Late Friday, President Donald Trump announced new tariffs—a 50% duty on all imports from the European Union and a 25% tariff on imported Apple iPhones—triggering a sharp selloff across global markets.

In the following 24 hours, bullish cryptocurrency positions suffered over $500 million in losses as traders rapidly exited amid fears sparked by the escalating trade conflict.

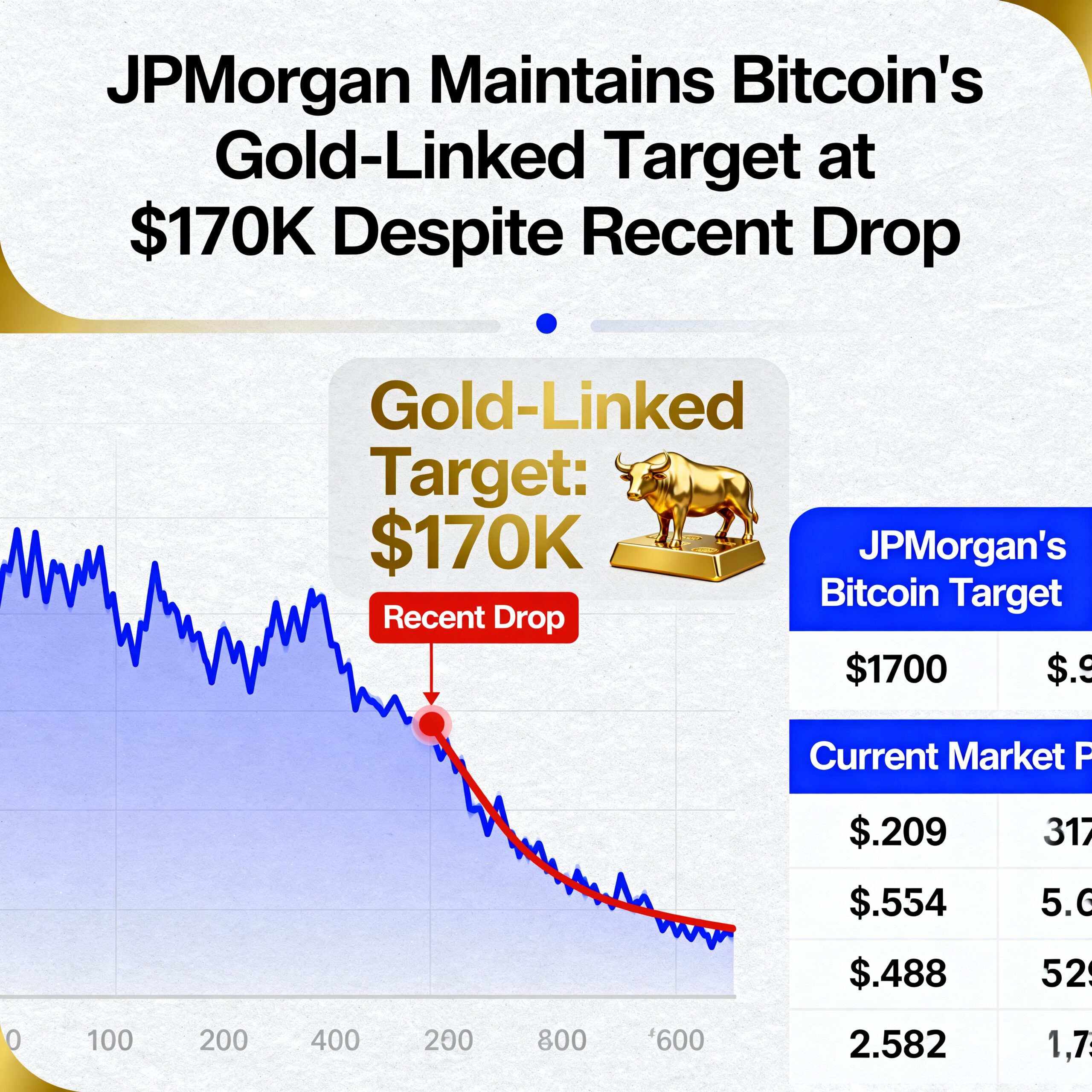

Bitcoin, which had climbed above $111,000, dropped swiftly to near $108,600, wiping out gains made earlier in the day and shaking overall market confidence.

This decline was reflected across the crypto sector, with futures tied to Ether (ETH), Solana (SOL), XRP, and Dogecoin (DOGE) experiencing liquidations ranging from $30 million to over $100 million.

Bitcoin futures liquidations accounted for approximately $181 million, Ether futures added close to $142 million, while altcoins combined contributed around $100 million in forced closures. SOL, DOGE, and XRP bore the brunt of these losses.

CoinGlass data shows the largest individual liquidation was a $9.53 million BTC-USDT swap on OKX.

Liquidations happen when leveraged traders fail to meet margin requirements, forcing exchanges to close positions—often a sign of heightened volatility and potential market turning points.

The pullback came just as Bitcoin was gaining momentum from ETF inflows and growing institutional interest, suggesting a stable weekend was on the horizon.

Instead, renewed trade war fears reintroduced volatility, leaving traders cautious as they prepare for the week ahead.

Share this content: