Bitcoin has slipped below a critical long-term support zone, disrupting a price pattern that traders have relied on throughout the current cycle and signaling a potential shift toward a more defensive market environment.

As of the latest session, BTC is trading near $90,091.77 after a nearly 10% decline for the week ending Nov. 16. The drop produced a decisive bearish weekly candle that pushed the cryptocurrency under its 50-week simple moving average (SMA), according to TradingView data.

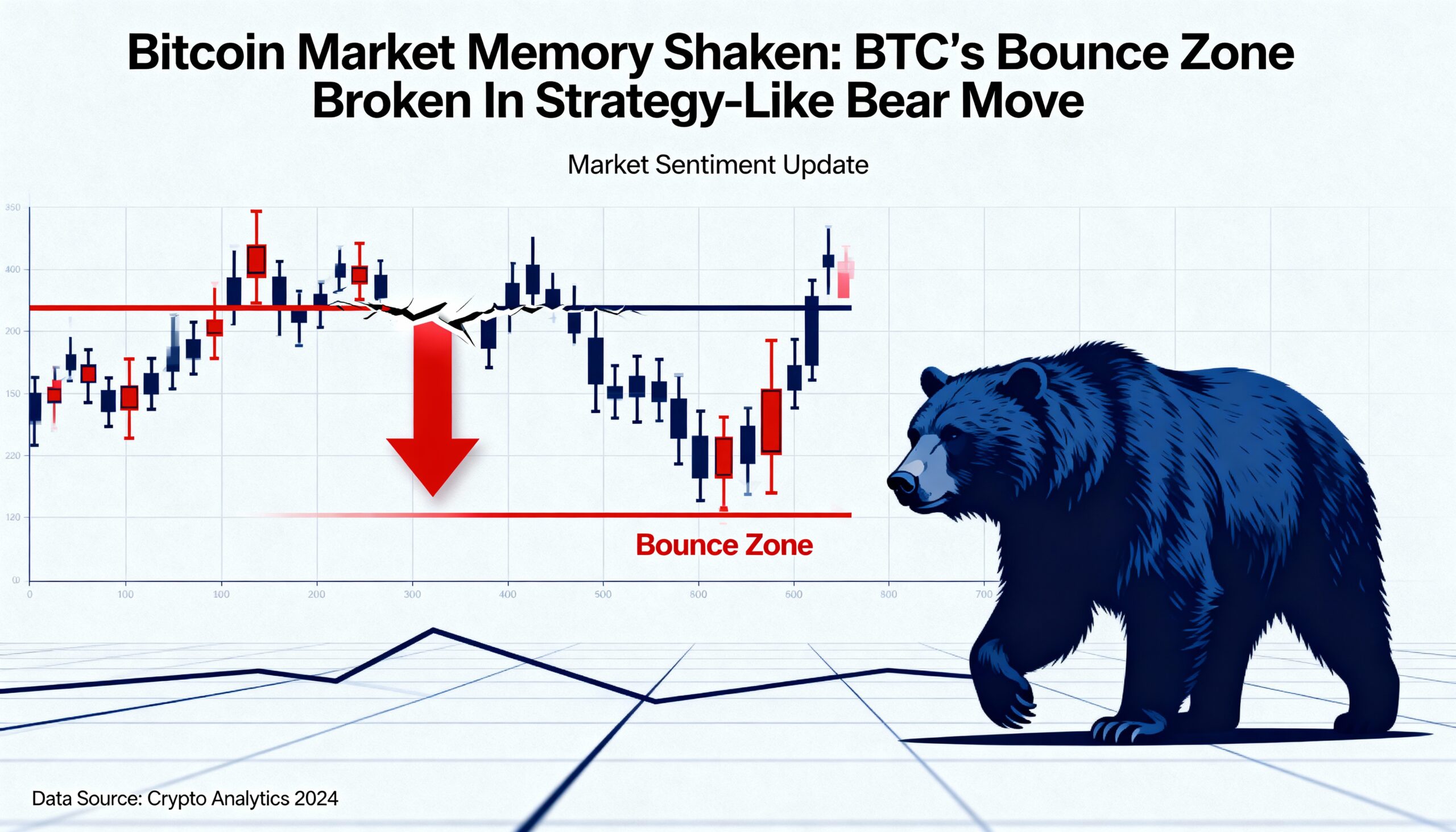

This break is significant: the 50-week SMA has acted as a dependable rebound level since early 2023, consistently catching pullbacks and serving as a springboard for new highs. That dynamic has now changed, with the once-reliable “bounce zone” failing to hold.

The pattern mirrors the weakness seen earlier in Strategy (MSTR), which experienced a similar breakdown months ago. CoinDesk previously noted that once MSTR fell beneath its own 50-week SMA, downside momentum accelerated as investor confidence faded. Bitcoin’s latest move suggests a comparable sentiment shift may be taking shape.

With BTC now trading firmly below the 50-week SMA, the former floor has turned into overhead resistance. Analysts view the $102,868 region as the key level Bitcoin would need to reclaim on a weekly closing basis to reestablish a bullish trend. Until then, rallies may be met with selling as market participants recalibrate expectations.

MSTR, the largest publicly listed holder of bitcoin, illustrates the potential implications: after its breakdown in September, the stock has continued sliding toward the $200 area, its weakest level since October 2024.

Share this content: