Bitcoin and Altcoins Rebound as Oversold Conditions Ease Selling Pressure

Crypto markets climbed on Sunday as Bitcoin entered extreme oversold territory, with more than $200 million in liquidations suggesting that selling pressure may be easing amid thin weekend liquidity.

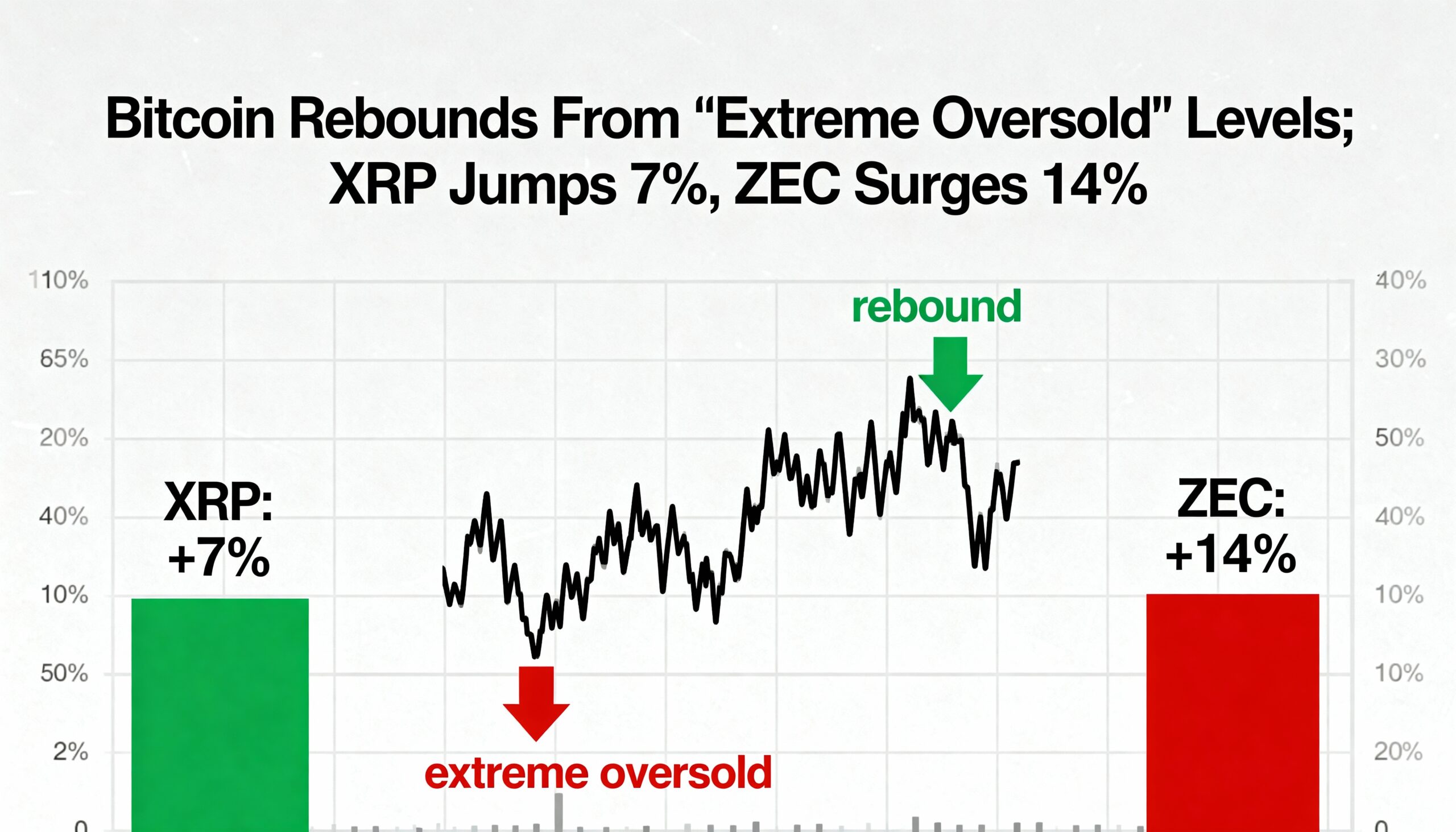

Bitcoin (BTC) traded near $86,466, up roughly 2.7% from earlier lows. Analyst Ali Martinez noted that Bitcoin’s RSI had dropped to extreme oversold levels—a signal historically followed by short-term rebounds, as seen in 2023 and March 2025.

The broader market advanced alongside Bitcoin, pushing total crypto market capitalization up 3.3% to $2.95 trillion. Major tokens including Ether (ETH $2,835), Solana, BNB, Dogecoin, Cardano, and TRON all posted gains.

XRP surged 7.7% to $2.04, while Zcash (ZEC) jumped 14.1% to $574.05, extending a rally that has lifted it 113.5% over the past month and over 900% year-to-date. Privacy-focused coins, including ZEC and Monero (XMR $395.26), continued to outperform other sectors.

Derivatives liquidations contributed to the rebound, with CoinGlass reporting about 117,928 traders liquidated, totaling $206.39 million, including a $3.03 million HYPE-USD position—the day’s largest single liquidation. Thin weekend liquidity likely amplified both the sell-off and the bounce.

Despite the rally, sentiment remains fragile. The Crypto Fear and Greed Index stands at 10, indicating extreme caution as traders watch whether this rebound can translate into a more sustained recovery.

Share this content: