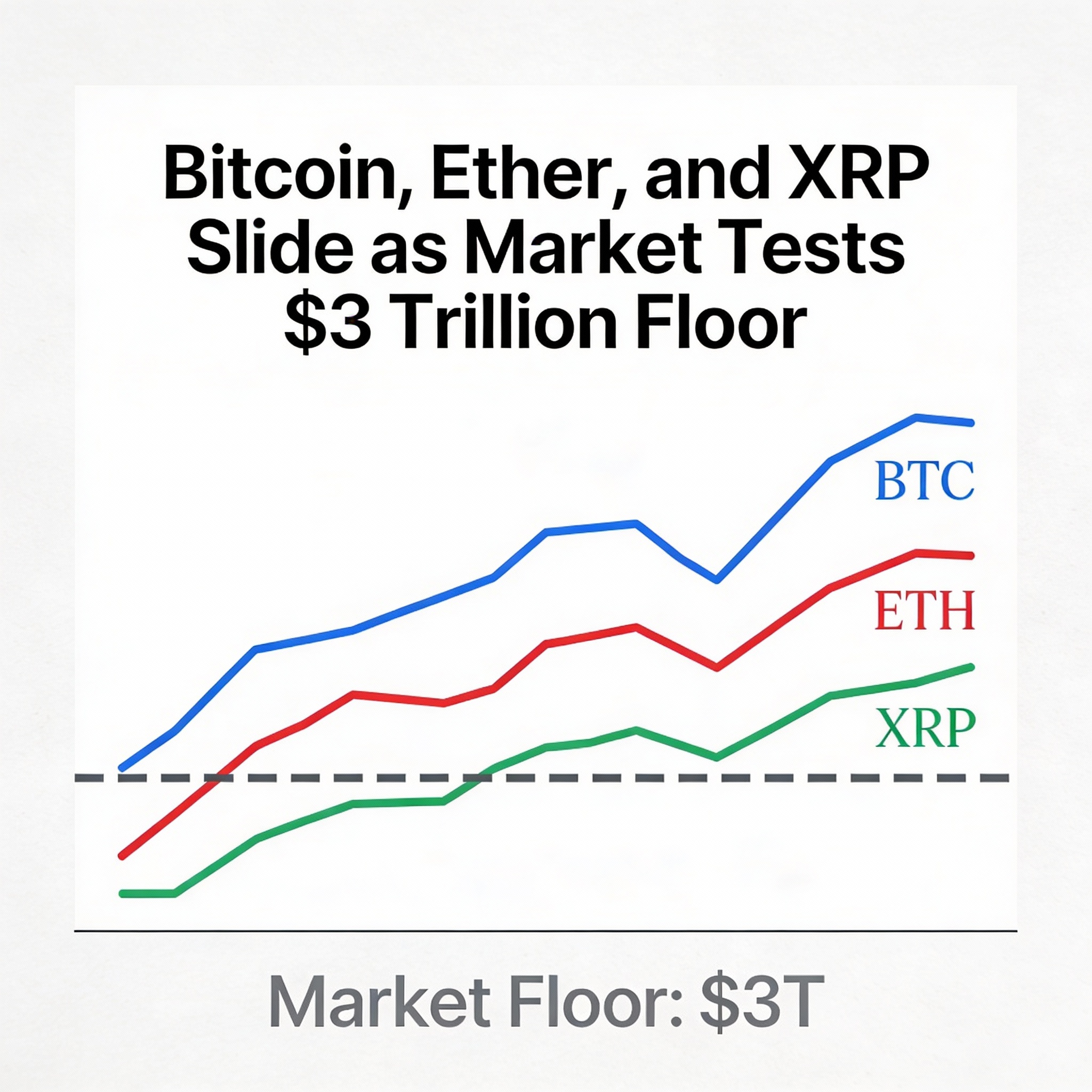

Crypto markets extended their pullback on Wednesday, with total capitalization dipping below $3 trillion for the third time this month, raising concerns about further downside.

The weakness was concentrated in large-cap tokens, particularly those with significant ETF exposure, suggesting institutional repositioning rather than broad retail selling. Bitcoin (BTC) fell 1.5% to $86,580, partially erasing Tuesday’s gains. Ether (ETH) retreated to $2,930 from an overnight high near $2,980, while XRP stalled around $1.90, according to CoinDesk data. These major coins, which benefited from earlier institutional inflows, are now leading losses amid cooling sentiment.

“Major coins are increasingly influenced by changing institutional sentiment,” said Alex Kuptsikevich, chief market analyst at FxPro, noting that investors are reassessing risk heading into year-end.

Bitcoin’s weakness contrasted with moderate gains in key Asian equities—including the Hang Seng, Shanghai Composite, Kospi, and IDX—supported by expectations of Beijing fiscal stimulus after weak November economic data.

Macro developments also weighed on crypto. The U.S. dollar index rose to 98.30 from a 2.5-month low of 97.87 after November jobs data showed 64,000 new positions, exceeding forecasts, while unemployment unexpectedly climbed to 4.6%, its highest since 2021. A stronger dollar generally pressures BTC and other dollar-denominated assets, although gold remained firm above $4,300 per ounce.

Market sentiment and technical outlook

The crypto Fear & Greed Index dropped to 11, indicating extreme fear. Unlike short-lived pullbacks earlier this year, the current decline shows signs of a broader correction, with several large-cap assets breaking intermediate support levels. BTC’s next major support sits near $81,000, where November lows align with March consolidation zones. A deeper retracement could expose the $60,000–$70,000 range, historically significant from prior cycles.

Liquidity and on-chain trends

Thin liquidity is amplifying volatility. FlowDesk data show declining market depth and muted leverage as traders reduce exposure ahead of year-end, while overall exchange volumes remain low.

On-chain signals are mixed. CryptoQuant suggests the recent BTC rally may have run its course, pointing to a corrective phase, while Glassnode reports ongoing long-term accumulation by corporations and financial firms. Strategy’s recent $1 billion purchase of 10,624 BTC underscores selective accumulation even amid soft short-term momentum.

Share this content: