Chainlink’s LINK Slides 5% Amid Coinbase Bridge Deal, Early Support Emerging

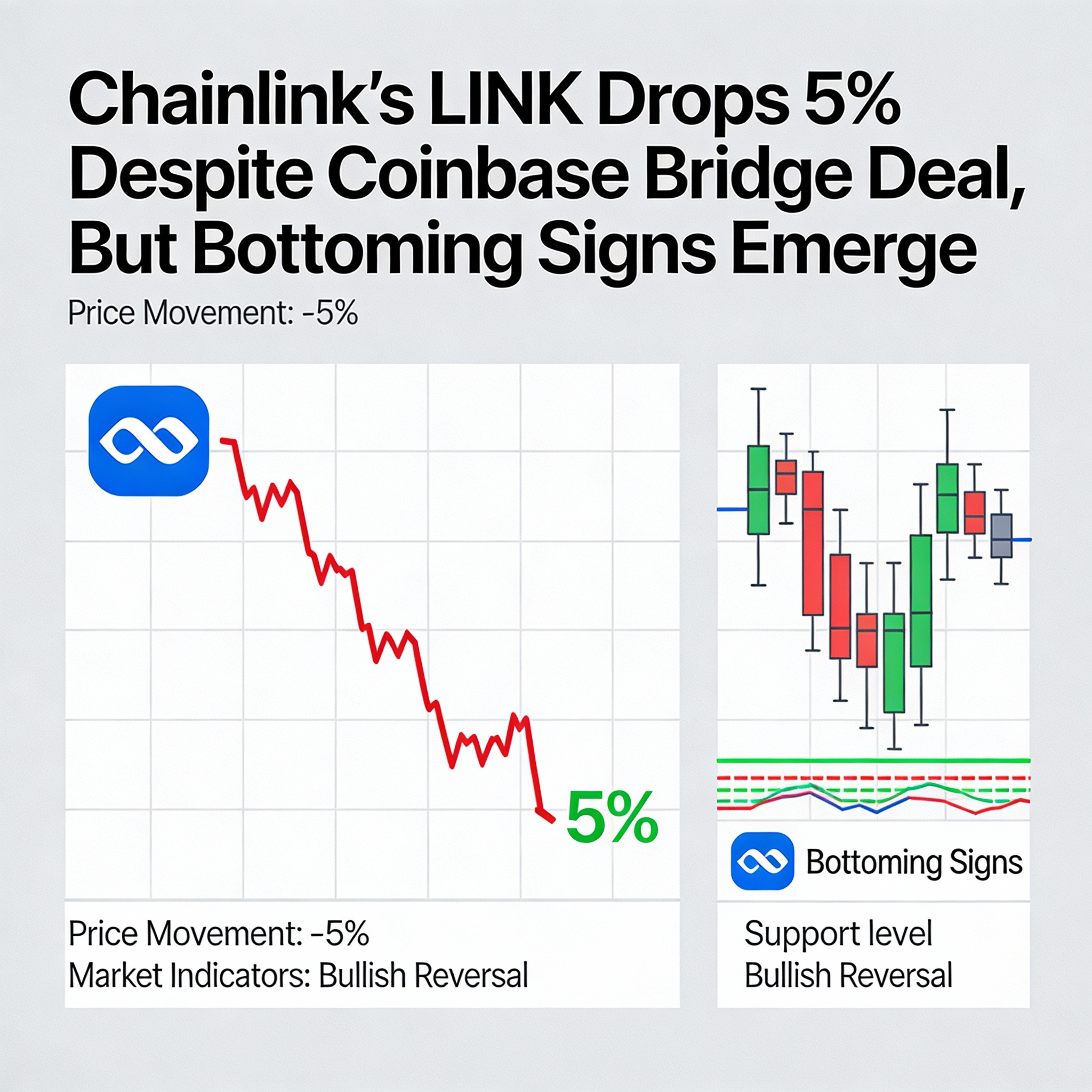

Chainlink’s LINK token dropped nearly 5% over the past 24 hours, hitting $13.74 on Thursday, as overall crypto market weakness weighed on sentiment despite positive news.

Coinbase announced it had chosen Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to power a bridge for $7 billion in wrapped assets, including cbETH, cbBTC, and cbDOGE—a move signaling strong institutional confidence in Chainlink’s cross-chain infrastructure.

Meanwhile, Nasdaq-listed digital asset firm Caliber (CWD) began staking 75,000 LINK tokens for yield, reflecting growing institutional participation.

Still, broader market headwinds—including soft altcoin momentum and renewed Federal Reserve rate concerns—drove LINK from Wednesday’s high of $14.46 to a Thursday low of $13.43.

Late-session activity indicated potential stabilization. Trading volume surged 20.4% above the seven-day average, with over 340,000 LINK changing hands in a short spike, according to CoinDesk data. Accumulation formed above key support at $13.46, suggesting institutional positioning amid market weakness.

Technical Levels

- Support: $13.46 | Resistance: $14.88 | Psychological: $14.00

- Volume: Late-session spike of 340K LINK (2,000% above average) | Daily volume +20.4%

- Chart Patterns: Consolidation $13.43–$13.67; breakout to $13.76 hints at short-term bottom

- Targets/Risk: Break above $14.00 targets $14.38–$14.88; failure of $13.46 risks $13.20

Share this content: