Shares of Coinbase swung in after-hours trading Thursday after the company reported fourth-quarter results that fell short of Wall Street expectations, pressured by softer trading volumes and lower crypto prices.

The exchange posted total revenue of $1.78 billion, missing analyst estimates of $1.83 billion. Adjusted earnings per share came in at $0.66, below the $0.86 consensus forecast.

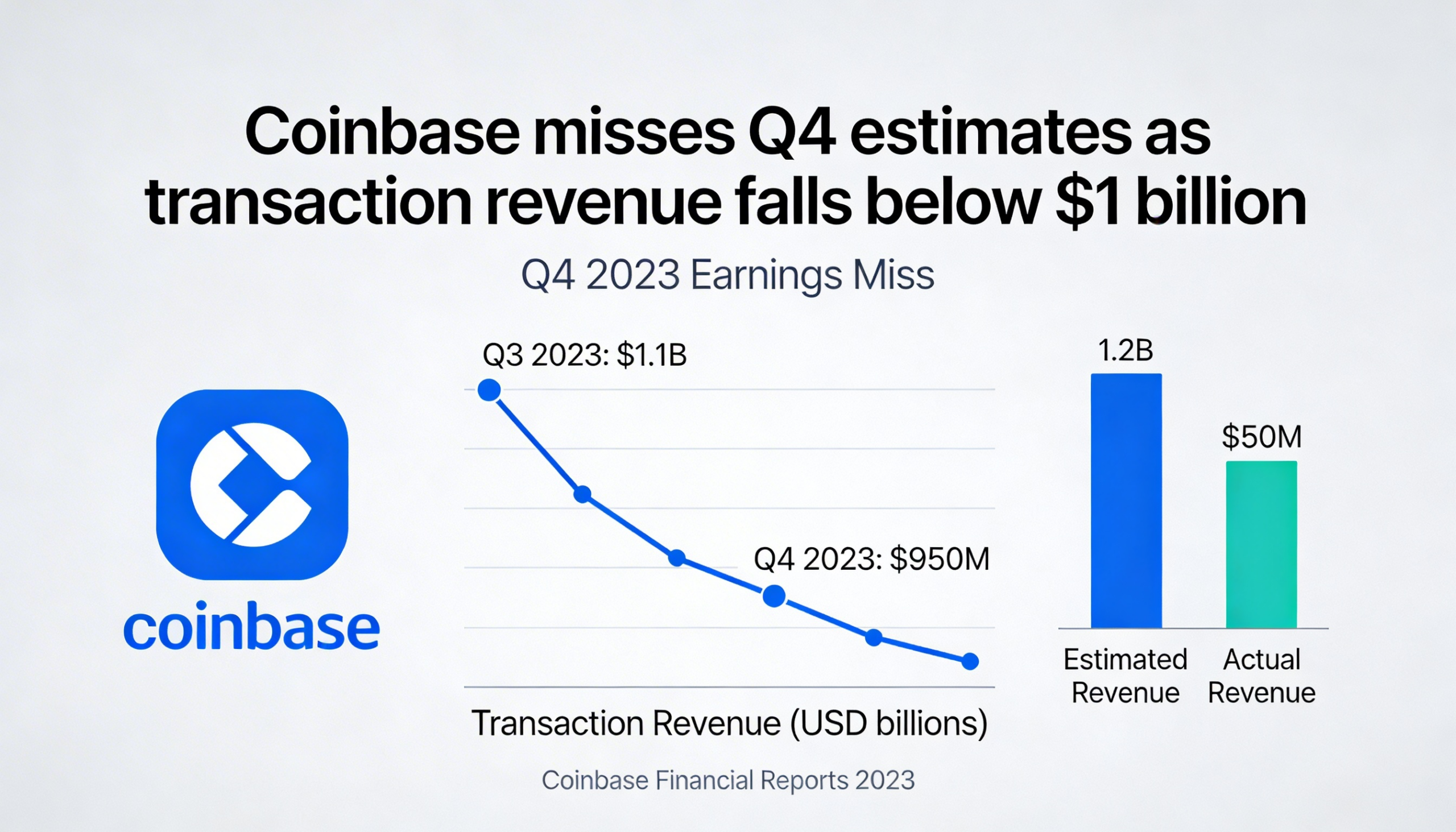

Transaction revenue totaled $983 million, under expectations of $1.02 billion and down from $1.046 billion in the third quarter and $1.556 billion in the same period a year earlier. The decline reflects reduced trading activity amid weaker digital asset prices.

Subscription and services revenue reached $727.4 million, compared with $746.7 million in the prior quarter and $641.1 million a year ago, showing year-over-year growth but a sequential dip.

Looking ahead, Coinbase said it generated roughly $420 million in transaction revenue through Feb. 10 in the first quarter. The company guided for subscription and services revenue between $550 million and $630 million for the full quarter.

“We continue to be optimistic about the long-term trajectory of the crypto industry,” the company said in its shareholder letter. “Crypto is cyclical, and experience tells us it’s never as good, or as bad as it seems. While asset prices can be volatile, under the surface an undercurrent of technological change and crypto product adoption continues.”

The stock rose modestly in after-hours trading following the report but had fallen 7.9% during the regular session, extending its year-to-date decline to roughly 40%.

Share this content: