Morningstar DBRS Warns Corporate Bitcoin Treasuries Could Increase Credit Risk

As more companies incorporate bitcoin and other cryptocurrencies into their treasury reserves, Morningstar DBRS highlights growing credit risk concerns tied to these strategies.

The report points to regulatory uncertainties, liquidity risks during volatile markets, and exposure to exchange counterparties as key vulnerabilities that could negatively affect firms’ credit profiles.

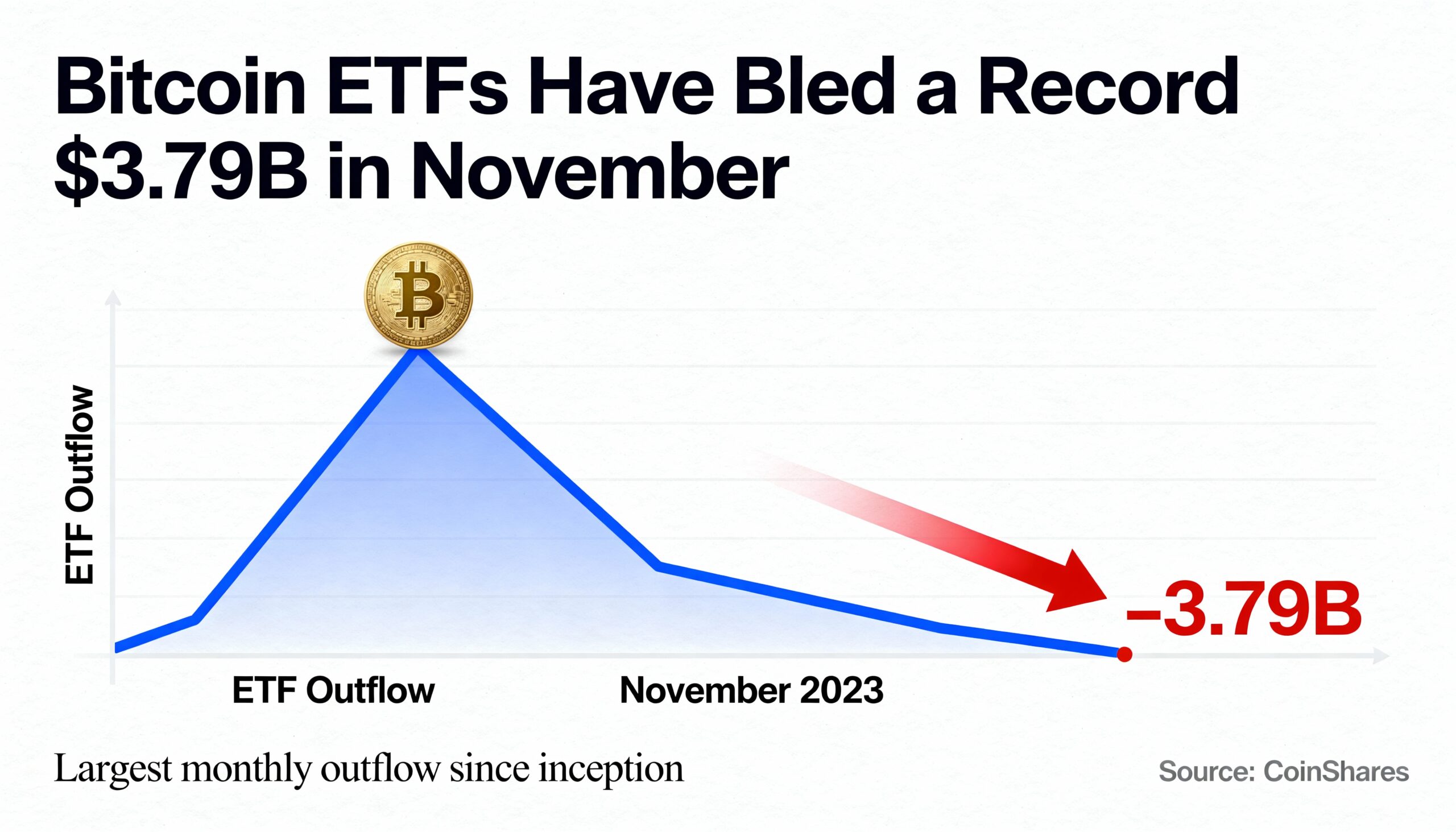

According to BitcoinTreasuries.net, about 3.68 million BTC—valued at roughly $428 billion as of mid-August—are held by various entities including public companies, funds, ETFs, governments, DeFi protocols, and custodians, representing nearly 18% of bitcoin’s circulating supply.

Funds lead holdings with 40%, followed by public companies at 27%. Notably, Strategy (MSTR) alone controls over 629,000 BTC, comprising 64% of corporate public-company bitcoin reserves, underscoring significant concentration risks.

The report also highlights the challenges of managing liquidity given bitcoin’s price volatility, along with governance and security issues related to different tokens and custody methods.

With corporate adoption expected to rise—driven by firms like Strategy and MARA Holdings—Morningstar DBRS warns these factors may substantially impact how credit markets view corporate risk going forward.

Share this content: