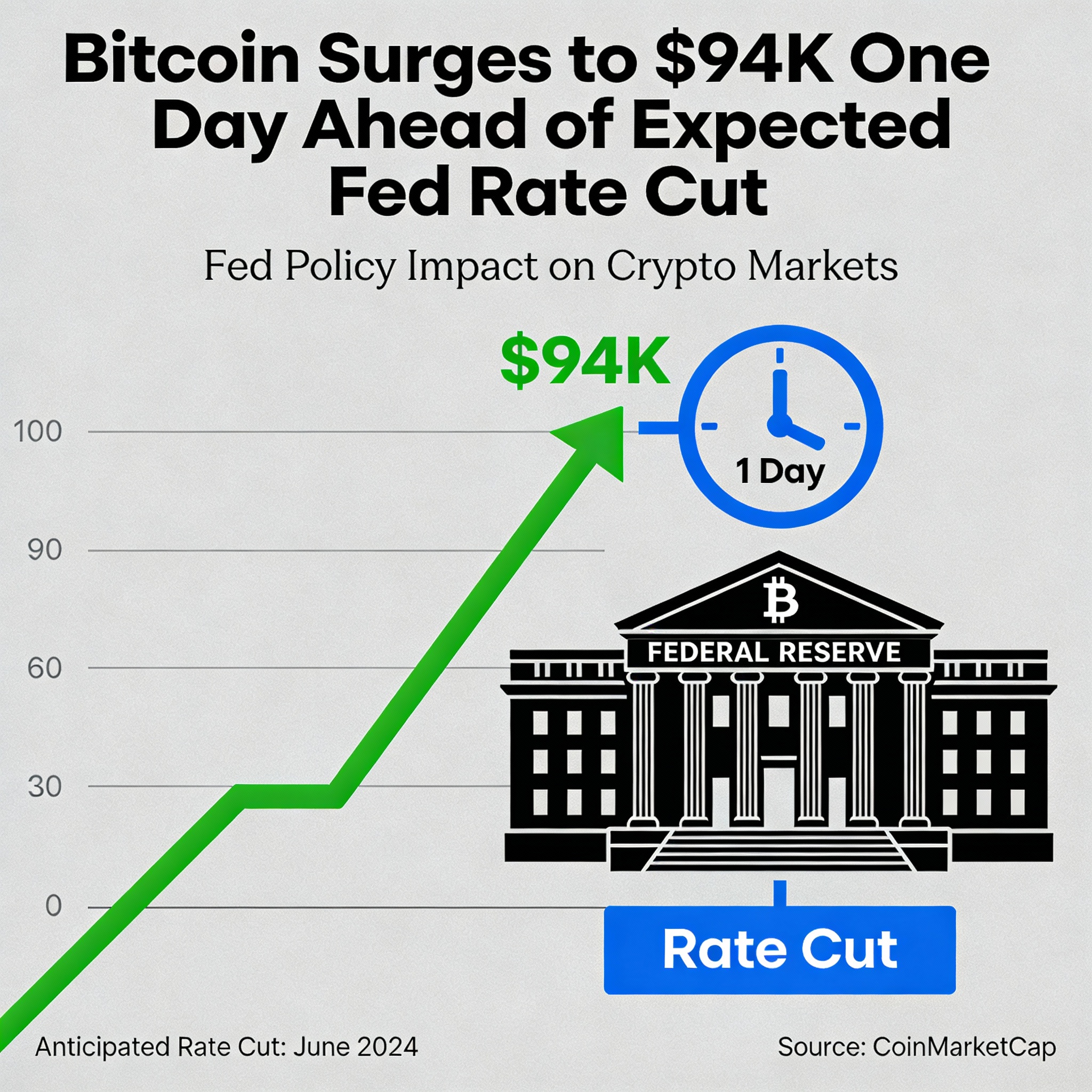

Bitcoin surged past $94,000 on Tuesday, climbing more than $3,000 in under an hour after trading near $90,000 earlier in the day. The 4% gain over 24 hours signals a potential shift from the typical bearish U.S. session, suggesting seller exhaustion may be setting in.

The move coincided with silver hitting new record highs above $60 per ounce. Broader equity markets remained mostly flat, but crypto-focused stocks followed bitcoin’s lead. Galaxy Digital (GLXY) and miner CleanSpark (CLSK) rose over 10%, while Coinbase (COIN), MicroStrategy (MSTR), and BitMine (BMNR) gained 4%-6%.

Analysts pointed to defensive positioning in crypto derivatives and crowded trades as contributors to the swift rebound. Vetle Lunde of K33 Research noted these factors likely fueled the rapid snapback.

Signs of bear market capitulation also surfaced as Standard Chartered’s Geoff Kendrick slashed multi-year BTC forecasts. The Coinbase bitcoin premium has turned positive, reflecting renewed U.S. investor demand. BTC’s gains outpaced derivatives open interest growth, suggesting the rally is being driven by spot demand.

Investors are watching the Federal Reserve’s two-day meeting, expected to conclude with a 25-basis-point rate cut, which could further support risk appetite amid a resilient U.S. economy.

Share this content: