Bitcoin is undergoing one of the sharpest momentum collapses of the current cycle, with on-chain indicators signaling conditions last seen during the market’s most severe sell-offs.

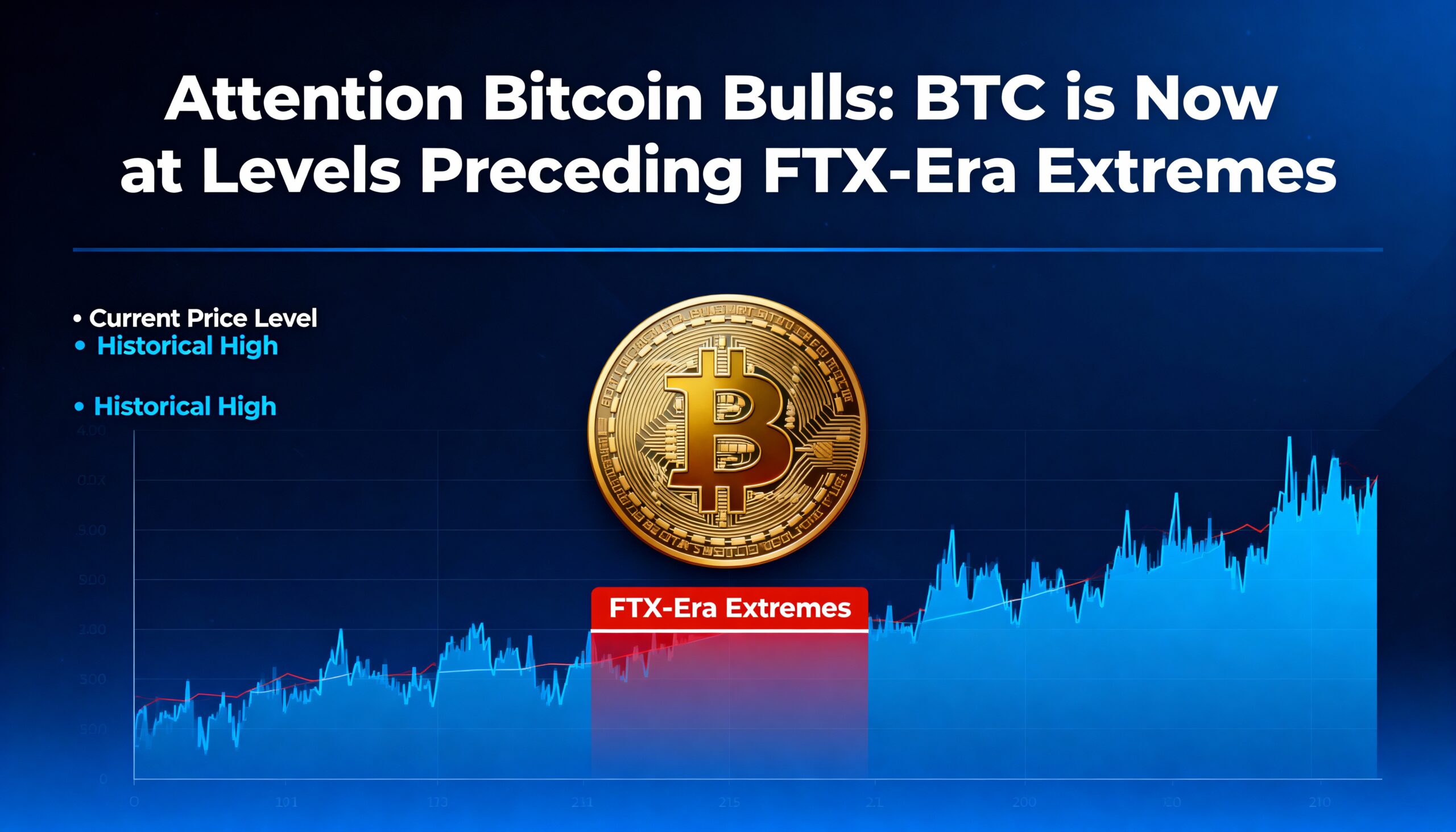

Data from Glassnode shows realized losses have surged to levels reminiscent of the November 2022 capitulation around the FTX collapse. This surge is driven almost entirely by short-term holders—wallets that acquired BTC within the past 90 days—selling off as Bitcoin trades below its 200-day moving average.

Although short-term realized-loss dominance is typical during periods of market stress, the magnitude this week is notable. It represents the largest cluster since early 2023 and is one of only a few occasions in the past five years where daily realized losses have reached $600 million to $1 billion.

Market structure indicators paint a similar picture. Analyst MEKhoko notes that BTC is now trading more than 3.5 standard deviations below its 200-day moving average, a level only seen three times in the past decade: November 2018, March 2020, and June 2022 during the Three Arrows Capital/Luna crisis.

The current drawdown mirrors historical patterns: sharp spot selling, collapsing funding rates, and a retreat of marginal buyers who previously relied on momentum.

With Bitcoin now deeply below trend, short-term holders largely washed out, and sentiment pinned in extreme fear, market positioning is approaching levels historically linked to short-term bottoms.

However, analysts warn that volatility is likely to remain elevated in the absence of a clear macro catalyst.

Share this content: